Envelopes

Information is not investment advice

Envelopes technical indicator is aimed to identify the upper and the lower borders of a trading range.

The indicator consists of 2 moving averages one of which is shifted upwards and another is shifted downwards. Envelops can be used as bands around price action that signify overbought and oversold levels and can also be used as price targets.

Many traders consider Envelopes a variation of Bollinger Bands. The basic principle of both tools is the same: after any fluctuations, the price will always return to the main trend.

How to implement

The Envelopes is included in the default set of MetaTrader. You can add it to the chart by clicking “Insert” – “Indicators” – “Trend” and then choosing “Envelopes”. The indicator lines will appear in the same window as the price chart.

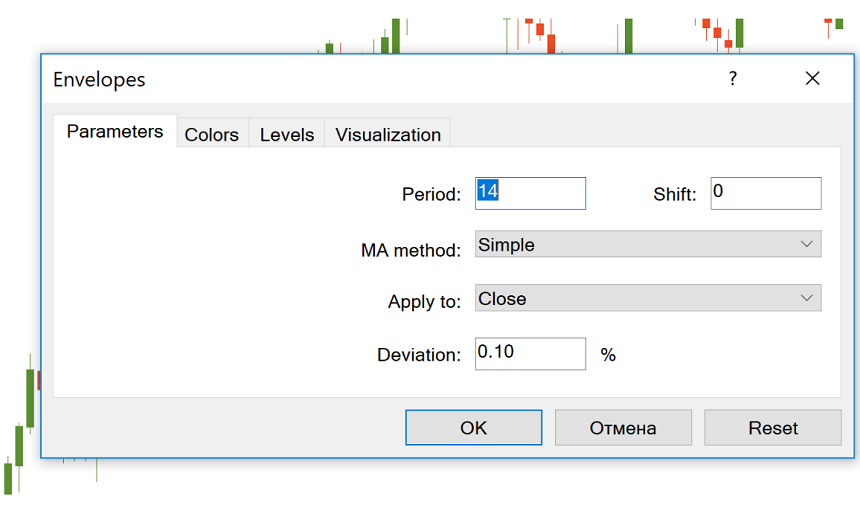

The period set by default in MetaTrader equals 14 and the deviation (shift of the MAs) is set at 0.1%. You can adjust the amount of deviation depending on the market’s volatility: the higher the volatility is, the bigger the deviation should be. However, it’s not recommended to set the deviation above 2%.

For intraday trading, one may use an H1 chart, and a 10-period average and 0.3-0.5% deviation should be fine for any currency pair.

The 'Shift' field, which has a default value of 0, allows moving the average backward or forward along the time axis. A value of 20 moves the indicator lines forward by 20 bars, while a value of -20 would move them back by 20 bars.

How to interpret Envelopes indicator

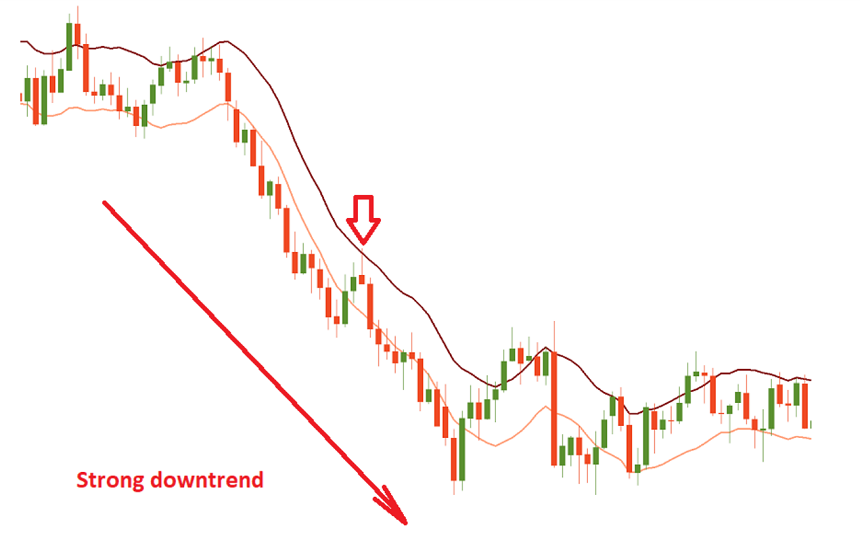

The Envelopes indicator is based on Moving Averages and thus has the specific features and applications as other MAs do. First of all, the slope of the indicator lines show the direction of a trend: if the Envelopes bands are slopings up, it’s an uptrend, while if they are sloping down, it’s a downtrend. In addition, the indicator clearly shows the start of a sideways market as its lines become horizontal.

There are several ways to interpret the Envelopes indicator.

Firstly, it’s possible to trade inside the channel created by the Envelopes bands: buy when the price reaches the lower band in an uptrend and sell when the price gets to the upper band in a downtrend.

When the market is range-bound, the moves of the price above the upper Envelopes band signal that the asset is overbought and will likely reverse down. Moves below the lower band mean that the market is oversold and may reverse up.

At the same time, when the price breaks above the upper band during an uptrend, it is a sign that this uptrend is strong and we may see a prolonged move up. When the price breaks below the lower envelope in a downtrend, it means that the downtrend is strong and the price may fall steeply.

The Envelopes indicator can be a part of various trading strategies. For example, it may be used for scalping on small timeframes. As it’s a trend indicator, it’s possible to achieve good results by combining it with some oscillator.

Other articles in this section

- Timeframes

- Renko charts Japanese candlestick chart

- Types of charts

- Heiken Ashi

- Quantitative easing policy

- Pivot Points

- ZigZag

- Moving Average

- Williams’ Percent Range (%R)

- Relative Vigor Index (RVI indicator)

- Momentum

- Force index

- Bulls Power and Bears Power

- Average True Range

- How to trade on central bank decisions?

- CCI (Commodity Channel Index)

- Parabolic SAR

- Stochastic Oscillator

- Relative Strength Index

- Oscillators

- ADX indicator

- Bollinger bands

- Trend indicators

- Introduction to technical indicators

- Support and resistance

- Trend

- Technical analysis

- Central Banks: policy and effects

- Fundamental factors

- Fundamental analysis

- Fundamental vs technical analysis