Comment trader sur les cassures

Les informations données ne sont pas des conseils en investissement

| Il y a beaucoup d'outils techniques qui peuvent vous aider afin de déterminer les niveaux importants. Les traders tracent ces niveaux à travers les hauts et les bas précédents, utilisent les retracements de Fibonacci et les points pivots, les lignes de tendance, etc. Les niveaux importants servent de support / résistance pour le prix. Plus le prix atteint un tel niveau, plus le niveau que vous avez réussi à trouvé est valide. |

| Lorsque le prix atteint un niveau important, cela signifie qu'il devrait continuer à évoluer dans cette direction. Cependant, cela n'arrivera que dans le cas d'une vraie cassure et cela n'arrive pas à chaque fois. Dans de nombreux cas, un prix dépasse un niveau important mais ne parvient pas à maintenir ce mouvement. Il revient à son range de trading précédent, donc la cassure s'avère être fausse. |

| Comment pouvons-nous savoir si une cassure est vraie ou fausse ? Juste après que le prix passe un certain niveau, cela peut être très difficile à dire. Dans le même temps, il est évident qu'un trader doit trader différemment avec une véritable cassure qu'avec une fausse cassure. |

| Notez que de tels figures de prix comme les canaux, les triangles et les drapeaux peuvent être vraiment utiles afin d'identifier les points de cassure potentiels. Plus le niveau est important, plus il sera difficile de le casser. Dans le même temps, rappelez-vous qu'une véritable cassure d'un tel niveau aura des conséquences plus lointaines. |

Trader sur les fausses cassures

| Cela vaut la peine de dire qu'il y a plus de fausses cassures que de vraies. Les traders novices ont tendance à se lancer dans le trading de cassure sans avoir de véritable confirmation, et, par conséquent, ils se font sortir du marché par des acteurs plus importants. |

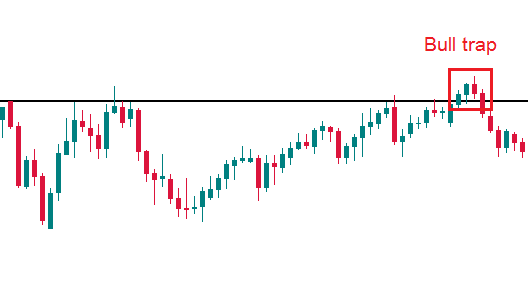

| Lorsque, après une tentative de cassure, le prix revient au range précédent et s'y fixe, il s'agit d'une fausse cassure. Cela peut arriver instantanément après qu'un prix ait atteint un niveau important ou après 4 bougies ayant été au-delà du niveau. Ce dernier est appelé piège de taureau / ours. Les figures de chandelier d'inversion situés à proximité d'un niveau de "cassure" donnent des indications fiables informant qu'une cassure a échoué. |

| Les fausses cassures sont mieux lorsque l'on trade dans le sens de la tendance. Nous vous recommandons fortement d'analyser le H1 et les intervalles de temps plus longs étant donné qu'avec les plus courts (M30, M15, etc.) l'action des prix est trop chaotique. |

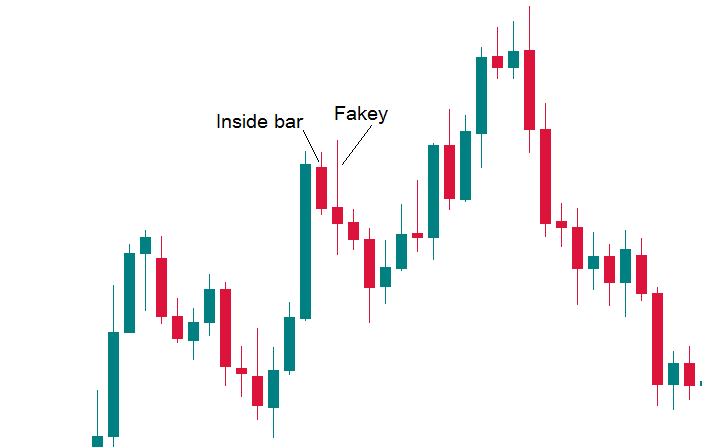

| Un cas particulier à mentionner est le modèle que l'on nomme "Fakey" qui est, en d'autres termes, une fausse cassure d'une barre intérieure. Une barre intérieure est un chandelier, qui est complètement couvert par le chandelier précédent. Si vous voyez une barre intérieure et que sa cassure se termine dans une bougie, c'est un signal fort qui indique que le prix ira dans la direction opposée à la fausse cassure. |

