Relative Vigor Index (RVI indicator)

Information is not investment advice

The Relative Vigor Index (RVI) measures the strength of a trend by comparing an asset’s closing price to its trading range and smoothing the results.

The indicator is based on the idea that in a bull market the closing price is, in general, higher than the opening price. In this, the RVI resembles the Stochastic Oscillator. The difference between the two is in the fact that the RVI compares the close relative to the open rather than the close relative to the low.

How to implement in the MetaTrader

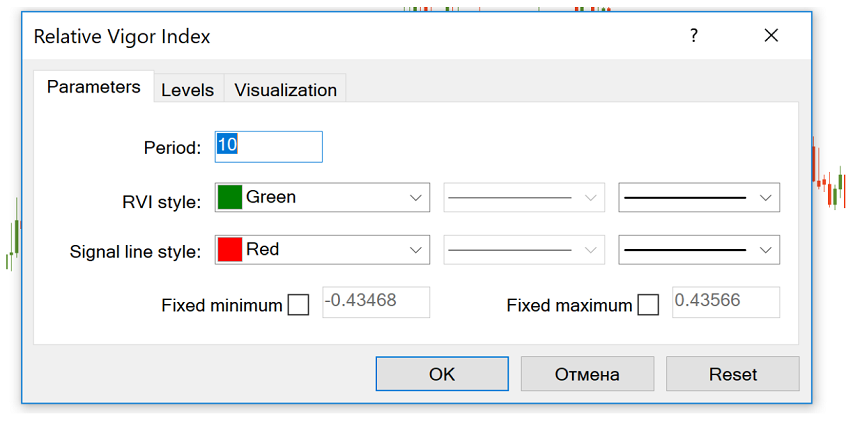

The RVI is included in the MetaTrader default indicator kit, so you don’t need to download it. Go to “Insert”, find “Indicators” and then “Oscillators” – and you will see the RVI. The indicator will appear in a separate window below the price chart.

The reading of 10 is considered the most suitable period. The indicator has 2 lines. One is the RVI line itself, the other is a signal line which is a moving average of the indicator with the period of 4.

How to interpret RVI indicator

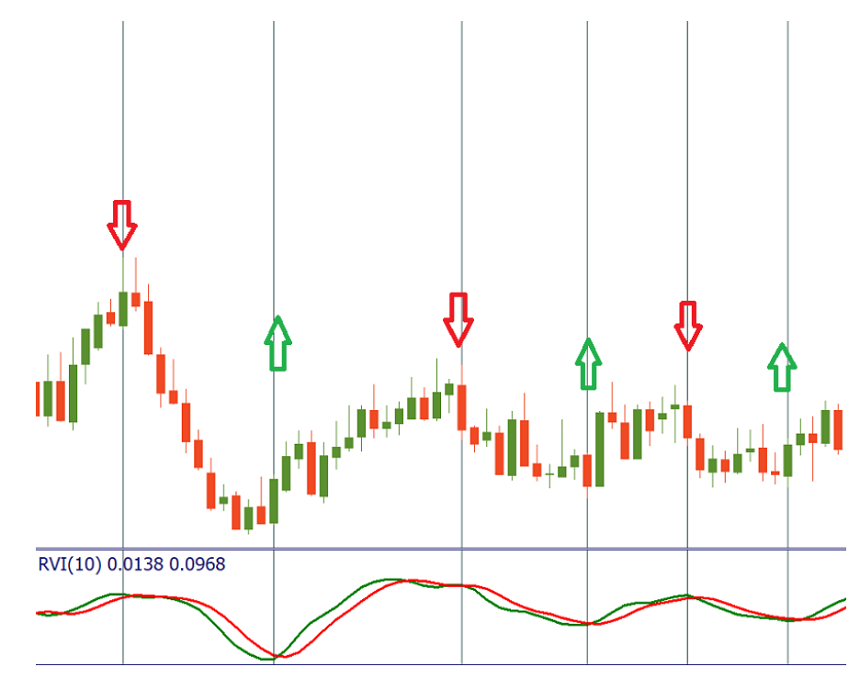

The RVI oscillates across a center line. It is interpreted in the same way as many other oscillators, for example, MACD and RSI. In particular, the RVI shows when the market is overbought or oversold and sends signals when it diverges with the price chart.

Overbought/oversold conditions. If the market is flat, look for the RVI to exit the overbought (high) or oversold (low) areas for a signal to sell/buy. Note that the indicator doesn’t offer exact levels for overbought and oversold areas, so traders need to figure this out themselves. It addition, it’s necessary to remember that oscillators can remain at extreme levels over a prolonged period of time.

Signal line crossovers. Watch for crossovers between the RVI and the signal line. When the indicator rises above the signal line, it’s a bullish sign. When the indicator goes below the signal line, it’s a bearish sign.

Convergence/divergence. If a new price high is higher than the previous one, while the new RVI high is lower than the previous one (bearish divergence), look for the RVI to cross the signal line to the downside and then sell. If a new price low is below the previous one, while the new RVI low is higher than the previous one (bullish divergence), look for the RVI to cross the signal line bottom-up and then buy.

Relative Vigor Index is useful for trading but may give false signals, so it has to be used in combination with other indicators and trading tools.

Other articles in this section

- Timeframes

- Renko charts Japanese candlestick chart

- Types of charts

- Heiken Ashi

- Quantitative easing policy

- Pivot Points

- ZigZag

- Moving Average

- Williams’ Percent Range (%R)

- Momentum

- Envelopes

- Bulls Power and Bears Power

- Average True Range

- How to trade on central bank decisions?

- Parabolic SAR

- Stochastic Oscillator

- Oscillators

- Bollinger bands

- Trend indicators

- Introduction to technical indicators

- Support and resistance

- Trend

- Technical analysis

- Central Banks: policy and effects

- Fundamental factors

- Fundamental analysis

- Fundamental vs technical analysis