How to place a Take Profit order?

Information is not investment advice

How to place a Take Profit order?

There two special orders which serve to close a trade: Take Profit order or TP and Stop Loss order or SL. These orders make trading results more predictable and profitable. We told you about SL in the previous article. If you missed, you can read it here.

In this article, we will explain what Take Profit is and how to set this kind of orders to grab the maximum profit.

Similar to Stop Loss, Take Profit order is an exit order. However, unlike SL that limits trader’s loss on a trade, TP indicates a particular price at which a profitable trade will automatically close. In other words, TP is a profit target. You need to place TP at the level you expect the price to reach. If you buy, TP will be above the current price. If you sell it will be below it.

You can have a brilliant trade idea, but if you choose a TP level poorly, you won’t get as much profit as you could have.

Every trader should know how to place Take Profits. There are several strategies on how to do it.

I. Support and resistance

If you look at the chart, you will notice that usually, a price struggles to break support or resistance. More often after the struggling the price reverses and moves in the opposite directions. So, levels of resistance and support will help you to set really good TPs. That is why this strategy is the most popular among traders.

- Resistance

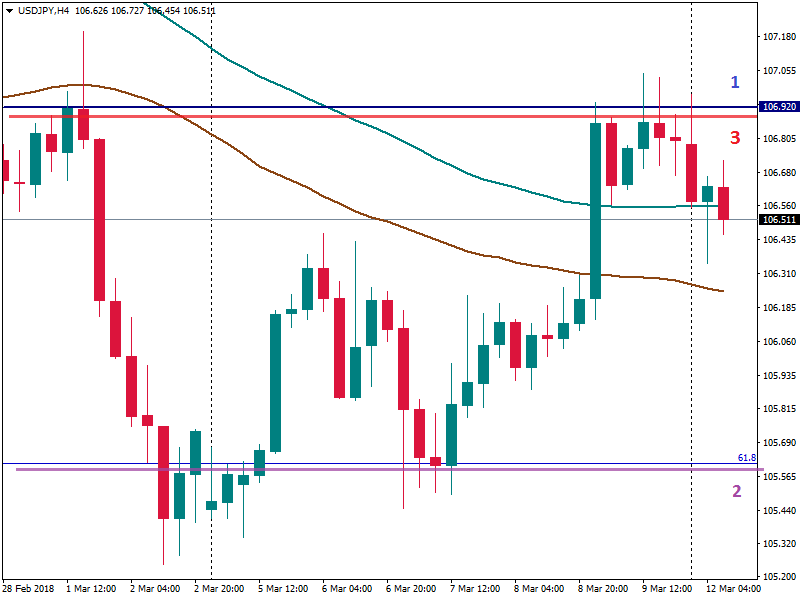

Let’s look at the chart.

- Resistance.

- Level of entry before the uptrend.

- Level of take-profit.

Firstly, find a resistance level. Then based on this level, you will be able to place a Take Profit order. As you can see, we put the TP level a few pips below the resistance. We highly recommend you to place the TP a little bit below the resistance level, as the chance that the price will hit this level and you close your position with profit will, in this case, be higher.

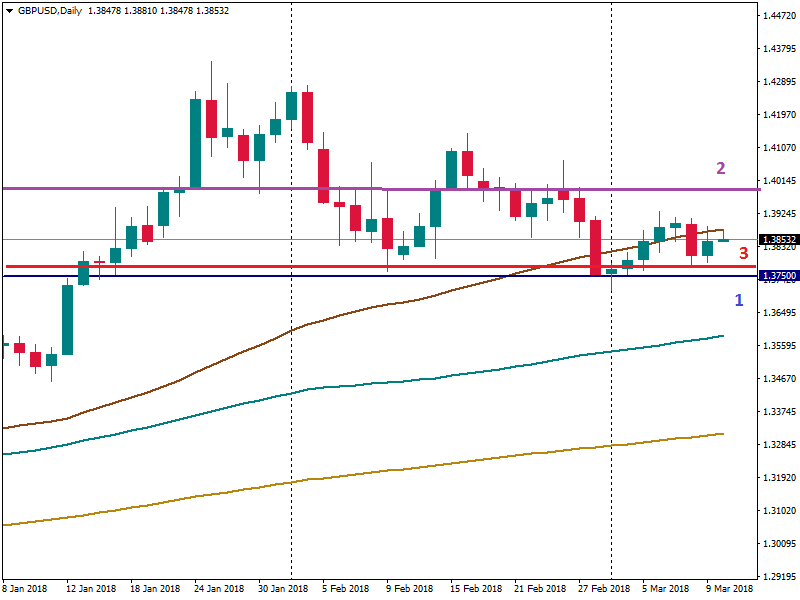

- Support

- Support.

- Level of entry before the downtrend.

- Level of take-profit.

If you see a downward trend, find a support level. Contrary to the situation with resistance, a TP level should be a few pips above the support.

Note: Support and resistance levels can be displayed not only with horizontal lines which mark the previous highs and lows but with trend lines and channels, as well pivot points and Fibonacci levels.

II. Daily range levels

Another way to identify a nice level for Take Profit is by using daily range levels. The average true range indicator (ATR) will help you do that.

The ATR measures volatility that a pair experiences during a certain period of time. It gives the average of these moves and shows the number of pips that the pair is anticipated to move.

