Bill Williams ist der Schöpfer einiger der bekanntesten Marktindikatoren: Awesome Oscillator, Fraktale, Alligator und Gator.

Verschwenden Sie nicht Ihre Zeit - beobachten Sie, wie die NFP den US-Dollar beeinflusst!

Hinweis zur Datenerfassung

Wir speichern Ihre Daten für den Betrieb dieser Website. Durch Drücken der Taste stimmen Sie unserer Datenschutzpolitik zu.

Forex-Buch für Anfänger

Ihr Leitfaden durch die Welt des Handels.

Überprüfen Sie Ihre Inbox!

In unserer E-Mail finden Sie das Buch Forex 101. Tippen Sie einfach auf die Schaltfläche, um es zu erhalten!

Risikowarnung: ᏟᖴᎠs sind komplexe Instrumente und bringen ein hohes Risiko mit sich, aufgrund von Hebelwirkung schnell Geld zu verlieren.

68,53 % der Privatanleger-Konten verlieren Geld, wenn sie mit diesem Anbieter ᏟᖴᎠs handeln.

Sie sollten sich überlegen, ob Sie verstehen, wie ᏟᖴᎠs funktionieren und ob Sie es sich leisten können, zu riskieren, Ihr Geld zu verlieren.

2023-01-17 • Aktualisiert

Informationen sind keine Investitionsberatung

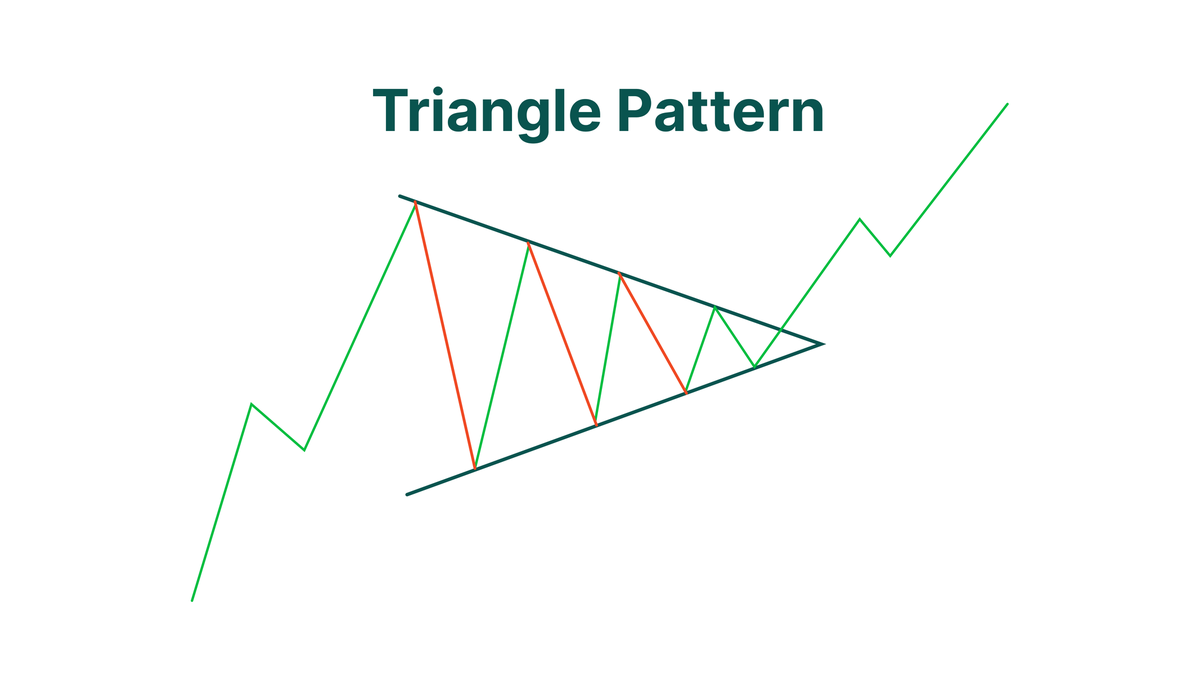

Ein Dreieck-Chart-Muster ist ein Konsolidierungsmuster, bei dem sich der Kurs eines Vermögenswerts innerhalb einer sich allmählich verengenden Spanne bewegt. Dreiecksmuster veranschaulichen den Kampf zwischen Käufern und Verkäufern auf dem Markt. Trotz dieses Kampfes signalisieren Dreiecksmuster in der Regel die Fortsetzung eines vorherigen Trends, so dass Händler dazu neigen, auf den Ausbruch des Kurses aus der Spanne zu warten, um in den Handel einzusteigen.

Dreiecksmuster lassen sich auf einem Chart erkennen, indem man zwei Trendlinien durch die Höchst- und Tiefstwerte der Formation zeichnet. Wenn die Trendlinien zu Beginn weit auseinander liegen, später aber zusammenlaufen, handelt es sich bei dem Muster tatsächlich um ein Dreieck-Chart-Muster.

