Pattern di inversione con candele

Le informazioni non possono essere considerate consigli di investimento

Di seguito sono riportati i modelli e le spiegazioni dei più comuni pattern di inversione.

Pattern rialzisti

I pattern di inversione rialzista appaiono alla fine di una tendenza al ribasso e segnalano un’inversione del prezzo al rialzo.

Hammer o Martello

Un pattern con 1 candela. Può segnalare la fine di una tendenza ribassista, un minimo o un livello di supporto. La candela ha un’ombra inferiore più lunga che deve essere lunga almeno il doppio del corpo reale. Il colore del martello non ha importanza, ma se è rialzista, il segnale è più forte.

I martelli sono comuni e facili da riconoscere. Mostrano che sebbene gli orsi siano riusciti a far scendere il prezzo a un nuovo minimo, non sono stati in grado di tenere il passo e alla fine di un periodo di trading hanno perso la battaglia con gli acquirenti. Se si forma un martello dopo un lungo calo del prezzo il segnale è più forte.

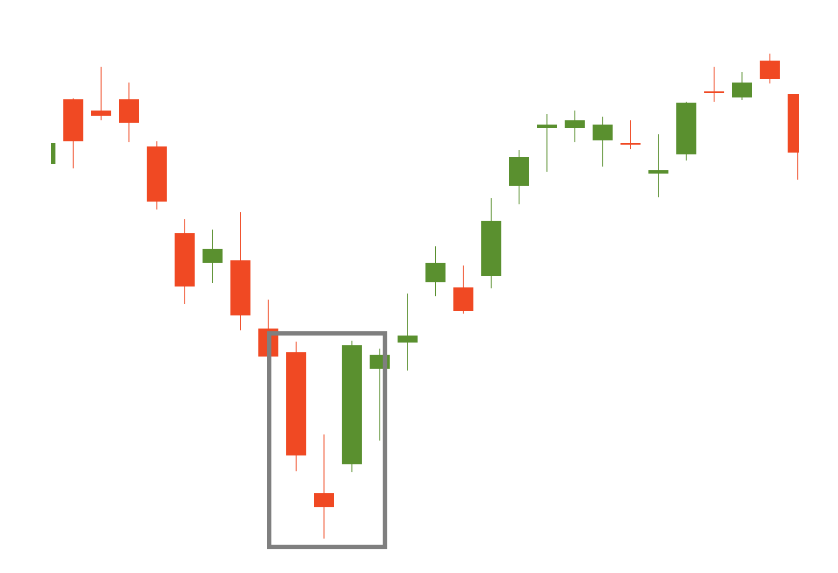

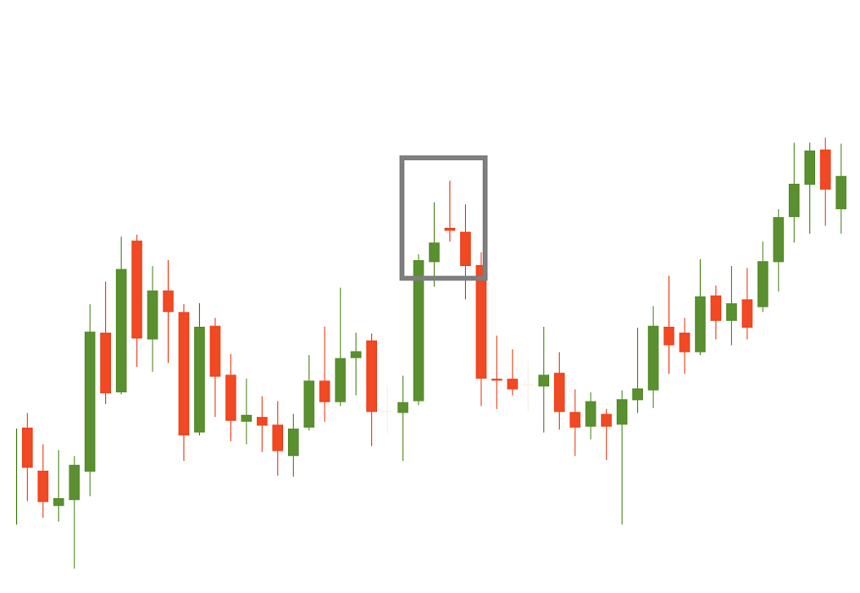

Inoltre, il segnale di acquisto sarà più affidabile se un martello è seguito da una candela che si chiude al di sopra del prezzo di apertura della candela alla sua sinistra. Ecco come appare un martello su un grafico reale:

Morning star

Un pattern con 3 candele. Dopo una lunga candela ribassista, c’è un gap ribassista. Gli orsi hanno il controllo, ma non riescono a raggiungere un buon risultato. La seconda candela è piuttosto piccola e il suo colore non è importante, anche se è preferibile che sia rialzista. La terza candela rialzista si apre con un gap rialzista e colma il precedente gap ribassista. Questa candela è spesso più lunga della prima.

