How to trade?

Information is not investment advice

To 'trade Forex' means to buy or sell different currency pairs.

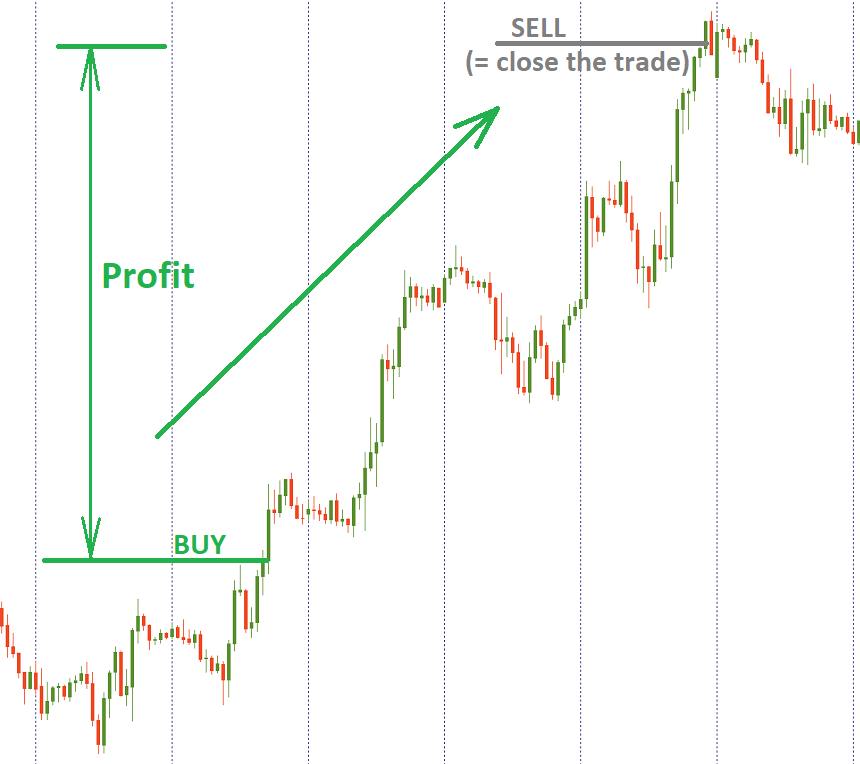

For example, the current price of EUR/USD is 1.1000. If you expect the euro to appreciate against US dollar, you buy EUR/USD. This is a common Forex transaction. To execute it, you need to open a trading program (MetaTrader 4 or MetaTrader 5), click on a “new order” and then choose 'buy'.

As some time passes and the price of EUR/USD rises, you close the position and get the profit. The amount of profit depends on how much the rate of this currency pair has increased as well as on the size of your position.

If your assumption was wrong and EUR/USD declined after you bought it, you will have a loss. Same as with profit, the size of your loss will depend on how much the rate of this currency pair has fallen during this time and the size of your position.

Traders who expect the prices to rise are called ‘bulls’, while those who expect a decline are referred to as ‘bears’. A buy trade is also known as a ‘long position’, while sell trade is also called a ‘short’ position.

Currency pairs tend to move in trends, i.e. to rise or fall for significant periods of time. “A trend is your friend” is a common saying among traders. If you see a series of higher highs, it’s an uptrend. If you see a sequence of lower lows and lower highs, it’s a downtrend. The idea of trend trading is to open positions at the start of the trend and get a big profit as it progresses.

It’s sensible to buy at a lower price and sell at a higher price. Notice though that one currency is always strengthening against another. The same is also true: one currency is always weakening against another. As a result, you have an equal opportunity to buy or sell to enter the Forex market. All you need to do is to analyze the chart and the economic potential of the currencies that form a pair and make a forecast about which direction they will move next.

Other articles in this section

- Demo accounts

- MACD (Moving Average Convergence/Divergence)

- Leverage and margin

- Swap and rollover

- Transaction, profit, loss. Types of orders

- Economic calendar

- When is Forex market open?

- Bid and Ask price. Spread

- Calculating profits

- What are pips and lots?

- Currency pairs. Base and quote currencies. Majors and crosses

- What technical tools do I need for trading?

- The advantages of Forex market

- What is Forex?