Bill Williams es el creador de algunos de los indicadores del mercado más populares: oscilador asombroso, fractales, alligator y gator.

¡No pierdas tu tiempo – mantente informado para ver cómo las NFP afectan al USD!

Aviso de Recopilación de Datos

Mantenemos un registro de tus datos para ejecutar este sitio web. Al hacer click en el botón, estás aceptando nuestra Política de Privacidad.

Manual para Principiantes de Forex

Tu guía definitiva a través del mundo del trading.

¡Revisa Tu Correo!

En nuestro correo electrónico, encontrarás el Manual de Forex 101. ¡Solo toca el botón para descargarlo!

Advertencia de Riesgo: Los ᏟᖴᎠs son instrumentos complejos y tienen un alto riesgo de pérdida de dinero rápidamente debido al apalancamiento.

El 68,53% de las cuentas de los inversores minoristas pierden dinero al operar ᏟᖴᎠs con este proveedor.

Deberías tener en consideración si comprendes el funcionamiento de los ᏟᖴᎠs y si puedes darte el lujo de arriesgarte a perder tu dinero.

2020-03-25 • Actualizada

Esta información no son consejos para inversión

Introducción

El nivel de cambio en el empleo no agrícola, también conocido como Nóminas No Agrícolas o NFP por sus siglas en Inglés, es uno de los indicadores de mayor valor en el calendario económico. Los traders e inversionistas le dan el mismo nivel de importancia que las reuniones de política monetaria y los discursos de los directores de los bancos centrales. Este indicador hace que el mercado sea muy volátil y puedes crear una estrategia rentable basada en él. Los analistas de FBS te explicarán qué estrategia es más adecuada para operar las NFP.

¿Qué son las Nóminas No Agrícolas y cuándo se publican?

El cambio en el empleo no agrícola representa el cambio en el número de personas empleadas durante el mes anterior, excluyendo a aquellas que trabajan en la industria agrícola. Mientras más personas estén empleadas, mejores serán las condiciones económicas. Si la economía está creciendo, las empresas contratan a más personas. Cuando las personas obtienen empleo y estabilidad, comienzan a gastar sus ingresos adicionales y, por lo tanto, impulsan la economía. Por otro lado, la situación económica desfavorable hace que las empresas empleen a menos personas e incluso despidan a algunos de sus trabajadores. Así, las personas pierden sus ingresos y tienden a gastar menos dinero. Esto reduce el gasto general del consumidor y, como resultado, la economía se ralentiza.

Como resultado, el indicador sirve como base para la decisión de tasas futuras de la Reserva Federal. Un alto nivel del indicador aumenta la posibilidad de más alzas de tasas en el futuro; por otra parte, la disminución de las cifras de las NFP genera preocupación por la desaceleración económica y reduce el número de alzas de tasas proyectadas por la Reserva Federal.

El nivel de las NFP de EE.UU. usualmente se publica el primer Viernes de cada mes, junto con los niveles mensuales promedio de ganancias por hora y tasa de desempleo. Puedes consultar la hora de la próxima publicación en el calendario económico

¿Qué operar?

Dado que las NFP es un indicador estadounidense, definitivamente afectará al USD. Algunos analistas sugieren elegir entre los pares GBP/USD o EUR/USD para operar. Sin embargo, el par EUR/USD tiende a ser más volátil en esta publicación.

