Timeframes

Information is not investment advice

A timeframe is a period that a trader chooses to study the market. There are several timeframes in MetaTrader, you can find them in the special panel (to see it click View - Toolbars - Timeframes).

In MT4, the timeframes available go from 1-minute charts (M1) to monthly charts (MN).

Timeframes from M1 to M30 are known as small or low, while timeframes from H4 to MN are called large or big. H1 is somewhere in-between.

If you open a small timeframe, you will see the dynamics of the price for only a small period of time, for example, one day if you look at M1. On the other hand, on the MN timeframe, you will be able to see how the price was changing during several years.

Which timeframe is best for trading?

Traders often ask which timeframe is the best. There’s no universal answer to this question. Much depends on your trading style and the time you have for trading. In brief, if you have time to trade every day and are tolerant to stress, you can choose small timeframes where you will be able to make a lot of small trades. If you don’t have much time and want to avoid emotional situations, larger timeframes might be the best option for you. Here you can find out more about choosing a suitable timeframe.

Each timeframe allows you to have a different view of the market.

On the one hand, smaller timeframes will let you see the price action in greater detail. If you are a scalper, i.e. a person who keeps a trade open only for several minutes, this is where you will need to work.

On the other hand, if you want to make a bigger trade you will have to switch to bigger timeframes. First of all, you see the bigger picture of what was and what is happening in the market. Secondly, the price can make random moves on intraday charts. These moves are also known as “market noise”. Larger timeframes allow traders to filter these misleading changes of the price and make a trade decision on the basis of the really important information.

Notice that certain trading strategies may require using a particular timeframe or timeframes. Finally, remember that you are not limited to only one timeframe. On the contrary, multitimeframe analysis may increase the efficiency of your trading.

Multitimeframe analysis

Modern trading software allows traders to view the price action on many different timeframes and quickly switch between them. Professional traders have long since discovered that the analysis of multiple timeframes can make trading more profitable.

The classic solution is to use a set of 3 timeframes. Fewer timeframes won’t allow you to filter out false signals, while more timeframes will give you too much data to process.

When choosing your timeframes combo, start by picking out the medium-term timeframe depending on how long you plan to hold your trade. Then choose a smaller timeframe and a larger timeframe. It’s good when the medium timeframe is 4 times bigger than the small one and 4 times smaller than the big one (ex.: H4-H1-M15).

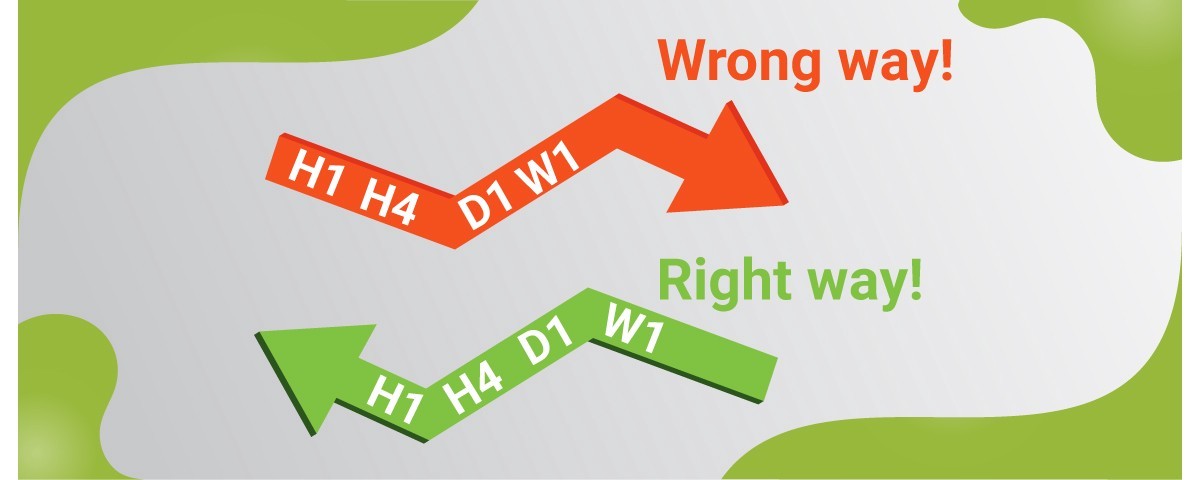

Once you have chosen your timeframes, you can start the analysis. The most important thing here is to analyze the timeframes in the right order. The correct way is to start with a larger timeframe and then switch to a smaller one. Otherwise, there will be a considerable risk that you pick an idea that has a low probability of success as price action on smaller timeframe may be a form of market noise that leads nowhere, whereas a shift on a big timeframe will change the situation on a small timeframe as well.

The famous trader Alexander Elder proposed the following scheme of working with 3 timeframes:

- Large timeframe: identify the overall trend using a 13 EMA and MACD.

- Medium timeframe: find a point where a counter-trend correction ends using the Stochastic Oscillator or other oscillators.

- Small timeframe: find a place for your order by trailing a pending order (Buy Stop or a Sell Stop). You trade should be in the direction of the main trend you see on the large timeframe.

Such a strategy, also known as the Triple Screen System, allows getting the trading signals which have the highest probability of success. The first timeframe will generate many signals, while the other two will allow to pick the best of them and make a precise market entry.

Multiple timeframe analysis is a universal concept for trading financial markets. So, no matter whether you are a scalper or a position trader, make sure you reap the benefits of analyzing several timeframes.

Other articles in this section

- Renko charts Japanese candlestick chart

- Types of charts

- Heiken Ashi

- Quantitative easing policy

- Pivot Points

- ZigZag

- Moving Average

- Williams’ Percent Range (%R)

- Relative Vigor Index (RVI indicator)

- Momentum

- Force index

- Envelopes

- Bulls Power and Bears Power

- Average True Range

- How to trade on central bank decisions?

- CCI (Commodity Channel Index)

- Parabolic SAR

- Stochastic Oscillator

- Relative Strength Index

- Oscillators

- ADX indicator

- Bollinger bands

- Trend indicators

- Introduction to technical indicators

- Support and resistance

- Trend

- Technical analysis

- Central Banks: policy and effects

- Fundamental factors

- Fundamental analysis

- Fundamental vs technical analysis