In diesem Artikel erfahren Sie mehr über die verschiedenen Arten von Dreiecksmustern, wie Sie sie auf einem Chart erkennen können und welche Handelsstrategien Sie anwenden können, wenn Sie ein Dreiecksmuster auf einem Chart entdecken.

Der erste Typ von Dreiecksmustern, den wir besprechen werden, ist ein symmetrisches Dreieck. Werfen wir einen Blick auf den unten stehenden Chart.

Dies ist ein Beispiel für ein typisches symmetrisches Dreiecksmuster. Wie Sie sehen, sieht dieses Muster sehr ordentlich aus, da beide Trendlinien mit einer ähnlichen Neigung zusammenkommen. Dieses Muster wird oft als allgemeines Beispiel für Dreiecksmuster verwendet, weil es eine sehr klare und erkennbare Form bildet.

Symmetrische Dreiecke entstehen, wenn sich der Kurs innerhalb einer begrenzten Spanne, die im Laufe der Zeit immer kleiner wird, nach oben und unten bewegt. Die Spitzen von symmetrischen Dreiecken werden allmählich niedriger, während die Tiefpunkte höher als die vorherigen steigen.

Symmetrische Dreiecke treten in der Regel auf Märkten auf, die sich nicht nur in eine Richtung bewegen. Kein einzelner Trend dominiert diesen Markt, so dass Käufer und Verkäufer die Preisbewegungen gleichermaßen beeinflussen und eine Konsolidierungsphase einleiten können.

Wenn der Kurs aus dieser begrenzten Bewegungsspanne ausbricht, bewegt er sich in der Regel in Richtung des vorherigen Trends, und zwar mit einem viel größeren Volumen als während der Bildung des Musters, was darauf hindeutet, dass die Händler die Phase der Unentschlossenheit hinter sich gelassen haben und der Trend wieder in die richtige Richtung geht.

