Leverage and margin

Information is not investment advice

“Leverage” and “margin” are key definitions every trader should know.

Leverage

Leverage allows you to trade with more money than you have on your account. How much more? Different brokers offer different leverage sizes. You can check the leverage provided by FBS in the “Trading” section of the website.

For example, if you have a leverage of 1:30, you will need to provide only 3.3% of the desired trade size and the rest 96.7% will be added by the broker to make your trade work.

Why do brokers give traders leverage? Notice that the sizes of lots on Forex are quite big. The minimum position size in 0.01 lot. For EUR/USD currency pair that accounts for 1,000 euro. Not everyone will want to trade with such amounts of money, especially at the beginning. As a result, brokers provide traders with the opportunity to invest only a small part of the money to finance such a trade.

Example. You want to trade 1 lot in USD/CAD.

Situation 1. You provide $100,000 (1 standard lot) and make your trade. You don’t borrow money from the broker.

Situation 2. You can spare only $3,500. With 1:30 leverage, you will provide $3,333 your broker will provide the remaining $96,666 to help you open the trade.

You can choose the size of leverage you would like to use. The bigger the leverage, the more profit you will get from each pip the price moves in your favor. As a result, skilled traders may use bigger leverages in order to make profits faster and/or in larger quantities.

At the same time, you should always be aware that your risks also increase with leverage. If you opened a buy trade but the price is going down, each pip the price moves against you will bring you a bigger loss the bigger the leverage you are using. As a result, you should be careful and choose a reasonable leverage size. The most common leverage among Forex traders is 1:100.

Margin

You may be wondering how brokers survive if they allow traders to borrow so much money from them. The answer is that brokers are protected because of the margin. A margin is an amount of money you need to have on your account to open and maintain a leveraged trade.

When we explained leverage, we showed you the situation where to control $100,000 with $3,333 you need 1:30 leverage. In this example, $3,333 is what is called “margin”. You can see that the margin size depends on your desired trade size (i.e. how many lots you want to trade) and on the leverage you have chosen (you can specify the leverage for your account in your personal area with FBS). All in all, the bigger the leverage you use, the smaller the margin you will need to make a trade.

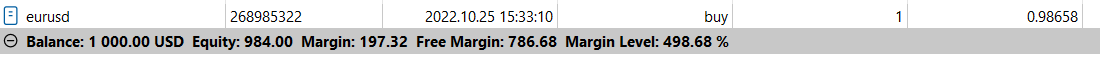

In your terminal “Trade” window you can see columns “Balance”, “Equity”, “Margin”, and “Free margin”. So, the margin is the amount of money you have already used: this sum finances your current open trades. The amount of money you can still use for new trades is reflected in the “Free margin” area. Your free margin will always be equal to “Equity” less “Margin”.

Brokers usually define the “margin call” level. This level represents a certain percentage of margin. If you have a losing trade and your equity falls to that level, you will get a warning from the broker that you need to close your trade or deposit more money to meet the minimum margin requirement. The trading server may also decide to close the trade.

There’s also a level called “stop out”. It comes in sight if you keep losing money in an unsuccessful trade. If your losses pull your equity to that level, then the broker will be entitled to close your trading position without any warnings.

At FBS, a margin call is at 80% and lower. It means that you'll get a margin call if your account equity drops to 80% of the margin and lower (in our example, 80% of $100 is $80). A stop out equals 50% at FBS, so your trade will be automatically closed if your equity drops to $50 (50% of the margin and lower).

The margin is needed for your broker’s security in case the market goes against your position. It’s in your interest as a trader to avoid margin calls. If you are careful and abide by the rules of risk management, you will be able to do that and trade with profit.

Other articles in this section

- How to start trading on Forex?

- How to open a trade in MetaTrader?

- How much money do I need for Forex trading?

- Demo accounts

- MACD (Moving Average Convergence/Divergence)

- How to determine position size?

- Transaction, profit, loss. Types of orders

- Economic calendar

- When is Forex market open?

- Calculating profits

- How to trade?

- What technical tools do I need for trading?

- The advantages of Forex market

- What is Forex?