I gap non sono una necessità assoluta per questo pattern, ma il segnale di inversione sarà più forte se sono presenti.

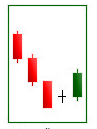

Morning doji star

Un pattern con 3 candele. È quasi identico al precedente, tranne per il fatto che la sua seconda candela è un doji.

Il segnale di questo pattern è considerato più forte di un segnale proveniente da un semplice pattern “Morning star”.

Inverted hammer o martello invertito

Un pattern con 1 candela. La candela ha un corpo piccolo e un’ombra superiore lunga che è almeno 2 volte più lunga del corpo reale.

Il colore del martello non ha importanza, tuttavia se il segnale è rialzista, quest’ultimo è più forte. Un martello invertito richiede sempre un’ulteriore conferma rialzista.

Piercing line

Un pattern con 2 candele. La prima candela è lunga e ribassista. La seconda candela si apre con un gap ribassista, al di sotto del livello di chiusura della prima. È una grande candela rialzista che si chiude sopra il 50% del corpo della prima candela. Entrambi i corpi dovrebbero essere abbastanza lunghi.

Il pattern mostra che anche se il trading è iniziato con un impulso ribassista, gli acquirenti sono riusciti a invertire la situazione e garantire i propri guadagni. Il segnale è moderatamente forte.

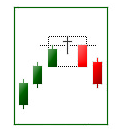

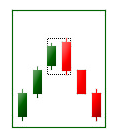

Harami rialzista

Un pattern a 2 candele. Il corpo della seconda candela è completamente racchiuso all’interno del corpo dellla prima e ha il colore opposto.

Un pattern Harami richiede sempre una conferma: la candela successiva dovrebbe essere grande e rialzista.

Harami cross rialzista

Un pattern con 2 candele, simile all’Harami. La differenza è che l’ultimo giorno è un Doji.

Puoi vedere che questo pattern assomiglia molto al pattern “Morning doji star”. La logica e le implicazioni sono simili.

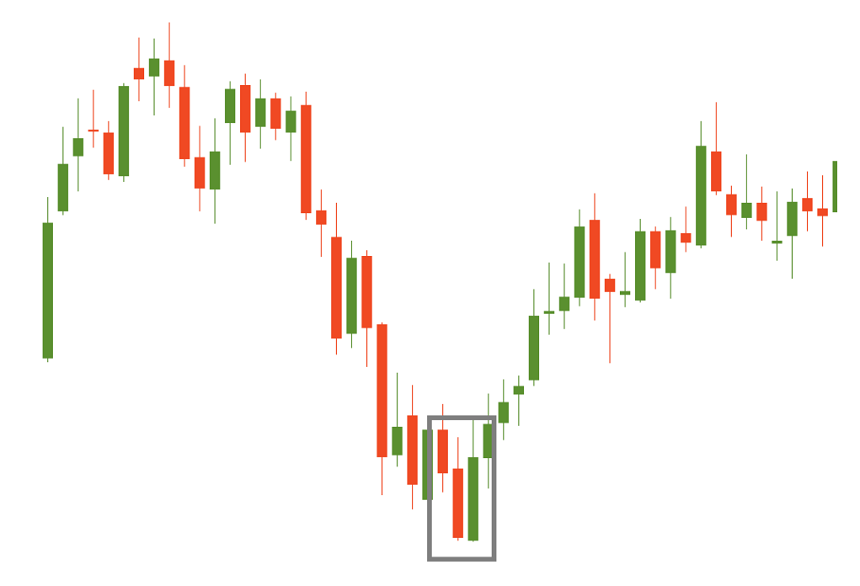

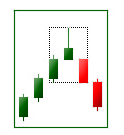

Engulfing pattern rialzista

Un pattern a 2 candele. Appare alla fine della tendenza ribassista. La prima candela è ribassista. La seconda candela dovrebbe aprirsi sotto il minimo della prima candela e chiudersi sopra il suo massimo.