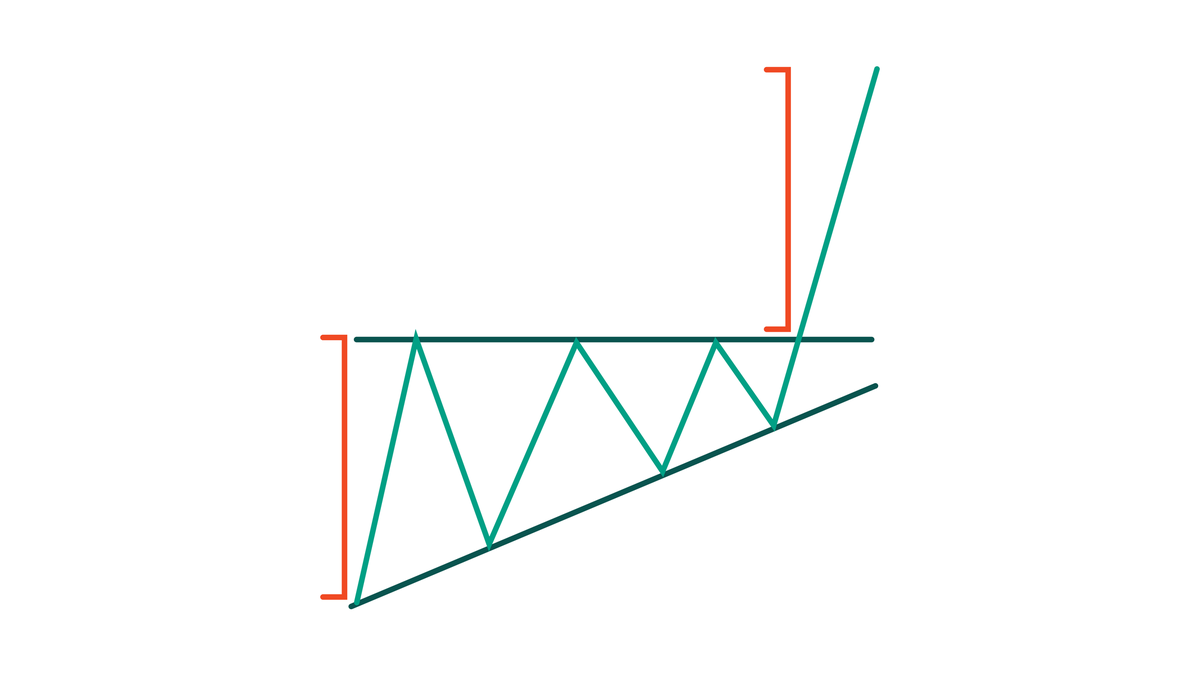

Die nächste Art von Dreiecksmustern, die wir uns ansehen werden, ist ein aufsteigendes Dreieck. Aufsteigende Dreiecke unterscheiden sich von symmetrischen Dreiecken dadurch, dass nur ihre Unterseite schräg ist. Die Oberseite eines aufsteigenden Dreiecks, die durch den Scheitelpunkt der Formation verläuft, bleibt horizontal und signalisiert, dass der Widerstand der Bären trotz des Vormarschs der Bullen unverändert bleibt.

Typischerweise tritt dieses Muster nach einem sehr deutlichen Aufwärtstrend auf, den Sie an der steigenden Unterstützungslinie erkennen können. Es setzt seinen Anstieg fort und konvergiert schließlich mit der statischen Widerstandslinie, durchbricht diese und nimmt den vorherigen Aufwärtstrend wieder auf. Ein aufsteigendes Dreieck wird daher als ein bullisches Muster betrachtet, das einem Anstieg der Kursbewegung und des Handelsvolumens vorausgeht.

Aufsteigende Dreiecke können nicht nur die künftige Richtung der Kursbewegung anzeigen, sondern auch den besten Zeitpunkt für den Einstieg oder den Ausstieg aus dem Geschäft, so dass das Aufspüren von aufsteigenden Dreiecken auf einem Chart bedeutet, neue Gelegenheiten für gewinnbringende Geschäfte zu finden.

