Leva e margine

Le informazioni non possono essere considerate consigli di investimento

Leva e margine sono elementi chiave che ogni trader deve conoscere.

Leva

La leva ti permette di fare trading con più denaro di quello che hai a disposizione sul tuo conto. I broker offrono misure della leva diverse. Puoi vedere la leva fornita da FBS nella sezione “Trading” del sito web. Ad esempio, se hai una leva di 1:30, dovrai fornire solo l’3.3% della dimensione della posizione desiderata e il restante 96.7% verrà aggiunto dal broker. Perché i broker offrono la leva ai trader? Le dimensioni dei lotti sul Forex sono piuttosto grandi. La dimensione minima della posizione è 0.01 lotto. Per la coppia di valute EUR/USD corrisponde a 1000 euro. Non tutti vogliono negoziare con tale somma di denaro, specialmente all’inizio. Per questo motivo, i broker danno la possibilità di investire solo una piccola parte del denaro necessario per finanziare tale operazione.

Esempio. Vuoi negoziare 1 lotto in USD/CAD.

Situazione 1. Fornisci 100.000$ (1 lotto standard) e fai la tua operazione. Non prendi in prestito denaro dal broker.

Situazione 2. Il tuo importo disponibile è di 3.500$. Con una leva di 1:30 dovrai fornire 3.333$, mentre il tuo broker fornirà i restanti 96.666$ per aiutarti ad aprire l'operazione.

Puoi scegliere la dimensione della leva che desideri utilizzare. Più la leva è grande, più profitti guadagnerai da ogni pip quando il prezzo si sposta a tuo favore. Di conseguenza, i trader esperti possono utilizzare un effetto leva maggiore per guadagnare più in fretta e/o guadagnare di più. Allo stesso tempo, dovresti tenere conto che anche i tuoi rischi aumentano con la leva finanziaria. Nel caso in cui tu abbia aperto una posizione di acquisto ma il prezzo stia calando e si stia quindi muovendo contro di te, otterrai una perdita maggiore per ogni pip, in proporzione alla leva utilizzata. Bisogna sempre fare attenzione e scegliere una dimensione della leva ragionevole. La leva più comune tra i trader Forex è di 1:100.

Margine

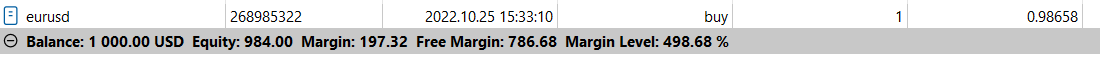

Ti starai chiedendo come sopravvivono i broker se permettono ai trader di prendere in prestito così tanti soldi. La risposta è che i broker sono protetti dal margine. Il margine è la quantità di denaro che devi avere sul tuo conto per aprire e mantenere un’operazione con leva. Quando ti abbiamo spiegato la leva finanziaria, ti abbiamo mostrato la situazione in cui per controllare 100.000$ con 3.333$ hai bisogno della leva di 1:30. In questo esempio, 3.333$ è ciò che viene chiamato “margine”. La dimensione del margine dipende dalla dimensione dell’operazione che vuoi effettuare (cioè quanti lotti vuoi negoziare) e dalla leva che hai scelto (con FBS puoi impostare la leva per il tuo conto nell’Area personale). In generale, maggiore è la leva che utilizzi, minore è il margine necessario per fare un’operazione. Nella finestra “Posizioni” del tuo terminale puoi vedere le colonne “Saldo”, “Patrimonio netto”, “Margine” e “Margine libero”. Il margine è la quantità di denaro che hai già utilizzato: questa somma finanzia le tue operazioni aperte. Nella finestra “Margine libero” puoi visualizzare la somma di denaro ancora utilizzabile per nuove operazioni. Il margine libero è uguale a “Patrimonio netto” meno “Margine”.

Di solito i broker impostano il livello di “Chiamata a margine”. Questo livello rappresenta una certa percentuale di margine. Se hai una posizione in perdita e il tuo patrimonio netto scende a quel livello, riceverai un avviso dal broker che ti avvisa di chiudere il tuo trade o depositare più denaro per soddisfare il requisito di margine minimo. Il server di trading può anche decidere di chiudere l’operazione. Esiste anche un livello chiamato “Stop Out”. Appare se continui a perdere denaro in un trade in perdita. Se le tue perdite portano il patrimonio netto a quel livello, il broker avrà il diritto di chiudere la tua posizione di trading senza alcun preavviso. In FBS, la chiamata a margine si verifica al 80% e inferiore. Significa che riceverai una chiamata a margine se il patrimonio netto del conto scende al 80% del margine e inferiore (nel nostro esempio, il 80% di 100$ è 80$). In FBS, lo Stop Out equivale al 50%, quindi il tuo trade verrà chiuso automaticamente se il tuo capitale scende a 50$ (50% del margine e inferiore). Il margine è necessario per la sicurezza del broker nel caso in cui il mercato si muova contro la tua posizione. È nel tuo interesse evitare le chiamate a margine. Se stai attento e rispetti le regole di gestione del rischio, sarai in grado di farlo e negoziare con successo.

Altri articoli in questa sezione

- Come iniziare a fare trading sul Forex?

- Come aprire una posizione in MetaTrader?

- Quanti soldi mi servono per fare trading nel Forex?

- Dimensione della posizione, livello di rischio

- Swap e Rollover

- Transazione, profitto, perdita. Tipi di ordini

- Calendario Economico

- Come posso prevedere come si muoveranno i tassi di cambio?

- Quando è aperto il mercato Forex?

- Prezzo Bid e Ask. Spread

- Calcolare il valore di 1 pip per coppie di valute diverse

- Che cos'è un lotto?

- Calcolo profitti

- Come fare trading?

- Coppie di valute. Valute di base e quotazione. Major e cross

- Quali sono i rischi?

- Quanti soldi può fare una persona con il trading Forex?

- Cos'è il Forex?

- Conti demo

- Broker Forex

- MACD (Moving Average Convergence/Divergence)

- Come determinare la dimensione della posizione?

- Swap e Rollover

- Transazione, profitto, perdita. Tipi di ordini

- Calendario Economico

- Come posso prevedere come si muoveranno i tassi di cambio?

- Quando è aperto il mercato Forex?

- Prezzo Bid e Ask. Spread

- Calcolo profitti

- Cosa sono i pip e i lotti?

- Come fare trading?

- Coppie di valute. Valute di base e quotazione. Major e cross

- Di quali strumenti tecnici ho bisogno per il trading?

- Quanti soldi può fare una persona con il trading Forex?

- Cos'è il Forex?