Einführung in die Elliott-Wellen-Analyse

Informationen sind keine Investitionsberatung

Worum geht es bei der Elliott-Wellen-Analyse?

Sie haben wahrscheinlich etwas über Elliott-Wellen gehört oder sogar Wellenzahlen gesehen. Das liegt daran, dass die Elliott-Wellen-Analyse heutzutage zu einem der beliebtesten Ansätze der Forex-Marktprognose wird. Warum? Das Elliott-Wellen-Prinzip ist nach unserer Erfahrung das einzige Instrument, das die Kursbewegung in jedem Zeitrahmen von den monatlichen oder sogar jährlichen Charts bis hin zu nur einminütigen Intraday-Intervallen ausgleichen kann. Sie können beispielsweise auf Intraday-Charts handeln, aber gleichzeitig haben Sie auch ein größeres Bild. Einfach ausgedrückt, sind Elliott-Wellen die DNA des Marktes. In den folgenden Artikeln führen wir Sie durch das Elliott-Wellen-Prinzip.

Wer ist der Autor?

Vielen Dank an Ralph Nelson Elliott (1871 - 1948), der Buchhalter und Ökonom war. 1938 veröffentlichte er "Das Wellen-Prinzip", und sein zweites Buch "Nature's Law - The Secret of the Universe" wurde 1946 gedruckt. Elliott beschrieb Muster, die sich nach sehr genau bestimmten Regeln immer wieder auf dem Markt bilden.

Wir müssen auch Robert R. Prechter Jr. und A.J. Frost für das Buch "Elliott Wave Principle: Key to Market Behavior" danken, das heute die wichtigste Quelle für Regeln und Richtlinien ist. Und außerdem wurde 2006 ein weiteres großartiges Buch veröffentlicht -'Elliott's Code' von D.V. Vozny. Leider für viele Leser auf der ganzen Welt ist das Buch auf Russisch.

Der Beginn der Reise

Also, wir haben die Serie von Artikeln, die auf den beiden Büchern basieren. Jede Regel oder Richtlinie in einem Artikel entspricht den Regeln in diesen Publikationen. Und ich versichere Ihnen, dass ich Ihnen nicht einfach die Bücher noch einmal erzähle. Was ich wirklich tun werde, ist, Ihnen das Elliott-Wellen-Prinzip beizubringen und meine Erfahrungen zu teilen. Die meisten Beispiele stammen aus dem realen Markt. Außerdem werden wir einige Fälle durchgehen, die nicht in den Büchern beschrieben sind, aber Sie können sie in den Charts finden.

LEGO des Marktes

Im Elliott-Wellen-Prinzip gibt es zwei wesentliche Dinge: Impulse (fünfwellige Kursbewegungen) und Korrekturen (dreiwellige Kursbewegungen). Wir werden in den nächsten Artikeln darauf zurückkommen, so dass Sie sehen werden, dass es nur einen Haupt-LEGO-Block gibt, der ein Impuls ist. Aber im Moment konzentrieren wir uns auf diese beiden.

Werfen wir einen Blick auf die Grafik unten. Sie können dort einen 5-Wellen-Absinken sehen - das ist eine Impulswelle (es gibt einige Fälle, in denen wir eine 5-Wellen-Korrektur haben könnten, aber ich werde es später beschreiben). Außerdem gibt es einen 3-Wellen-Vorsprung, den wir als Korrektur betrachten könnten. Gut, wir haben gerade einen Impuls und eine Korrektur gefunden, also ist es Zeit, ein etwas größeres Bild zu sehen.

Der nächste Chart ist nur die tatsächliche Wellenzahl, die ich in meiner Analytik veröffentlicht habe. Der Abstieg ist wahrscheinlich in der dritten Welle eines rückläufigen Impulses, während ein Aufschwung die vierte Welle ist.

So können wir zu folgendem Schluss kommen: Es gibt keine Welle, die von den anderen getrennt bleiben könnte. Das Elliot-Wellen-Prinzip ist wie eine russische Puppe, Matrjoshka. Jede Welle ist Teil einer anderen Welle, aber auch jede Welle besteht aus kleineren Wellen. Diese Geschichte spielt sich von höheren zu niedrigeren Zeitrahmen ab.

Und das unterscheidet das Elliott-Wellen-Prinzip von anderen Techniken der Marktanalyse. Die Mehrheit der technischen Analyseansätze konzentriert sich auf Muster und Signale, die sich voneinander abgrenzen. Die Stärke von EWP ist die Möglichkeit, das Gesamtbild zu sehen, nicht nur ein individuelles Setup.