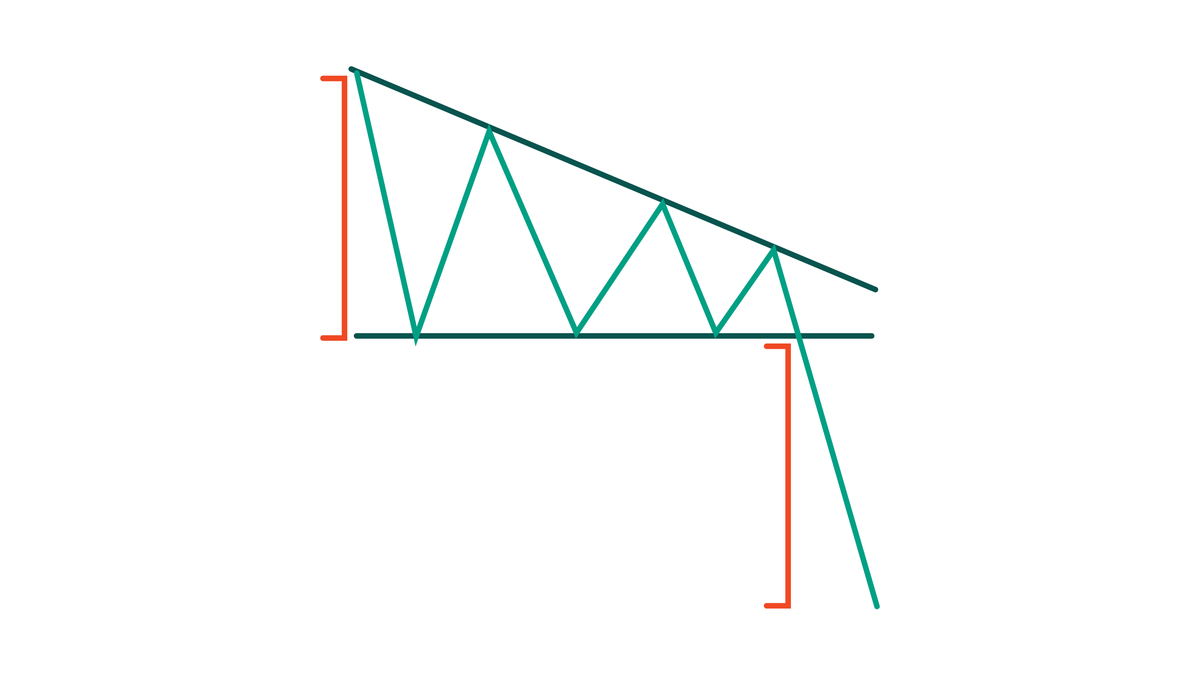

Ein absteigendes Dreieck ist das genaue Gegenteil eines aufsteigenden Dreiecksmusters. Absteigende Dreiecke treten in einem bärischen Markt auf und gelten, wie Sie vielleicht schon erraten haben, als bärische Muster.

Wie Sie auf diesem Chart sehen können, spiegelt ein absteigendes Dreieck sein Gegenstück und hat eine schräge und eine horizontale Trendlinie. Bei absteigenden Dreiecken ist jedoch die abfallende Seite die Widerstandslinie. Dieses Muster zeigt, dass es die Bären sind, die immer weiter auf die Bullen vorrücken, die ihrerseits nicht in der Lage zu sein scheinen, angemessene Unterstützung zu bieten, um dem drohenden Widerstand entgegenzuwirken. Am Ende durchbrechen die Bären in der Regel die Unterstützungslinie, was das Ende und die Bestätigung des Dreiecks und die Fortsetzung des vorherigen Abwärtstrends signalisiert.

Obwohl sowohl absteigende als auch aufsteigende Dreiecke in der Regel den Beginn eines Abwärtstrends bzw. eines Aufwärtstrends signalisieren, ist es immer noch möglich, dass der Kurs von der horizontalen Trendlinie abprallt, was zu einer Umkehrung eines früheren Trends führt. Daher ist es in den meisten Fällen besser, zu warten, bis das Muster vollständig ist, bevor man Handelsentscheidungen trifft.

Wenn Sie auf Ihrem Chart ein Dreiecksmuster erkennen, sollten Sie in der Regel warten, bis der Kurs ausbricht und einen neuen Trend bildet. Ist dies der Fall, können Sie am Breakoutspunkt in den Handel einsteigen und sich in die Richtung bewegen, in die sich der Kurs bewegt. Was den Ausstiegspunkt betrifft, so bewegt sich der Kurs nach der Bildung eines Dreiecksmusters in der Regel um ungefähr die gleiche Distanz wie die Höhe des Musters, so dass Sie Ihren nächsten Schritt planen und sich auf die Gewinnmitnahme vorbereiten können.

