Risk management

Information is not investment advice

Risk management is the key element of Forex trading. It’s better to understand this simple fact rather sooner than later and put a lot of efforts into mastering this science.

By definition, risk management is the identification, analysis, assessment, control, and avoidance, minimization, or elimination of unacceptable risks. The risk that exists for Forex traders is simple to understand: it’s the ever-present risk of a bad trade that is closed with a loss.

A trader can’t control the price movements and can’t be 100% sure for the results of his/her trade. However, it’s possible to control many other things: when to trade and when not to trade, what to trade, when to exit a trade, how big a position to open. When you open an order, you can know the worst-case scenario if you have safety mechanisms in place. For example, if you have a Stop Loss order, you know that your maximal loss on this trade won’t exceed the size of the Stop Loss. It means that you shouldn’t worry about losing and can concentrate on the winning.

What is more, risk management allows traders to be profitable even if only 30% were successful. How so? Let’s find out.

Be a controlled trader

We distinguish two approaches to Forex trading: a reckless trading and a controlled one. A reckless trader has no systematic approach and doesn’t use Stop Loss orders. Such trader puts at stake the money he/she can’t afford to lose. As a result, this trader is under constant stress – something that drives him/her to ill-judged decisions.

Controlled trader, on the other hand, has a trading system that fits his/her personality. He/she uses the rules of risk management and trades with spare money. Such trader is an active learner, psychologically stable and, consequently, will be able to stay in the market for a long time becoming a professional.

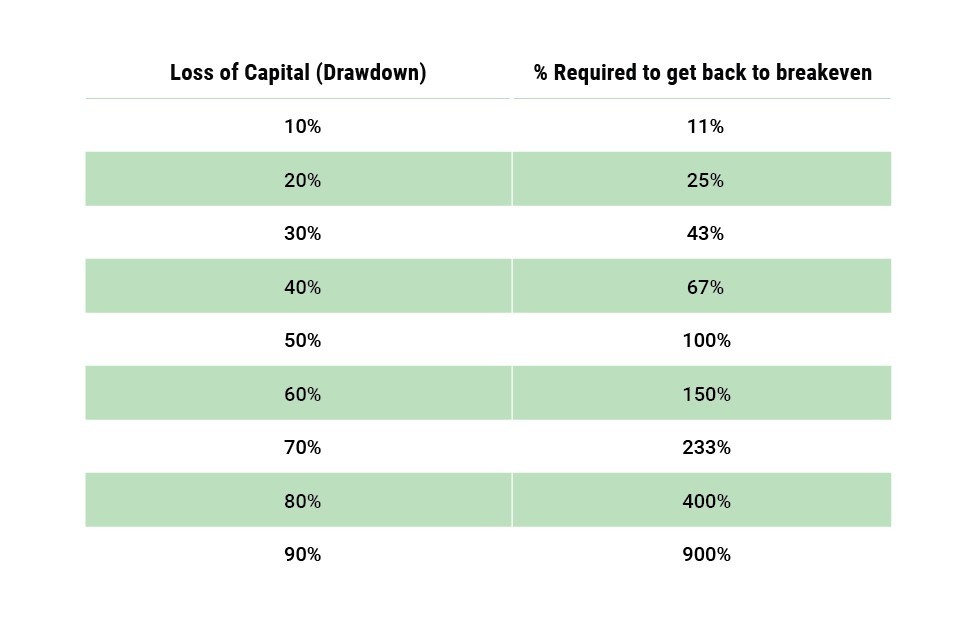

In addition, note that the bigger loss your account suffers, the harder it will be to recover your capital to the starting position. For example, if you had $100 and lost $50 (50% of your capital), you’ll need to increase the $50 have by 100% to get your account back to $100. The conclusion is that it’s necessary to be cautious and not to let your losses run.

The importance of position sizing

The secret of limiting losses lies in the triad Position sizing – Leverage – Stop Loss. Position sizing is a technique that determines how many units you should trade to achieve the desired level of risk.

It’s very important to choose your position size wisely. Here’s the golden rule of experienced traders:

risk no more than 1-2% of deposit for 1 trade.

Have a look at the table below. It shows 2 traders with the same initial amount of money – $20,000. The difference is that the first one risks 2% of his account on each trade, while the second one risks 10% of his account on each trade. If each trader has 10 losing trades in a row, the first one will have $16,675 left, while the second will remain with only $7,748.