Durchdenken von Möglichkeiten

Sie haben wahrscheinlich gehört, dass, wenn Sie das EWP im Handel verwenden, Sie auf mehr als eine mögliche Wellenzahl stoßen werden. Normalerweise hat man ein paar mögliche Szenarien, die manchmal widersprüchlich sind. Das ist das Aufregendste an dem EWP, weil es wie Schachspielen ist.

Wenn ein heiliger Gral Indikator Ihnen sagt, dass Sie kaufen oder verkaufen sollen, würden Sie nicht denken, was Sie tun werden, wenn etwas schief geht. Mit dem EWP versuchen Sie, Handelsaktionen herauszufinden, je nachdem, welche Wellenzahl vorhanden ist. Das ist eine Kernkompetenz eines erfolgreichen Händlers.

Echte Beispiele

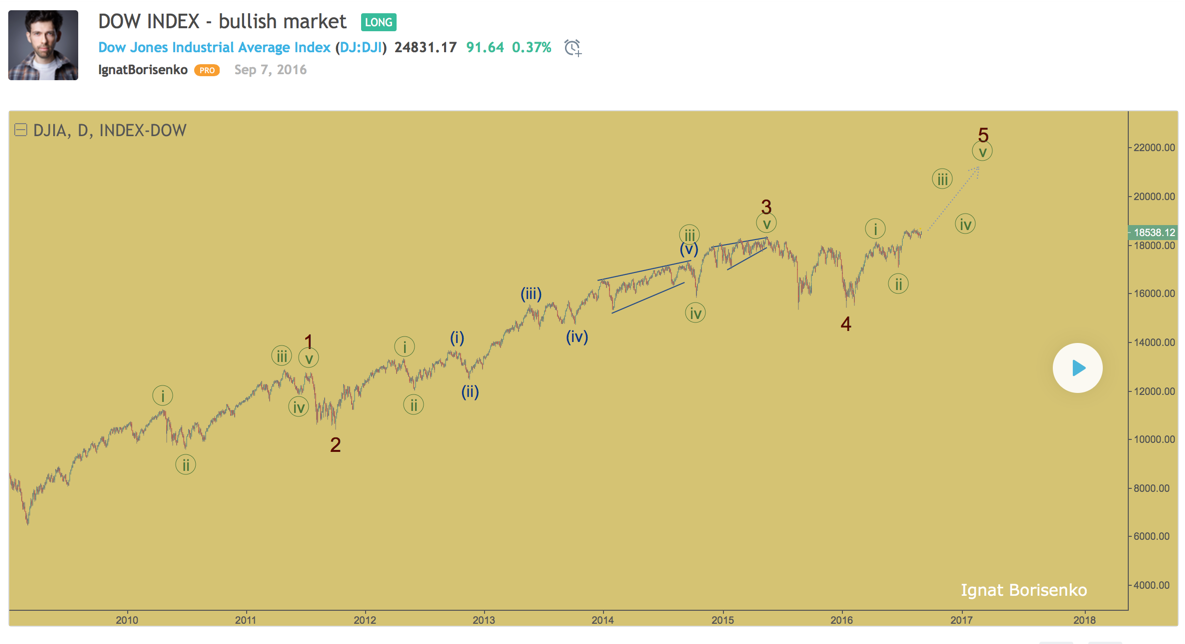

Kommen wir zu ein paar echten Geschichten. Das erste Beispiel ist der DJI-Index. Im September 2016 erreichte der Index das historische Hoch, und ich verzeichnete eine optimistische Wellenzahl. Ich habe den Markt viel höher erwartet, weil die fünfte Welle noch lange nicht vorbei war.

Einige Monate später stieg der Markt noch stärker an, aber ich war immer noch optimistisch. Diese Erwartung basierte auf einigen Dingen in dem EWP, die wir bald lernen werden, aber im Moment können Sie sehen, wie es funktioniert hat.

Der Trend ist also immer noch zinsbullisch, und Sie können die aktuelle Wellenzahl unten sehen.