Dennoch gibt es beim Handel mit verschiedenen Dreiecksformen verschiedene Dinge zu beachten, auf die wir im Folgenden eingehen werden.

Wie wir bereits gelernt haben, können symmetrische Dreiecke sowohl auf bullischen als auch auf bärischen Märkten auftreten. Sowohl Bullen als auch Bären haben gleiche Positionen, so dass sich der Preis in beide Richtungen bewegen kann.

Was Sie in diesem Fall tun können, ist, Einstiegsaufträge knapp über der Widerstandslinie und unter der Unterstützungslinie zu platzieren. Auf diese Weise steigen Sie automatisch in den Handel ein, ohne sich Gedanken darüber zu machen, in welche Richtung sich der Markt als nächstes bewegt. Alternativ können Sie auch den Breakout abwarten, um zu sehen, wohin sich der Kurs schließlich bewegt, und dann mit dem Strom schwimmen.

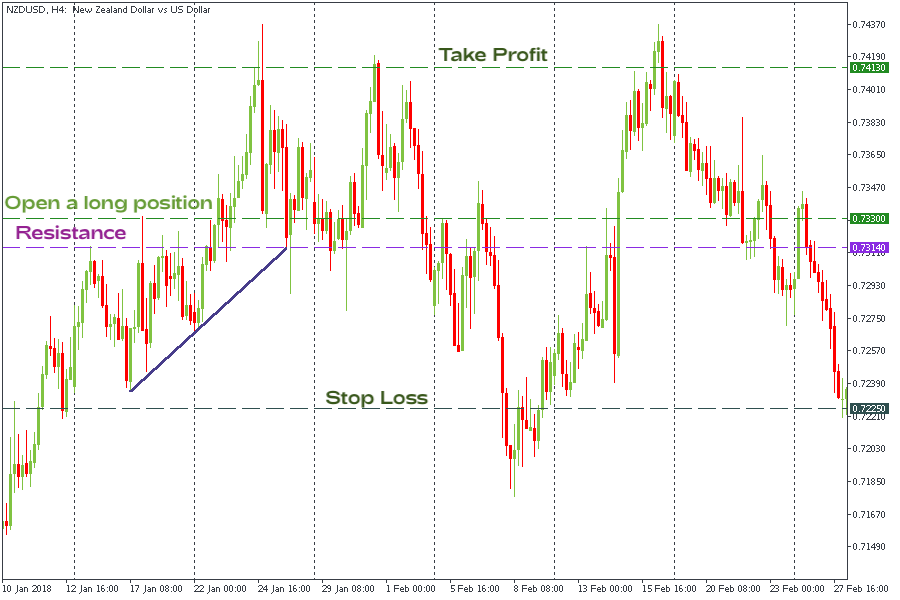

Schauen wir uns das folgende Beispiel an.

Auf dem Tages-Chart von EURUSD können Sie ein symmetrisches Dreieck am Schnittpunkt einer steigenden Trendlinie und einer abwärts gerichteten Linie innerhalb eines großen Abwärtstrends beobachten. Nachdem das Muster identifiziert wurde, warteten wir auf den Breakout entweder nach unten oder nach oben. In unserem Beispiel durchbrach die Kerze die Widerstandslinie, woraufhin wir die Position bei 1,3355 eröffneten. Wir platzierten einen Stop-Loss etwa 10 Punkte unter dem tiefsten Punkt des Dreiecks bei 1,2324. Wie wir bereits erwähnt haben, entspricht die Bewegung des Preises in der Regel der Höhe des Musters. Deshalb haben wir als nächsten Schritt den Abstand zwischen dem höchsten und dem niedrigsten Punkt des Musters gemessen:

1,3294 - 1,2334 = 0,096.

