Crab

Information is not investment advice

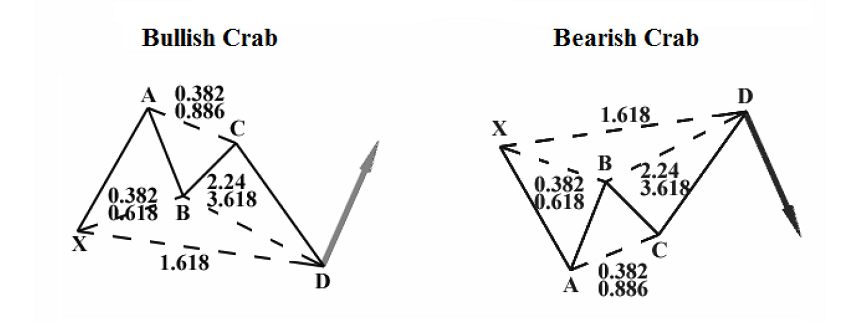

The Crab is another harmonic pattern that is derived from the Gartley pattern. The special thing about it is the long XA and CD swings. The point D is far away and lies beyond the starting point X. This is what differentiates the Crab from other harmonic patterns.

Here are the key parameters of a Crab pattern:

- Point B is at the 38.2-61.8% retracement of XA.

- Point C can be at the 38.2%-88.6% retracement of AB.

- Point D can be found at the 224%-316% extension of AB or at the 161.8% extension of XA. The closer D is to the 161.8% extension of X, the stronger is the signal of this pattern.

How to trade

The entry is at the point D. Always wait for the market to reverse from CD before opening your trade. Take Profit may be at 61.8% of CD (TP1), and 127.2% of CD (TP2). Put a Stop Loss in line with your rules of risk management.

Let's see how a Crab pattern may look on the chart. The point B is at the 61.8% retracement of XA. The point D is near the 161.8% extension of the XA.

Other articles in this section

- Structure of a Trading Robot

- Building a Trading Robot without Programming

- How to Launch Trading Robots in MetaTrader 5?

- Algorithmic trading: what is it?

- Algo trading with MQL5

- Advanced techniques of position sizing

- What does ‘truncation’ mean?

- Ichimoku

- How to trade gaps

- Leading diagonal pattern

- Wolfe waves pattern

- Three drives pattern

- Shark

- Butterfly

- Bat

- Gartley

- ABCD

- Harmonic patterns

- Intoduction to Elliott Wave analysis

- How to trade breakouts

- Trading Forex news

- How to place a Take Profit order?

- Risk management

- How to place a Stop Loss order?

- Technical indicators: trading divergences