Shark

Information is not investment advice

Shark pattern was discovered in 2011 by Scott Carney. The swing points in this pattern are marked with 0, X, A, B, C.

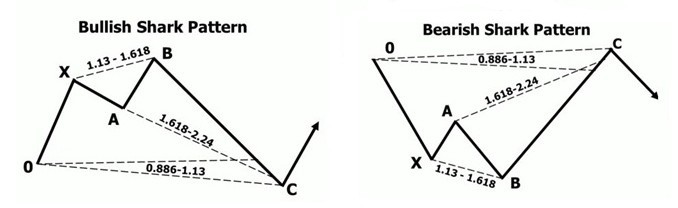

Notice that in all the patterns we studied before (Gartley, Bat, Crab, Butterfly), the second top in a bullish pattern and the second bottom in a bearish pattern were lower/higher than the first one. In a bullish Shark pattern, however, the second top is higher than the first one. In addition, it combines Fibonacci with Elliott waves theory and some new ratios like 113% are used.

Here are the key parameters of a Shark pattern:

- There’s no specific place for A.

- Point B is at the 113%-161.8% extension of XA.

- Point C is at the 113% extension of 0X and at the 161.8%-224% extension of AB.

How to trade Shark pattern

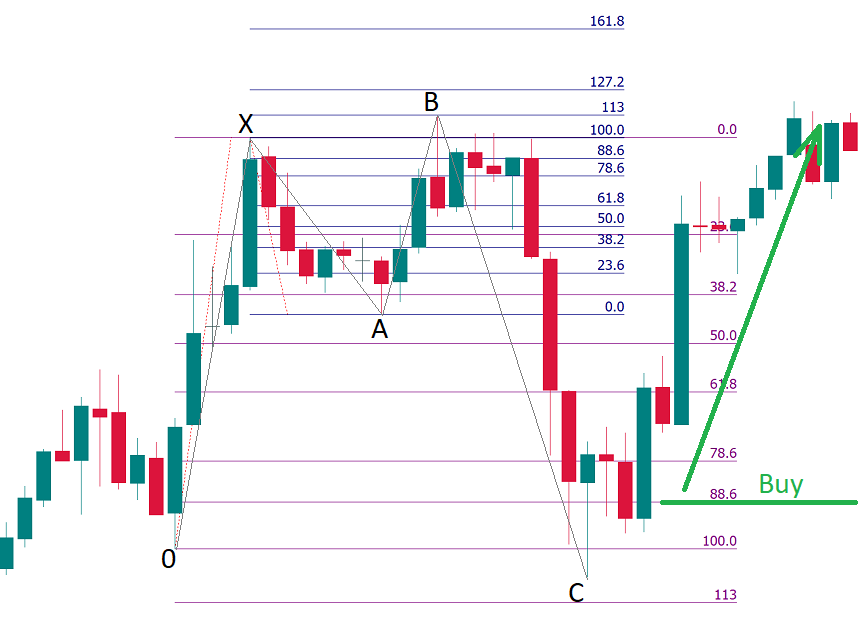

The approach to trading a Shark pattern is a bit different from that we designed for other patterns. The entry is at 88.6% of 0X. The Take Profit can be at 50%-61.8% of BC. The Stop Loss should be at the point C.

Here’s how a bullish Shark pattern looks like on the chart. The point B is at the 113% extension of XA. The point C is near the 113% extension of 0X. The entry to a buy trade is at the 88.6% retracement of 0X. The Stop Loss is at the point C.

Other articles in this section

- Structure of a Trading Robot

- Building a Trading Robot without Programming

- How to Launch Trading Robots in MetaTrader 5?

- Algorithmic trading: what is it?

- Algo trading with MQL5

- Advanced techniques of position sizing

- What does ‘truncation’ mean?

- Ichimoku

- How to trade gaps

- Leading diagonal pattern

- Wolfe waves pattern

- Three drives pattern

- Butterfly

- Crab

- Bat

- Gartley

- ABCD

- Harmonic patterns

- Intoduction to Elliott Wave analysis

- How to trade breakouts

- Trading Forex news

- How to place a Take Profit order?

- Risk management

- How to place a Stop Loss order?

- Technical indicators: trading divergences