Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

2022-12-12 • Updated

Information is not investment advice

If you are familiar with trading, you know about trends. A trend shows the direction of a price. It can be ascending, descending, or horizontal. If a trader understands how to define trends, they will most likely have few problems opening a position. A trader needs to have a clear strategy for riding trends to increase the chances of successful trading. This article will look at the most popular trend-trading tips and study some of the most exciting and simple trend following strategies.

To build an effective trend trading strategy, you need to know how to trade with the trend. Trend trading in Forex is a popular trading style for traders who take advantage of prices moving in one way for a prolonged period. When trading in a trending market, a trader needs to be very careful and pay attention to any signs of the upcoming reversal, which will most likely ruin their setup. One of the greatest trend traders of all time is George Soros, whose trend following trading strategies helped him predict market mood changes.

Trend following trading has multiple advantages over other trading styles. What are the main pros of using this approach?

Whether you trade on the stock, commodity, or Forex markets, dealing with the trend strategies requires the same rules of technical analysis for all of them. Trends can be found on any chart, so you can try trend following strategy on any instrument you like.

Successful trend traders managed to make billions of dollars with their trend trading skills, tactics, and knowledge of the market structure. We've already highlighted George Soros as one of the influencers of a trend trading approach. However, there are more people we can mention.

One of the big names of trend trading is Ed Seykota. He is one of the traders who was interviewed in "Market Wizards" by Jack Schwager. With only $5 thousand in his pocket, he managed to make $15 million over 12 years.

Another legend of trend trading is David Harding, the CEO of Winton Capital. His trend following fund for clients exceeds $30 billion in assets.

Finally, you have heard about the hero of the "Reminiscences of a Stock Operator" book Jesse Livermore. Some traders name him as a farther of the trend following approach. In 1929, he had $100 million. In today's money, that's about $1.5 billion. His sense of market was so impressive that he still inspires traders until now.

These are some of the most recognized trend following traders, who turned their power and skills into money. Maybe you will be the next to join the list?

The first step in building a trend following a trading strategy is the most obvious – you need to determine a trend. You can do it either manually or with the help of indicators.

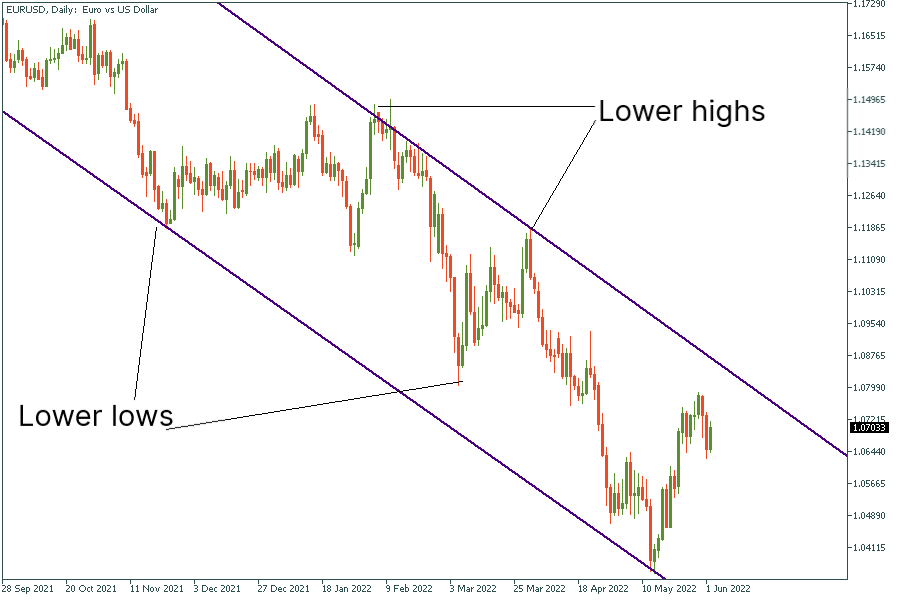

People with an experience in trading can spot a trend in a blink of an eye! The easiest way to do that is to connect highs and lows. You need to connect at least two points on the chart. If the price forms higher highs and higher lows, a trader can suggest that it moves within an uptrend. Vice versa, if the price forms lower lows and lower highs – you are facing a downward pressure, which will likely start a downtrend.