Questo pattern produce un forte segnale di inversione perché l’azione del prezzo al rialzo avvolge completamente quella al ribasso. Maggiore è la differenza di dimensioni delle due candele, più forte è il segnale di acquisto.

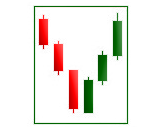

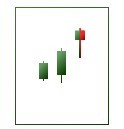

Three white soldiers

Un pattern con 3 candele. C’è una serie di 3 candele rialziste con corpi lunghi. Ogni candela deve aprirsi all’interno del corpo della precedente, idealmente al di sopra del suo centro. Ogni candela si chiude ad un nuovo massimo, vicino al suo massimo.

Questo pattern è molto affidabile, tuttavia, è preferibile un’ulteriore conferma nella forma di una candela bianca con una chiusura superiore o un gap verso l’alto.

Pattern di inversione ribassisti

I pattern di inversione ribassisti appaiono alla fine di una tendenza rialzista e indicano che è probabile che il prezzo si inverta verso il basso.

Shooting star

Un pattern con 1 candela. Il corpo della candela piccolo. L’ombra superiore è lunga e supera il corpo almeno di 2 volte.

L’ombra lunga superiore implica che il mercato ha tentato di trovare dove erano situate la resistenza e il supporto, ma l’aumento è stato respinto dagli orsi. La candela può essere di qualsiasi colore, tuttavia se è ribassista, il segnale è più forte.

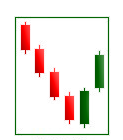

Evening star

Un pattern con 3 candele. Dopo una lunga candela rialzista, c’è un gap rialzista verso l’alto. I tori hanno il controllo, ma non riescono a raggiungere un buon risultato. La seconda candela è piuttosto piccola e il suo colore non è importante. La terza candela ribassista si apre con un gap verso il basso e colma il precedente gap rialzista. Questa candela è spesso più lunga della prima.

È preferibile che questo pattern abbia dei gap, tuttavia non è una condizione necessaria.

Evening doji star

Un pattern con 3 candele. Il pattern è simile all’“Evening star”, ma è considerato come un segnale più forte poiché la candela centrale è doji.

Il segnale di questo pattern è considerato più forte del segnale di un semplice pattern “Evening star”.

Hanging man

Un pattern con 1 candela. Può segnalare la fine di una tendenza rialzista, un massimo o un livello di resistenza. La candela ha un’ombra inferiore lunga che deve essere lunga almeno il doppio del corpo reale. La candela può essere di qualsiasi colore, tuttavia se è ribassista, il segnale è più forte.

Il pattern richiede un’ulteriore conferma ribassista. Il segnale di vendita viene confermato quando una candela ribassista si chiude sotto l’apertura della candela sul lato sinistro di questo pattern.

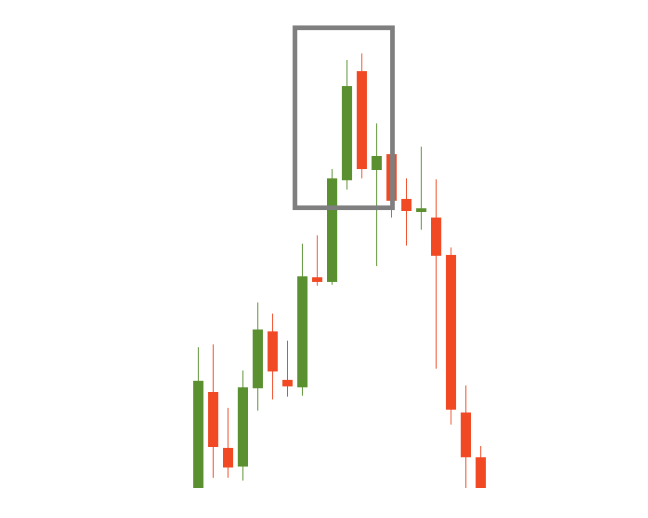

Dark cloud cover

Un pattern con 2 candele. La prima candela è rialzista e ha un corpo lungo. La seconda candela dovrebbe aprirsi significativamente sopra il livello di chiusura della prima e chiudersi sotto il 50% del corpo della prima candela. Il segnale di vendita è moderatamente forte.