Trader sur les vrais cassures

| Si vous avez décidé d'entrer sur le marché dans le sens d'une cassure, faites-le avec précaution. Dans de nombreux cas, le simple fait de placer un ordre différé, par exemple un Sell Stop un peu en dessous d'un niveau de support, peut déclencher votre ordre d'entrée et entraîner une perte si le prix redevient plus élevé. |

| Afin de résoudre ce problème, certains traders placent des ordres d'entrée pour une position courte en dessous de la bougie de cassure. Mais, même ainsi, le risque d'une fausse cassure reste élevé. |

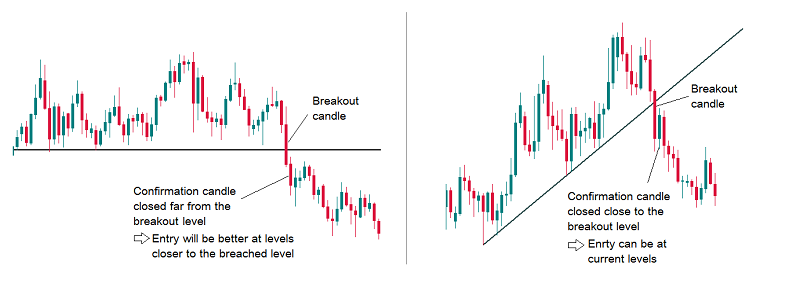

| Afin d'améliorer vos chances de succès, vous devriez regarder la bougie de cassure. Sa longueur devrait dépasser la moyenne d'au moins 1,5 fois. Elle devrait également avoir un corps complet (ce ne peut pas être un doji ou une barre d'épingle). Même si la bougie correspond à cette description et se ferme en dessous du niveau de support, attendez la deuxième bougie - la bougie de confirmation. Elle devrait être plus petite que la bougie de cassure et se fermer également au-dessous du niveau de cassure. |

| Si la bougie de confirmation se ferme à proximité du niveau de cassure, nous pouvons entrer au prix du marché. Si la bougie est fermée loin du niveau de cassure, nous plaçons un Sell Limit plus proche du niveau de cassure. |

| La patience est bien souvent la meilleure option. Avec les modèles de graphique comme le "Épaule-Tête-Épaule", il y a souvent un nouveau test de niveau cassé. |

| Si vous avez décidé de trader sur une cassure, cela signifie que vous prenez un risque plus élevé qu'autrement. Ce risque élevé doit être reflété dans votre gestion des risques : il est recommandé de déplacer rapidement l'ordre Stop Loss au niveau de rentabilité (autrement dit, déplacez votre Stop Loss jusqu'à un point où votre trade se clôturera avec 0 perte plus rapidement que pendant le range). Le rapport risque/rendement peut aller jusqu'à 1:4, 1:5. Vous pouvez utiliser l'échelonnage (fermez partiellement la position lorsque le prix évolue en votre faveur). |

| N'oubliez pas des facteurs tels que le sentiment du marché, les actualités économiques et le bon sens. Ces éléments peuvent vous donner des indications sur la nature de ce qui se passe sur le graphique. |

| Pour résumer, le mot "confirmation" devrait être votre mot magique. Peu importe que nous parlions d'une fausse ou d'une vraie cassure. Toutefois, une vraie cassure nécessite plus de confirmations qu'une fausses. |

Autres articles de cette section

- Structure d'un robot de trading

- Concevoir un robot de trading sans programmation

- Comment lancer des robots de trading avec MetaTrader 5 ?

- Trading algorithmique : de quoi s'agit-il ?

- Trading d'algo avec MQL5

- En quoi consiste le principe de la "troncature" ?

- Ichimoku

- Figure de diagonale d'initialisation

- Le modèle des vagues de Wolfe

- Modèle des "Three drives"

- Shark

- Papillon

- Crabe

- Chauve-souris (bat)

- Gartley

- ABCD

- Les figures harmoniques

- Introduction à l'analyse Elliott Wave

- Actualités sur le Forex

- Comment placer un ordre Take Profit ?

- Gestion des risques

- Comment placer un ordre Stop Loss ?

- Indicateurs techniques: trading des divergences