Three drives pattern

Information is not investment advice

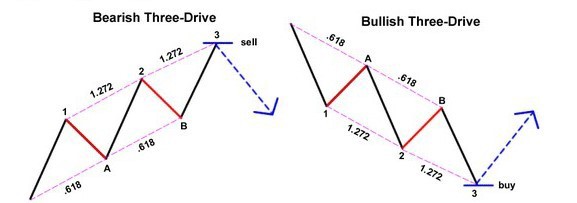

The three drives pattern consists of a series of higher highs or higher lows. It is similar to the ABCD pattern. The difference is that a Three drives pattern is made of 5 legs, while an ABCD pattern has only 4. Three-Drives is a reversal pattern, so it signals an upcoming change in a trend.

Here are the key parameters of a Three drives pattern:

- Point A is at the 61.8% retracement of the drive 1.

- Point B is at the 61.8% retracement of the drive 2.

- Drive 2 is at the 127.2%-161.8% extension of A.

- Drive 3 is at the 127.2%-161.8% extension of B.

Notice that the price should spend equal time on forming the drives 2 and 3. Corrections A and B should also take equal time.

How to trade Three drives patterns

There are 2 ways of trading a Three drives pattern:

- You can trade the drive 3. Enter the market when you are sure that the market has formed the point B (buy in a bearish Three-Drive and sell in a bullish Three Drive). Take Profit should be around the 127.2%-161.8% extension of B.

- You can trade when the entire pattern is complete. Enter the market at the 127.2%-161.8% extension of B (sell in a bearish Three-Drive and buy in a bullish Three Drive). Take Profit can be put at the 61.8% Fibonacci retracement of the entire pattern.

Other articles in this section

- Structure of a Trading Robot

- Building a Trading Robot without Programming

- How to Launch Trading Robots in MetaTrader 5?

- Algorithmic trading: what is it?

- Algo trading with MQL5

- Advanced techniques of position sizing

- What does ‘truncation’ mean?

- Ichimoku

- How to trade gaps

- Shark

- Butterfly

- Crab

- Bat

- Gartley

- ABCD

- Harmonic patterns

- Intoduction to Elliott Wave analysis

- How to trade breakouts

- Trading Forex news

- How to place a Take Profit order?

- Risk management

- How to place a Stop Loss order?

- Technical indicators: trading divergences