Operando antes de la publicación de las NFP

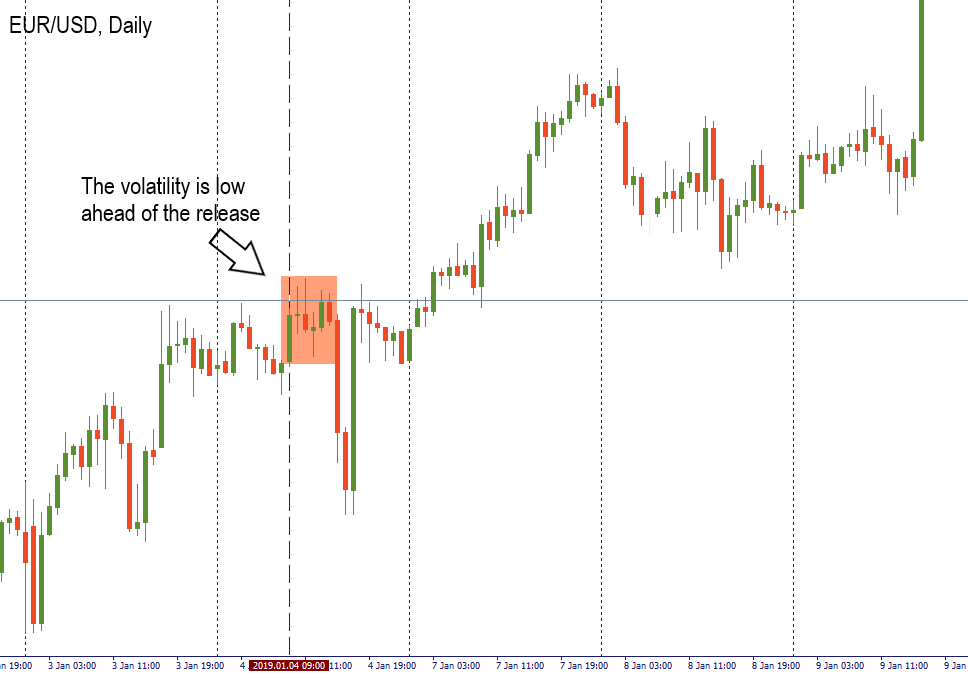

Como es un evento ampliamente esperado, podemos ver que la volatilidad disminuye antes de que se publiquen las NFP. Es recomendable mantenerse fuera del mercado durante las primeras horas de trading del Viernes, ya que podrías verte afectado por los cambios repentinos en la volatilidad.

Sencilla estrategia de trading de NFP a corto plazo

Para este tipo de estrategia, utilizamos un gráfico de 5 minutos. Veamos los siguientes pasos.

Paso 1: 30 minutos antes de la publicación de las NFP, abre el gráfico y encuentra el máximo más alto y el mínimo más bajo durante las últimas cuatro horas.

Paso 2: Coloca dos órdenes pendientes en ambos lados: una orden pendiente de compra al menos 5-10 pips por encima del máximo más alto y una orden pendiente de venta 5-10 pips por debajo del mínimo más bajo en ese rango.

Paso 3: Coloca los Stop Loss en ambos lados: tu Stop Loss para una posición larga será una orden pendiente de venta y viceversa.

Paso 4: Espera a que se publiquen las noticias y se activará una de las órdenes pendientes. No olvides cancelar tu otra orden pendiente.

Paso 5: Es recomendable establecer un precio objetivo del mismo tamaño que la distancia entre el máximo y el mínimo. Puedes usar estas fórmulas para determinar el objetivo:

Orden de compra + (el máximo antes de la publicación – el mínimo antes de la publicación) Orden de venta – (el máximo antes de la publicación – el mínimo antes de la publicación)

Paso 6: Disfruta de tus ganancias.

Ejemplo

En el gráfico de 5 minutos para el par EUR/USD, determinamos el máximo en 1.1384 y el mínimo en 1.1362. Abrimos una orden pendiente de compra en 1.1389 y una orden pendiente de venta en 1.1357. Luego colocamos los Stop Loss: el Stop Loss para la posición larga se ubica en 1.1357, mientras que el Stop Loss para la posición corta se ubica en 1.1389. Después de la publicación, vemos una gran vela alcista, lo cual muestra la fuerza de los toros. Colocamos la ganancia en 1.1411 y cancelamos la orden corta. Después de eso, el precio inmediatamente comenzó a disminuir. Ganamos +22 pips.

Conclusión

La estrategia explicada anteriormente te permitirá maximizar tus ganancias y reducir los riesgos durante el aumento de la volatilidad. Te ayudará a operar EUR/USD con mucha facilidad durante la publicación de las NFP.

Bill Williams es el creador de algunos de los indicadores del mercado más populares: oscilador asombroso, fractales, alligator y gator.

Las estrategias de tendencia son buenas: pueden dar resultados significativamente buenos en cualquier temporalidad y con cualquier activo. La idea principal de la estrategia ADX basada en tendencia es intentar posicionarse en el comienzo de la tendencia.

Las estrategias contra tendencia siempre son las más peligrosas, pero también las más rentables. Nos complace presentar una excelente estrategia contra tendencia para trabajar en cualquier mercado y con cualquier activo.

Su solicitud ha sido aceptada

Te llamaremos en el intervalo de tiempo que elijas

La próxima solicitud de devolución de llamada para este número de teléfono estará disponible en 00:30:00

Si tienes algún problema urgente, contáctanos a través del

Chat en vivo

Error interno. Por favor, inténtelo nuevamente más tarde