Transaktion, Gewinn, Verlust. Arten von Aufträgen

Informationen sind keine Investitionsberatung

Die Enscheidung das Währungspaar zu kaufen oder verkaufen hängt von Ihren Erwartungen an die zukünftige Kursentwicklung ab. Wenn Sie denken, dass EUR/USD steigen wird, kaufen Sie das Paar oder, mit anderen Worten, öffnen eine Lang-Position. Wenn Sie denken, dass EUR/USD sinken wird, verkaufen Sie das Paar oder, wie sagen die Händler, öffnen eine Short-Position. Nachdem schließen Sie die Position und erhalten den Gewinn, wenn der Kurs entsprechend Ihren Erwartungen sich verändert. Wenn der Kurs in der entgegengesetzten Richtung entwickelte, haben Sie einen Verlust bei dieser Transaktion.

Um diese Transaktionen auszuführen, brauchen Sie die Aufträge zu öffnen - geben spezielle Befehle Ihrem Broker durch das Handelsterminal. Es gibt verschiedene Arten von Aufträgen, die wichtigste sind: Börsenaufträge, ausstehende Aufträge, Stop-Loss- und Take-Profit-Aufträge. Welche Funktionen haben sie.

Börsenaufträge - kaufen und verkaufen - bestehen, um Positionen für den aktuellen Börsenkurs zu öffnen. Die Position wird geöffnet, wenn Sie solchen Auftrag schaffen. Mit ausstehenden Aufträgen, andererseits, können Sie die Einstiegslevel im Voraus wählen. In diesem Fall öffnet man den Handel automatisch, wenn der gewählte Kursstand erreicht wird, und Sie sollten nicht vor dem Monitor sein, wenn es passiert.

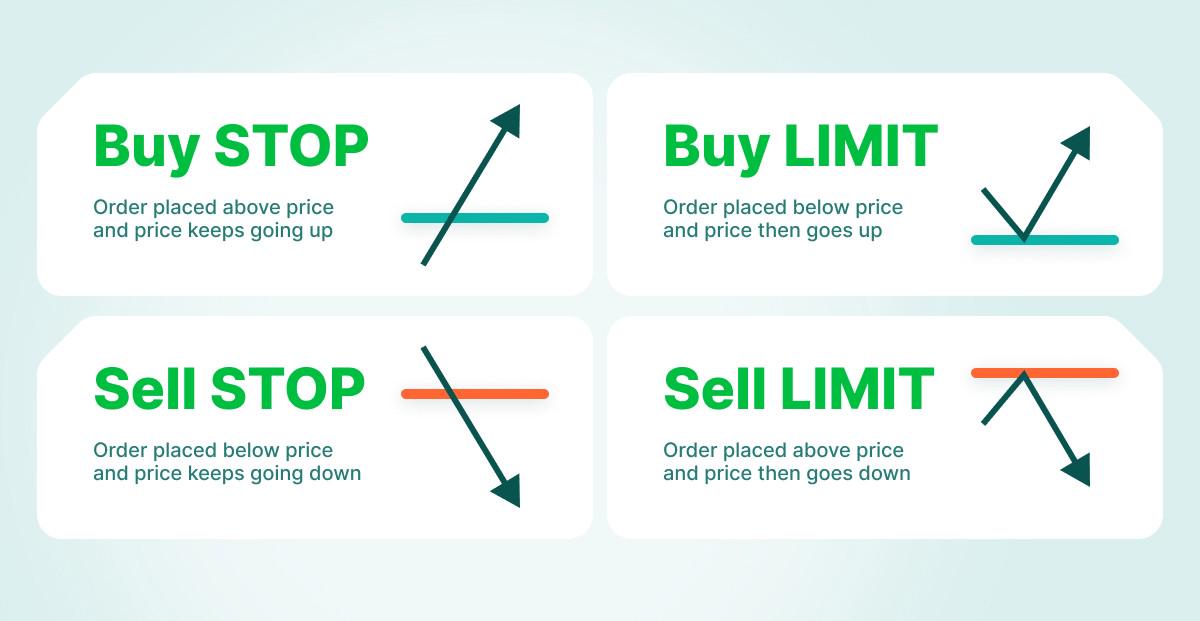

Wenn Sie denken, dass der Kurs steigen wird und dann sinkt, wählen Sell Limit über dem aktuellen Preis. Wenn Sie erwarten, dass das Währungspaar sinkt und dann steigt, wählen Buy Limit über dem aktuellen Preis. Wenn Sie denken, dass der Verkauf sich verstärken kann, wenn der Kurs bestimmtes Niveau überschreitet, stellen Sie Sell Stop über dem aktuellen Kurs. Wenn Sie denken, dass der Kauf sich verstärken kann, wenn der Kurs bestimmtes Niveau überschreitet, stellen Sie Buy Stop über dem aktuellen Kurs.

Um profitable Positionen zu schließen, benutzen eine Auftragsart Take Profit. Um unprofitable Position zu schließen, benutzen Sie den Stop LossAuftrag. Zum Beispiel, haben Sie eine Stop-Order in 100 Punkte weg von Ihrm Einspeisepunkt. Wenn der Markt 100 Punkte gegen Sie bewegt, schließt sich Ihr Stop Auftrag automatisch, um Sie vor größerem Verlust zu schützen.

Andere Artikel in dieser Sektion

- Wie beginnt man den Devisenhandel?

- Wie eröffnet man ein Geschäft in MetaTrader?

- Wie viel Geld brauche ich für den Forex-Handel?

- Demo-Konten

- Die Forex Broker

- MACD (Indikator für das Zusammen-/Auseinanderlaufen des gleitenden Mittelwerts)

- Wie bestimmt man die Positionsgröße?

- Hebelwirkung und Marge

- Swap und Rollover

- Wirtschaftskalender

- Wie kann ich vorhersagen, wie verändern sich die Wechselkurse?

- Wann wird der Forex Markt geöffnet?

- Bid und Ask. Spread

- Berechnung des Werts für 1 Pip in verschiedenen Währungspaaren

- Was ist ein Lot?

- Gewinnermittlung

- Was ist Pips und Lots?

- Wie handelt man?

- Die Währungspaare. Basiswährung und quotierte Währung. Majors und Crosses

- Welche technische Instrumente brauche ich für den Handel?

- Welche Risiken gibt es?

- Wie viele Gelder kann man mit Forex verdienen?

- Warum Handel mit Forex?

- Was ist Forex?