Swap and rollover

Information is not investment advice

There’s a difference between a trade that lasts several hours and a trade you keep open overnight. This difference is a swap.

A swap is an interest fee that is either paid or charged to you at the end of each trading day if you keep your trade open overnight. The procedure of moving open positions from one trading day to another is called rollover. If a trader extends his position beyond one day, he/she will be dealing with a cost or gain, depending on prevailing interest rates.

Let’s study an example. Imagine you bought EUR/USD. Your goal wasn’t to exchange money, you wanted to benefit from a speculative trade. In other words, you don’t need a specific amount of actual currency delivered to you, you only want the exchange rate to change in the direction of your bet because this will bring you profit. As a result, your order simply gets transferred to another day without the delivery of a real currency.

How are swaps calculated?

When you buy EUR/USD, ipso facto buy EUR and sell USD. When you sell USD you don’t own it, you borrow and pay interest on this credit if you keep a position open overnight.

If the interest rate for the euro is 0.5% and the interest rate for the US dollar is 2%, after a 0.5% — 2% = -1.5%.

You will have to pay the amount of the swap during the rollover.

In other words, your position will earn the interest rate of the currency that you have bought, and you will owe the interest rate of the currency that you sold. The difference in interest rates is what is called a swap.

When you sell EUR/USD, you buy USD and sell EUR. In case of rollover, there will be a positive swap of 1.5% (2% — 0.5% =1.5%).

Most brokers perform the rollover automatically by closing open positions at the end of the day, while simultaneously opening an identical position for the following business day. During this rollover, a swap is calculated. Brokers can also add their own charges to swaps.

The examples above show the basic logic of swap calculations. In reality, things are more precise as the interest rates are divided by 365 (to get an interest rate for 1 day) and there are other parameters in the swap’s formula like your account currency, volume, and price of a trade, as well as broker’s commission.

3-day swap

There’s one exception is how much you pay for rollover. Swap is 3 times bigger than usual if you keep your position overnight from Wednesday to Thursday. It happens because of the impact of the futures market. A swap involves pushing back the value date on the underlying futures contract. If a position was opened on Wednesday, the value date will be Friday. If a position is kept open overnight from Wednesday to Thursday, the value date will be moved forward to Monday, i.e. by 3 days, because there’s no trading during the weekend. As a result, the interest is charged for 3 days instead of just one.

Where to check swap sizes?

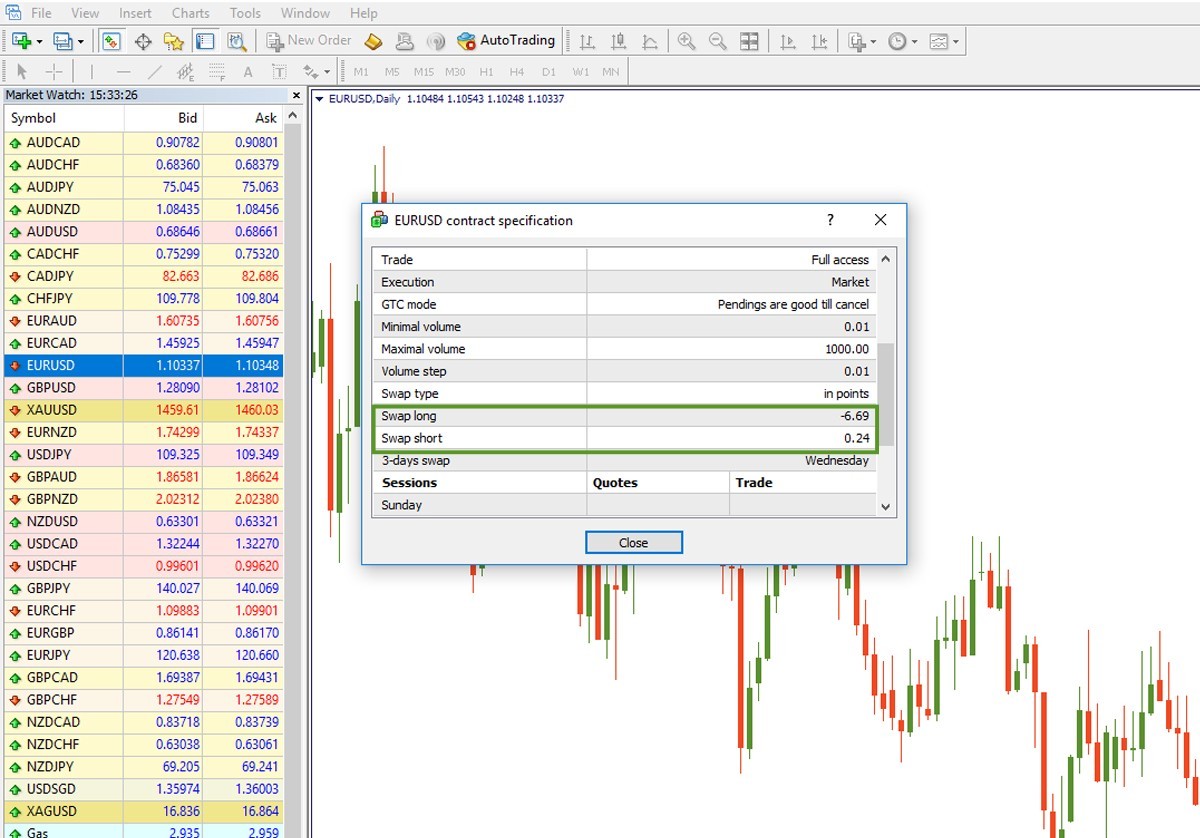

You can look up swaps long and short at your broker’s website. The specification of currency pairs usually represents swap as the number of base currency units for each currency pair on a 1-lot position.

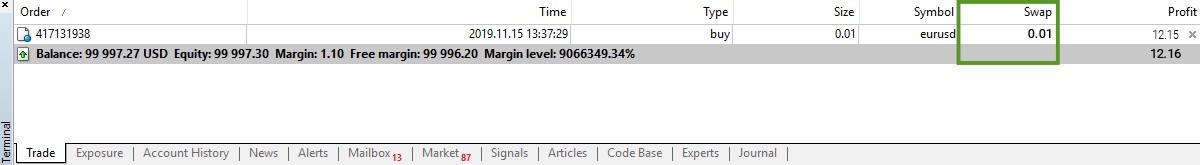

It’s also possible to check swaps in Metatrader. The trading terminal automatically calculates and reports all swaps for you. You will be able to see swaps on your open position (if you keep it open for longer than 1 day) when you open a “Terminal” window and click on the “Trade” tab. The swap will influence the value of your profit.

You can also right click on the symbol of a currency pair in the “Market watch” window and choose to see “Specification”. A window with information about this trading instrument will pop up and it will contain swaps among other figures.

Should you take swaps into account?

If you trade only intraday without rollovers, swaps aren’t your concern at all. Even if you keep a trade open for several days (up to 2 weeks) and trade one of Forex majors, your gain/loss from swaps will likely be small compared to the outcome of your trade (your profit or loss). As a result, many traders do not pay attention to swaps.

Swaps will become important if you hold an open position for longer than 2 weeks and if you trade exotic currencies that may have high interest rates.

Other articles in this section

- How to start trading on Forex?

- How to open a trade in MetaTrader?

- How much money do I need for Forex trading?

- Demo accounts

- MACD (Moving Average Convergence/Divergence)

- How to determine position size?

- Transaction, profit, loss. Types of orders

- Economic calendar

- When is Forex market open?

- Calculating profits

- How to trade?

- What technical tools do I need for trading?

- The advantages of Forex market

- What is Forex?