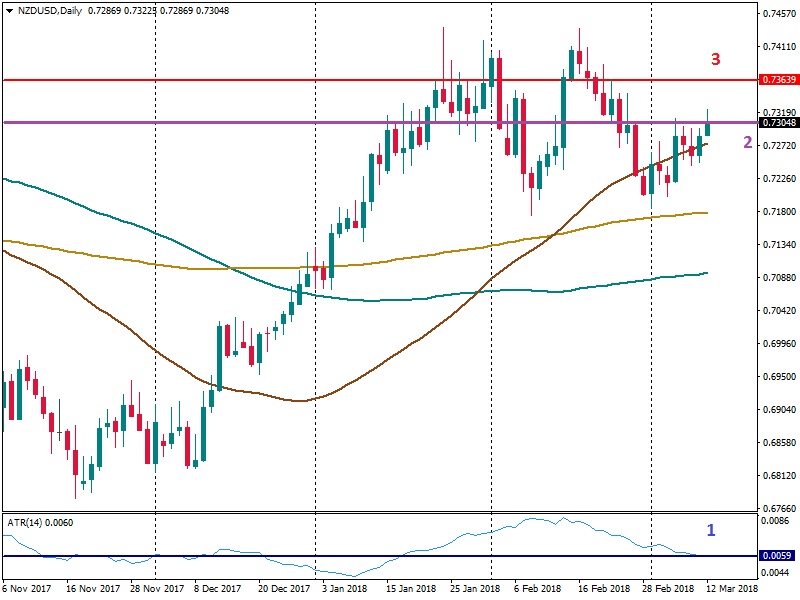

It will become clearer if you look at the chart.

- ATR level.

- Entry in the buying position.

- TP that equals the ATR level.

Find the value of the ATR indicator at the moment when you entered a trade. Then add this value to the entry price and you will get a level to place your TP.

Remember though that there are a lot of factors that can affect the price during a day. ATR shows the historic movement, but the real one can differ.

III. Chart patterns

There are many chart patterns that suggest specific target levels that can be used as a place for TP.

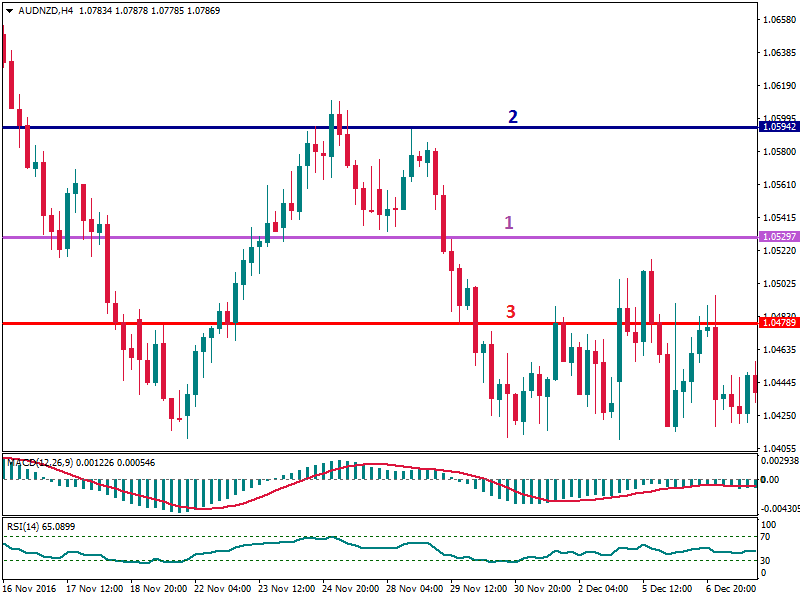

Let’s study the example of the “Double Top” pattern.

- Entry in the selling position (a break below the neckline).

- The size the of pattern – the distance between 1 (the neckline) and 2 (the peaks).

- TP that equals the size of the pattern.

Many chart patterns have the targets that are projected from the entry level in the direction of the trade (down when you SELL, up when you BUY). The target often equals the size the pattern, so level 3 is where a trader will put a TP. This is true for Triple Tops/Bottoms, Head and Shoulders, Rectangular, etc.

Risk/reward ratio

When you set a Take Profit, you should take into consideration a Risk/Reward ratio. This measure shows how much profit a trader anticipates in exchange for a risk of a limited loss. In general, the best ratio is 1:3, so the profit should be 3 times bigger than the loss. For example, if your Stop Loss equals 50 pips, the Take Profit should be 150 pips.

In some cases, other Risk/Reward ratios are possible. For example, if you trade on a break of a level, you may use 1:5 ratio as the possibility of a false break is high and you might want to protect yourself more.

A piece of advice for traders

Often enough, even if a trader places a good Take Profit order, he/she loses. Why does it happen? Because it is highly important to follow your strategy and do not make other mistakes that lead to losses.

- Be patient and do not move TP closer to the entry price half-way during the trade.

- Do not close a position too early, so you do not allow the Take Profit to get hit.

- Be careful analyzing a market. Have an algorithm of market analysis.

- Do not make your predictions based on short-term charts, it can lead to wrong decisions. Usually, a trend or a reversal on the short-term chart doesn’t affect the general direction of a pair. Traders use mostly H4 and daily charts for the analysis.

- Do not guess Take Profit levels, otherwise, you will lose. Base your predictions only on the technical and the fundamental analysis.

Making a conclusion, we can say that it is highly important to place Take Profit orders. They help to eliminate the destructive impact of emotions on your trade as you should plan TP at the moment of entry. One of the most popular TP strategies is to use resistance/support levels as profit targets. However, remember that you will be able to get profit only by following your strategy and basing your predictions on the accurate market analysis.

Other articles in this section

- Algorithmic trading: what is it?

- Algo trading with MQL5

- Advanced techniques of position sizing

- What does ‘truncation’ mean?

- Ichimoku

- Leading diagonal pattern

- Wolfe waves pattern

- Three drives pattern

- Shark

- Butterfly

- Crab

- Bat

- Gartley

- ABCD

- Harmonic patterns

- Trading Forex news

- Risk management

- Technical indicators: trading divergences