Ecco un esempio di questo pattern su un grafico:

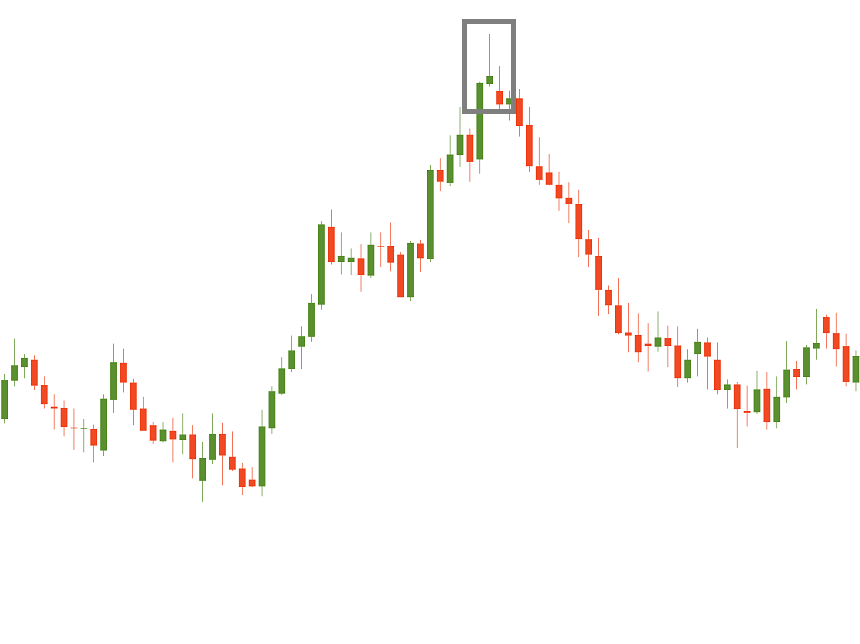

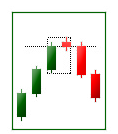

Engulfing pattern ribassista

Un pattern con 2 candele. La prima candela è rialzista. La seconda candela è ribassista e dovrebbe aprirsi sopra il massimo della prima candela e chiudersi sotto il suo minimo.

Questo pattern produce un forte segnale di inversione perché l’azione del prezzo al ribasso avvolge completamente quella al rialzo. Maggiore è la differenza di dimensioni delle due candele, più forte è il segnale di vendita.

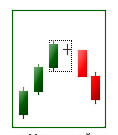

Harami ribassista

Un pattern a 2 candele. Il corpo della seconda candela è completamente racchiuso all’interno del corpo dellla prima e ha il colore opposto.

Ricorda che i pattern harami richiedono sempre una conferma: la candela seguente dovrebbe essere grande e ribassista.

Harami cross ribassista

Un pattern con 2 candele, simile all’harami. La differenza è che la seconda candela è un doji.

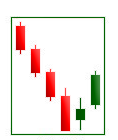

Three black crows

Un pattern con 3 candele. C’è una serie di 3 candele ribassiste con corpi lunghi. Ogni candela si apre all’interno del corpo della precedente, idealmente al di sotto del suo centro. Ogni candela si chiude ad un nuovo minimo, vicino al suo minimo.

Questo pattern è molto affidabile, tuttavia, è preferibile un’ulteriore conferma nella forma di una candela ribassista con una chiusura inferiore o un gap verso il basso.

Altri articoli in questa sezione

- Fan Lines di Fibonacci

- Espansioni di Fibonacci

- Come usare i ritracciamenti di Fibonacci

- Pattern di continuazione con candele

- Come gestire il rumore del mercato?

- Come fare il backtest di una strategia di trading

- Oscillatore Gator

- Market Facilitation Index

- Awesome Oscillator

- Range

- Alligatore

- Teoria di Bill Williams

- Frattali

- Pattern grafici

- Alla scoperta degli indicatori di Gann

- Come creare la propria strategia di trading?

- Pattern di candele

- Trend trading

- Carry trade

- Swing trading

- Position trading

- Day trading

- Lo scalping

- Stili di trading

- Cosa sono gli strumenti di Fibonacci?

- Psicologia

- Come individuare un’inversione del mercato

- Candele giapponesi

- Trends

- Condizioni e fasi del mercato