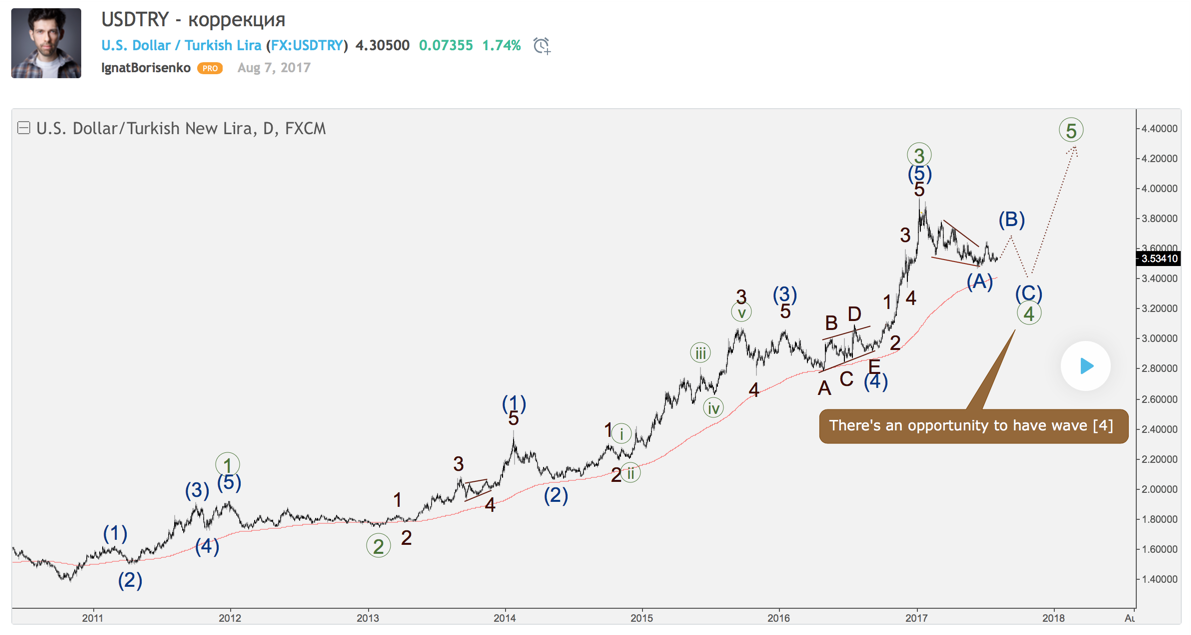

Das Zweite ist USD/TRY. Im Oktober 2016 sah die vierte Welle wie ein Dreieck aus, also erwartete ich einen weiteren bullischen Impuls, der sich in den nächsten Monaten entwickelte.

Dann gab es eine lange Geschichte mit einer rückläufigen Korrektur, die schließlich endete, so dass der zinsbullische Trend wie erwartet fortgesetzt wurde.

Im April 2018 gab es dann noch einen weiteren bullischen Moment wegen des möglichen Endes von Welle 4. So stieg der Markt noch weiter an.

Fazit

Es gibt auch schlechte Beispiele. Jedoch sprechend vom Handel, ist die wichtigste Sache, was Sie tun, wenn der Markt entlang der Tendenz entsprechend Ihrer Wellenzahl sich bewegt. So können wir das EWP als ein großartiges Instrument nutzen, um Chancen auf den Märkten zu finden.

Darüber hinaus gibt es keine Verpflichtung für Sie, eine Wellenzahl zu handeln, die Sie beschriftet oder nur im Internet gesehen haben. Sie sollten nur die besten Zählungen handeln, wenn Sie einen tollen Moment haben, um ein Geschäft zu eröffnen. Mit anderen Worten, Sie sollten auf einen guten Zeitpunkt warten, wie ein Jäger im Wald. Und wenn Sie die Gelegenheit sehen, dann tun Sie das Beste, um sie am erfolgreichsten zu handeln.

Es ist nur der Anfang. In den nächsten Artikeln gehen wir auf die spezifischeren Regeln und Richtlinien der EWP ein.

Andere Artikel in dieser Sektion

- Struktur eines Handelsroboters

- Einen Handelsroboter ohne Programmierung bauen

- Wie man Handelsroboter im MetaTrader5 benutzt?

- Algorithmischer Handel: Was ist das?

- Algo-Handel mit MQL5

- Was bedeutet "Trunkierung"?

- Ichimoku

- Führendes Diagonalmuster

- Wolfe-Wellen-Muster

- Three-Drives-Muster

- Hai

- Schmetterling

- Crab

- Bat

- Gartley

- ABCD

- Harmonische Muster

- Motiv- und Korrekturwellen. Wellengrade

- Wie man Breakouts handelt

- Devisenhandel Nachrichten

- Wie kann man einen Take Profit aufgeben?

- Risikomanagement

- Wie vergibt man einen Stop-Loss-Auftrag?

- Techische Indikatoren: Handel-Divergenzen

- Ichimoku Kinko Hyo