Butterfly

Information is not investment advice

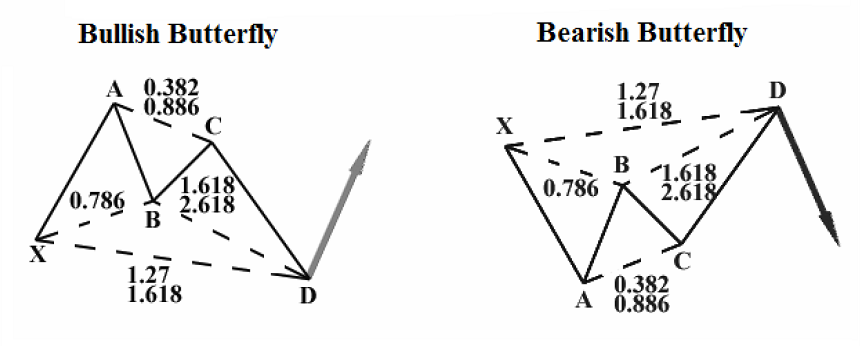

The Butterfly is another form of Gartley patterns. It was discovered by Bryce Gilmore and Larry Pesavento. This pattern usually forms near the extreme lows and highs of the market and foretells a reversal.

The main special thing about the Butterfly pattern is that CD extends beyond XA.

Here are the key parameters of a Butterfly pattern:

- Point B is at up to 78.6% retracement of XA.

- Point C can be at the 38.2%-88.6% retracement of AB.

- Point D can be found at the 161.8%-261.8% extension of AB or at the 127.2%-161.8% extension of XA. The difference from a Gartley pattern is that D is not at the retracement of XA but at its extension.

How to trade

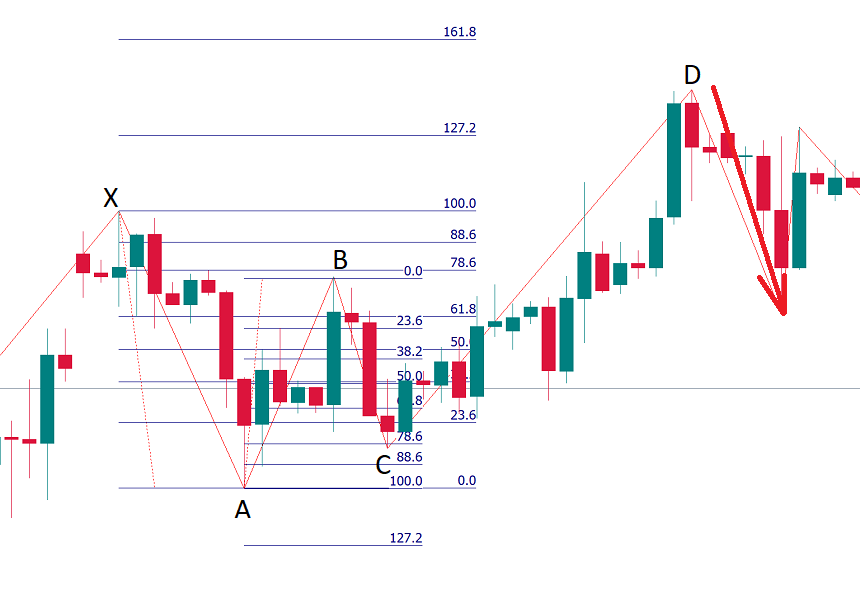

The entry is at the point D, which is a potential reversal zone. Take Profit may be at 61.8% of CD (TP1), and/or at 127.2% of CD (TP2). You can also target points B (a conservative approach) and A (an aggressive approach). Put a Stop Loss in line with your rules of risk management.

Here the example of a bearish Butterfly pattern.

The point B is at the 78.6% retracement of XA. The point C is at the 76.8% retracement of AB. The point D is at the 127.2%-161.8% extension of XA.

Other articles in this section

- Structure of a Trading Robot

- Building a Trading Robot without Programming

- How to Launch Trading Robots in MetaTrader 5?

- Algorithmic trading: what is it?

- Algo trading with MQL5

- Advanced techniques of position sizing

- What does ‘truncation’ mean?

- Ichimoku

- How to trade gaps

- Leading diagonal pattern

- Wolfe waves pattern

- Three drives pattern

- Shark

- Crab

- Bat

- Gartley

- ABCD

- Harmonic patterns

- Intoduction to Elliott Wave analysis

- How to trade breakouts

- Trading Forex news

- How to place a Take Profit order?

- Risk management

- How to place a Stop Loss order?

- Technical indicators: trading divergences