Fractals

Information is not investment advice

A fractal is a pattern in which the same configuration occurs throughout the structure, on a variety of different scales. In other words, it’s a pattern that can be subdivided into similar patterns similar to each other and to the parent pattern.

Just like it’s possible to find Fibonacci ratios in nature, fractals also occur quite often – in plants, crystals, snowflakes, etc.

The idea of fractals was applied to financial markets by Bill Williams. According to him, complex moves of the market are made of self-similar recurring patterns. As a result, although the dynamics of the price may seem random, it’s actually not and has a specific structure.

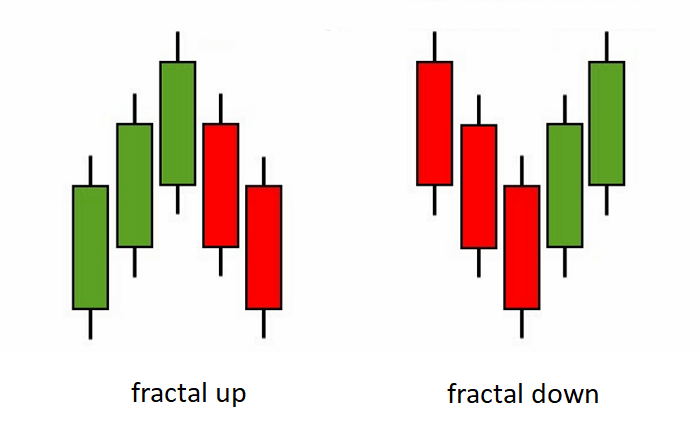

So if we get to the charts, a fractal is considered to be a pattern formed by at least 5 candlesticks in a way that the high/low of the central candlestick exceeds the extremes of the neighboring candles.

A fractal up is a series of five consecutive candlesticks (bars) where the highest high is preceded by two lower highs and is followed by two lower highs. The opposite configuration would be a fractal down. Both structures look like small reversals of the price. Both fractals (buy and sell) may share candlesticks.

It is not an easy task to constantly track fractals visually. You can have fractals marked on your Metatrader chart by clicking “Insert”, choosing “Indicators”, "Bill Williams" and then “Fractals”. The indicator will add a sign at the middle bar of every fractal it recognizes.

How to use fractals in trading

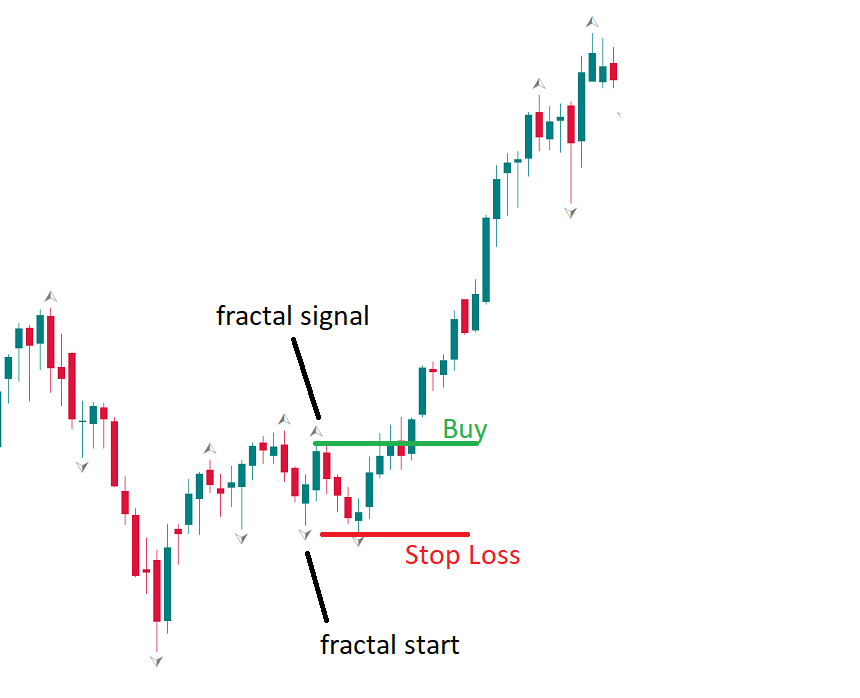

After you added the Fractals indicator to a chart, you can hunt for trade signals. Here’s the method proposed by Bill Williams:

- Wait for a situation when the latest fractal is pointing in the opposite direction from the previous one. This is called a fractal start. The trade should be in the direction of the second fractal.

- A trading signal will appear if the price goes beyond this fractal (i.e. its middle candlestick).

- Put a Stop Loss beyond a fractal stop, which is the furthest point from either of the previous two fractals in the opposite direction to the signal.

The Fractals indicator can produce a lot of signals. It’s wise to use it together with other technical indicators developed by Williams in order to filter the good signals from the bad ones.

Other articles in this section

- Fibonacci fan

- Fibonacci expansion

- How to Use Fibonacci Retracements

- Reversal candlestick patterns

- Continuation candlestick patterns

- How to deal with market noise?

- How to backtest a trading strategy

- Gator Oscillator

- Awesome Oscillator

- Ranges

- Alligator indicator

- Bill Williams theory

- Chart patterns

- Uncovering Gann indicators

- How to create your own trading strategy?

- Candlestick patterns

- Trend trading

- Carry trade

- Swing trading

- Position trading

- Day trading

- Scalping

- Trading styles

- Fibonacci tools

- Trader's psychology

- How to identify market reversal

- Japanese Candlesticks

- Trends

- Market conditions and phases