Leverage and Margin

Forex brokers provide a trader with the opportunity to trade with more money than the balance of his/her account. This is called margin-based trading. A margin is an amount of money you need to have on your account in order to purchase a currency on credit or, in other words, to open a trade on a bigger amount you have on balance.

As we have mentioned in the course for beginners, Forex brokers set margin requirements for clients. Usually, margin equals to 1-2% of the position size. A 1% margin requirement can also be referred to as 100:1 leverage.

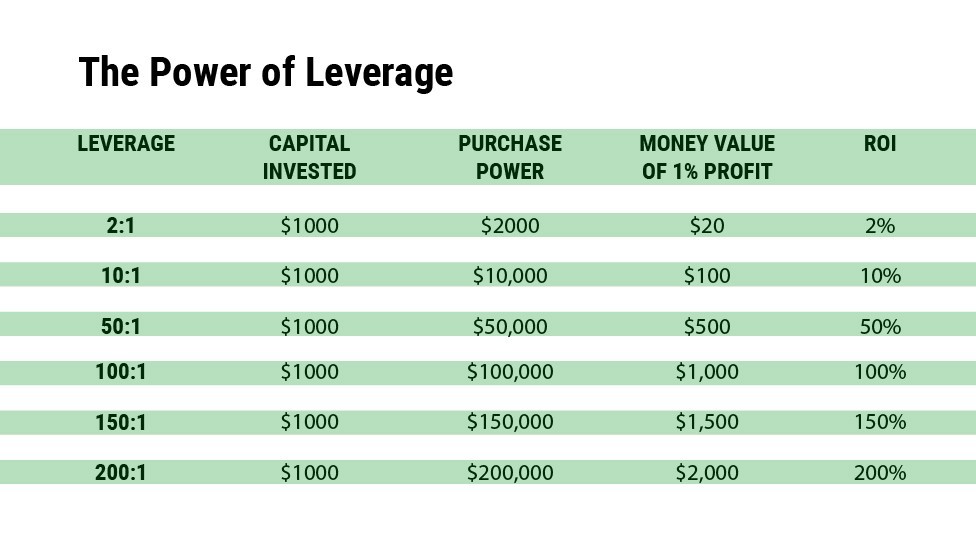

Leverage = Purchase Power/Capital Invested

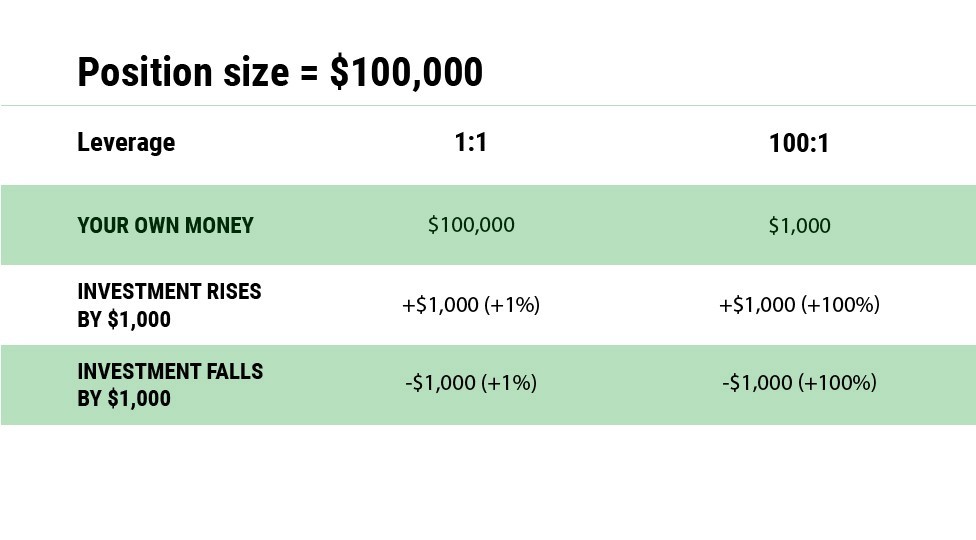

For example, if you trade 1 standard lot of EUR.USD ($100,000) while having only $1,000, it means that you are using 1:100 leverage. In other words, for every $1 you have in your account, you can place a trade worth $100. In the Forex market, traders trade with leverages of 50:1, 100:1, 200:1 or even higher depending on the broker and regulations. The ability to use high leverage distinguishes Forex from other markets.

You can see the power of leverage in the table below: with different values of leverage, you can get different purchasing power and amounts of profit.

