What are pips and lots?

Information is not investment advice

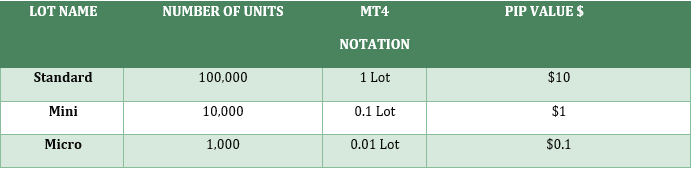

Lot

A lot is a number of currency units. A standard lot equal to 100,000 units of a base currency/your account currency. It means that if you want to trade EUR/USD, you will need $100,000. There are two other well-known lot sizes. They are a mini lot (equal to 10,000) and a micro lot (equal to 1,000 units).

To open a trade, you will need to decide how much money to put into it. The term ‘lot’ is closely linked to such notions as ‘leverage’ and ‘pip’. Let’s get deeper into this topic.

Leverage

A great benefit of trading at the Forex market is leverage. As we already said, a standard lot is $100,000, it’s a huge amount. However, your broker can help you. FBS offers up to 1:30 leverage. The standard lot is big but there are other types of lots. So, if you trade 0,01 lot on the cent account that equals 1,000 units, to open a trade of 0.01 lot you need only 10 euros. With the leverage of 1:10 you will be able to open 0.1 lot trade investing the same amount of money but getting bigger profit.

Pip

Reading analytic articles or news you definitely saw such phrase “the pair rose/declined by … pips”. What is the pip and how does it affect the amount of money you earned?

A pip means “Percentage in Point”. It represents the smallest change a currency pair can make. Usually, a pair is counted in four decimal points, for example, a quote of GBP/USD is given like this: 1.3463. However, there are some pairs that have 2 decimal points. For example, the US dollar/Japanese yen is quoted as 109.70. A pip is represented by the last decimal of a price/quotation.

If EUR/USD changed from 1.0800 to 1.0805, this would be a change of 5 pips. If USD/JPY changed from 120.00 to 120.13, this would be a change of 13 pips.

Note that some Forex brokers also count the 5th and the 3rd decimal places respectively. They are called “pipettes” and make the spread calculation more flexible.

Let’s learn how to count the value of one pip.

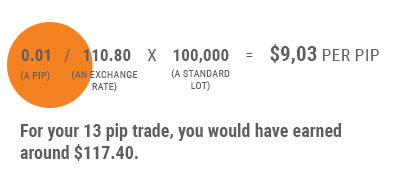

We will use the USD/JPY pair as an example. The exchange rate is 110.80.

(0.01 (a pip)/110.80(an exchange rate) X 100,000 (a standard lot) = $9,03 per pip

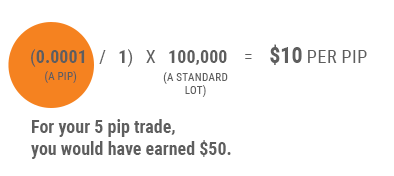

Let’s count a pair where the USD is not a base currency. For example, EUR/USD. The exchange rate is 1.15.

(0.0001/1) X 100,000 = $10 per pip

Now you know how leverage, lot, and pip are linked. And you even can calculate your profit. It’s time to practice your knowledge! OPEN YOUR ACCOUNT

Other articles in this section

- How to start trading on Forex?

- How to open a trade in MetaTrader?

- How much money do I need for Forex trading?

- Demo accounts

- MACD (Moving Average Convergence/Divergence)

- How to determine position size?

- Transaction, profit, loss. Types of orders

- Economic calendar

- When is Forex market open?

- Calculating profits

- How to trade?

- The advantages of Forex market