How to trade gaps

Information is not investment advice

A gap is an empty space within a price chart between the two neighboring candlesticks.

Gaps occur when the following candlestick opens at a distance from the previous candlestick closing price. This may happen if the market’s view of the price rapidly changes and there’s a sudden influx of buy/sell orders. At some point, the price which was at the closing of a candlestick is no more interesting for traders and the new price of the following candlestick better represents the value of an asset (a currency pair).

In Japanese technical analysis gaps are referred to as “windows”.

Here are the main types of gaps:

1. Breakaway gaps

Breakaway gaps occur at the end of a price pattern and signal the beginning of a new trend. Such gaps appear when the price is testing a level on the chart – support, resistance, trend line, trend channel etc. The price suddenly gaps through the tested level and then starts a new trend in the direction of the breakout. It’s easy to spot breakaway gaps on the chart. Their other advantage is that by spotting ing such gap a trader can join a new trend at the earliest stage.

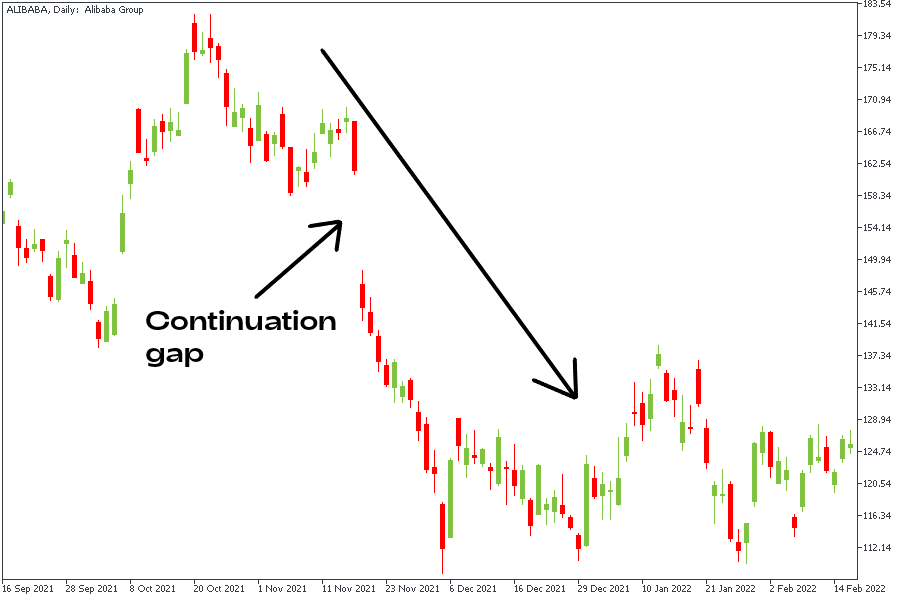

2. Continuation gaps

Continuation gaps happen in the middle of a price pattern and signal a rush of buyers or sellers who think that the price will continue going in the same direction. In other words, if you see a bullish gap during an uptrend, then you have a bullish continuation gap in the price chart. If a trend is bearish and a bearish gap is formed, it’s bearish continuation gap.

You can observe the example of the continuation gap in the chart of Alibaba below.

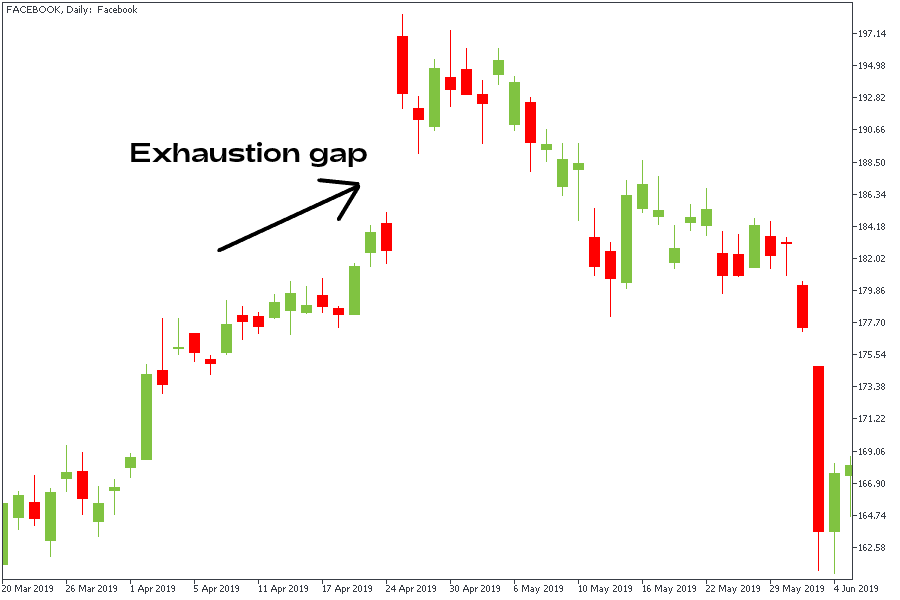

3. Exhaustion gaps

Exhaustion gaps take place near the end of a price pattern and signal a final attempt to hit new highs or lows. During these time, the last portion of market players joins the trend and there will be no one to support this trend after that. As a result, an exhaustion gap is followed by a reversal in price action. It’s possible to take an exhaustion gap for a continuation one. To make the right distinction between these two types of gaps, have a look at the size of candlesticks: if a currency pair is very volatile, candlesticks on the chart are big and the price made several jerking moves, it might be an exhaustion gap.

On the chart of Facebook, you can notice the exhaustion gap. After the last jump, there was no one to support the continuation of an uptrend, and the stock reversed down.

Besides the types of gaps mentioned above, it’s also possible to see common gaps. By this term, we mean gaps that can’t be placed in a price pattern and simply represent an area where the price has gapped.

Weekend gaps

A specific type of gaps takes place after weekends. As you know, the Forex market is not very active on Saturday and Sunday, so the main currency trading ends on Friday and starts on Sunday night with the beginning of the Asia-Pacific trading session. Yet, important events may happen during the time the market is standing still. The news may include a great number of things from political announcements and interviews to natural disasters. As a result, a great number of trading orders is accumulated before the opening of the market. These orders are not met with counter orders. As there’s no demand/supply, market players have to open positions for the prices that are higher/lower than the prices seen on Friday evening. You can easily spot weekly gaps on M1-H4 timeframes. Sometimes, when there really are some big news during the weekend, an opening gap can be very wide.

Other articles in this section

- Structure of a Trading Robot

- Building a Trading Robot without Programming

- Algorithmic trading: what is it?

- Algo trading with MQL5

- Advanced techniques of position sizing

- What does ‘truncation’ mean?

- Ichimoku

- Leading diagonal pattern

- Wolfe waves pattern

- Three drives pattern

- Shark

- Butterfly

- Crab

- Bat

- Gartley

- ABCD

- Harmonic patterns

- Trading Forex news

- Risk management

- Technical indicators: trading divergences