Let’s study another example. If you trade with $1,000 and 100:1 leverage, you are able to open positions on $100,000. In this case, the gain of $1,000 would mean 100% of profit for you. If you didn’t use leverage and earned the same $1,000, you would have to supply the entire amount ($100,000) to your account. Your profit percentage would be smaller ($1,000\$100,000 = 1%). The same is with losses: leveraged positions magnify losses.

You can see that despite the obvious merits of leverage, traders have to be careful. Leverage is a double-edged sword: it increases both your gains and losses. As a result, we recommend using Stop Loss orders to limit potential losses when trading with leverage.

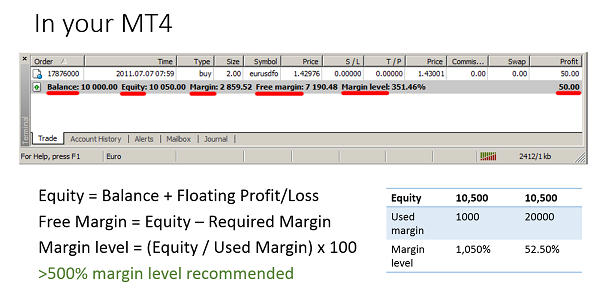

Pay attention to the parameter called “margin level”. Margin level is the number of times the used margin can be covered by the value of your account. It is the key indicator of how volatile your trading results are likely to be. The lower your margin level, the larger swings in equity you will experience. If your margin level is less than 500%, it means that you are probably taking too much risk on your account.

Risk-reward ratio

A risk/reward ratio is the amount of profit you plan to get on a position relative to what you are risking in case of a loss. To put it simply, if your Stop Loss equals to 10 pips and your Take Profit is 50 points, your risk/reward ratio is 1:5.

Risk/reward ratio is another thing you can control. In order to increase your chances of getting profit, it’s recommended to always have bigger reward than risk. The bigger the possible rewards, the more failed trades your account can withstand at a time. If you have 1:5 risk/reward ratio, one successful trade will sustain you through 5 bad trades with the same ratio.

The risk/reward ratio to choose depends on your trading style as well as the market conditions (level of volatility, state of the market – trend or range). There’s no universal solution here. We recommend keeping the reward higher than the risk for most trades. When trading in trend, risk/reward ratios can be 1:2 or 1:3. When you enter the market on a break of a specific level, it might be wise to choose 1:4 or 1:5 risk/reward ratios. When trading in a range, 1:1 may be suitable.

Diversify

Diversification is one of the key investment principles. You don’t have too “put your eggs in one basket”, because something may go wrong with this basket. The solution is to apply the portfolio principle and trade several currency pairs. Make sure, though, that you know these currency pairs (the factors which bring the currencies in motion). Every currency has its special features. It may be a good idea to first try trading on the demo account to see how a pair reacts to the various news.

Be aware of currency correlations. For example, EUR/USD and USD/CHF have a high inverse correlation. If you sell EUR/USD and buy USD/CHF, you are exposed two times to the USD and in the same direction. It equates to being long 2 lots of USD. If the USD declines, both of your positions will be losing.

Follow a plan

What makes trading risky is the wrong execution mindset. Drawbacks, losses are natural. You can’t control which trade will be a good one and which won’t. Risks exist when you don’t know what you are doing when you deviate from your trading plan.

A trading plan is a very individual thing: every trader needs a personalized trading plan. Such plan should include your personal expectations, risk management rules, and trading system(s). As Benjamin Franklin (or maybe someone else said), “by failing to plan, you are planning to fail”.

Having a plan will help you to organize your thoughts, control your emotions and avoid decisions made in a hurry.

Be a life-learning trader!

Invest time in learning more about trading and market analysis. Read articles and books, watch videos, take part in webinars and seminars. The constant increase of your knowledge about the market is the best kind of insurance from bad decisions.

Other articles in this section

- Structure of a Trading Robot

- Building a Trading Robot without Programming

- How to Launch Trading Robots in MetaTrader 5?

- Algorithmic trading: what is it?

- Algo trading with MQL5

- Advanced techniques of position sizing

- What does ‘truncation’ mean?

- Ichimoku

- How to trade gaps

- Leading diagonal pattern

- Wolfe waves pattern

- Three drives pattern

- Shark

- Butterfly

- Crab

- Bat

- Gartley

- ABCD

- Harmonic patterns

- Intoduction to Elliott Wave analysis

- How to trade breakouts

- Trading Forex news

- How to place a Take Profit order?

- How to place a Stop Loss order?

- Technical indicators: trading divergences