Nachdem wir dies gemessen haben, können wir nun die beste Position für eine Gewinnmitnahme bestimmen (1,3355 + 0,096 = 1,4315) und einen Ausstiegsauftrag erteilen.

Sowohl aufsteigende als auch absteigende Dreiecke treten innerhalb von Aufwärts- bzw. Abwärtstrends auf und gelten in der Regel als Fortsetzungsmuster, was bedeutet, dass sich der Markt nach dem Ausbruch weiterhin in dieselbe Richtung bewegt wie vor dem Auftreten des Musters.

Das ist jedoch nicht immer richtig. Der Kurs kann von einer der Trendlinien abprallen und den Trend vollständig umkehren. In Anbetracht dessen liegt es auf der Hand, dass die sicherste Vorgehensweise beim Handel mit diesen Mustern darin besteht, auf einen Ausbruch zu warten und mit der nächsten Kursbewegung mitzugehen.

Die folgenden Beispiele veranschaulichen, wie Sie mit aufsteigenden und absteigenden Dreiecken handeln können.

Auf dem H4-Chart von NZDUSD können Sie ein aufsteigendes Muster erkennen, das sich zwischen einer horizontalen Widerstandslinie bei 0,7314 und einer schrägen Unterstützungslinie gebildet hat. Wir haben beschlossen, die Position nach dem Durchbruch des Widerstands bei 0,7333 zu eröffnen. Dann setzten wir einen Stop-Loss bei 0,7225 (10 Punkte unter dem tiefsten Punkt des Dreiecks) und nahmen unsere Gewinne bei 0,7413 mit, nachdem wir die Höhe des vorhergehenden Dreiecksmusters (0,7314 - 0,7234 = 0,08) ermittelt hatten.

Betrachten wir abschließend, wie wir das absteigende Dreieck handeln können.

Auf dem H4 zeigt die Konsolidierung an der Spitze des Aufwärtstrends, dass die Bullen nicht in der Lage sind, den Preis nach oben zu treiben. Infolgedessen hat sich ein absteigendes Dreieck gebildet, dessen Unterstützungslinie bei 0,7470 liegt. Wir beschlossen, beim Durchbruch der Unterstützung in den Markt einzusteigen, und platzierten einen Short bei 0,7455. Um die Risiken zu minimieren, setzten wir einen Stop-Loss 10 Punkte über dem letzten Höhepunkt des Dreiecks bei 0,7534 und einen Take-Profit-Auftrag bei 0,7367.

Das Dreiecksmuster ist eines der häufigsten und am besten erkennbaren Chartmuster, das mit großer Wahrscheinlichkeit eine Fortsetzung der Marktbewegung vorhersagt. Händler sollten jedoch bedenken, dass bei einem Dreiecksmuster immer die Möglichkeit besteht, dass sich der vorherige Trend umkehrt, weshalb es besser ist, den Ausbruch abzuwarten, bevor Entscheidungen getroffen werden.

Bill Williams ist der Schöpfer einiger der bekanntesten Marktindikatoren: Awesome Oscillator, Fraktale, Alligator und Gator.

Trend-Strategien sind gut - sie können in jedem Zeitrahmen und mit jedem Vermögenswert signifikant gute Ergebnisse liefern. Die Hauptidee der ADX-Trend-Strategie besteht darin, den Beginn des Trends zu erwischen.

Gegentrend-Strategien sind immer die gefährlichsten, aber auch die profitabelsten. Wir freuen uns, Ihnen eine exzellente Gegentrend-Strategie vorstellen zu können, die in jedem Markt und mit jedem Vermögenswert funktioniert.

Ihr Antrag wird akzeptiert.

Wir werden Sie in dem von Ihnen gewählten Zeitintervall anrufen

Nächste Rückrufwunsch für diese Telefonnummer wird verfügbar in 00:30:00

Wenn Sie ein dringendes Problem haben, kontaktieren Sie uns bitte per

Live-Chat

Interner Fehler. Bitte versuchen Sie später noch einmal