In the picture above, we could identify a clear downtrend after connecting the most obvious peaks and lows of EURUSD on the daily chart. The price forms lower lows and lower highs. Moreover, the price has been moving within a so-called descending channel. That is, balancing between two diagonal lines that limited the price from both upside and downside without a breakout. The price has been moving within this channel for almost nine months. Thus, the downtrend is considered strong.

Most trend traders prefer building trend-following systems rather than using raw price charts. These complex setups include implementing technical indicators to the chart. There are several trend following indicators that can help you with that. The most popular is moving averages. There are simple, exponential, linear weighted, and smoothed moving averages. They all use different math functions behind them.

Simple moving average (MA) is the most popular type of moving average. It shows the average prices for the considered period.

Exponential MA and Linear Weighted MA calculate the latest prices with the higher coefficient. They tend to provide faster signals. However, they may provide lagging information, be careful!

Smoothed MA is based on the simple MA. It clears price moves from fluctuations the most.

The best moving averages for identifying trends are simple and smoothed moving averages. A trader can set different periods of MAs for trend analysis. Typically, a trader sticks to the 200-period simple moving average. It shows the directional bias of the market. A classic interpretation of trend trading strategy with a 200-period simple moving average is straightforward. If the price is moving above the moving average, it indicates an upside momentum. In this case, you need to consider long entries. Vice versa, when the price goes below the 200-period SMA, you are most certainly facing a downtrend.

On the daily chart of EURUSD above, you can see that the price was forming higher highs and higher lows when it was above the moving average. Alternatively, it was making lower lows and lower peaks when it was below the moving average.

There is another indicator that serves as a powerful helper when it comes to working with trends. It is the Trend intensity index (TTI) that M. H. Pee developed to measure the strength of a trend in the market. It compares the proportion of prices for the previous 30 days above or below today's 60-day moving average.

It takes today's 60-day MA and each day's deviation for calculations. The deviations are calculated as the difference between the close price and the average. Up deviations give a positive amount while the downside deviations give negative amounts. The formula for the TII indicator looks like this:

Trend intensity index (TII) = (total up / (total up + total down)) × 100

The Trend Intensity indicator balances between 0 and 100. If the TII value is below 50, the trend is bearish. When it moves near 20, the downtrend is strong. On contrary, if TII is above 50, the trend is bullish. The closer the indicator is to 80, the stronger an uptrend. You can download the Trend intensity index for Metatrader 5 from the official website of MQL5.

The chart above shows that when the price was heading upwards, the indicator was above the 80 level. When the price was making lows, the TII indicator fell below the 20 level. We can also notice that despite its seeming accuracy, the Trend intensity index is a lagging indicator. You can say that by looking at the right border of the green rectangle. The price reversed to the downside, but the indicator still shows a strong uptrend. Therefore, you can use it as an additional tool to spot a trend, but not as a signal provider.

Chart patterns play an important role in technical analysis and trend trading. If a trend trader has experience working with chart patterns, it will help them predict a reversal or a continuation of a trend. Some traders build the entire trend trading system rules on the chart patterns. Let's find the most popular out of them.

The head-and-shoulders pattern is usually formed at the end of an uptrend. It consists of a head (the second and the highest peak), two shoulders (lower heights), and a neckline that connects the lowest points of the pattern and acts as a support level. The neckline may be either horizontal or sloping up/down. If the price breaks below the neckline after forming the second shoulder, the pattern is confirmed, and you can see the beginning of a downtrend. The pattern helps trend traders exit their long entries and prepare for a new downward movement.

Alternatively, there is an inverse head and shoulders pattern, which appears at the end of a downtrend and signals the beginning of an uptrend.

The double top pattern consists of two consecutive peaks of similar height with a small distance between them. This pattern signals that the trend will change from ascending to descending. As with the head and shoulders, you can draw a neckline through the lowest points of this pattern.

There is also a double bottom pattern that predicts a potential reversal to the upside.

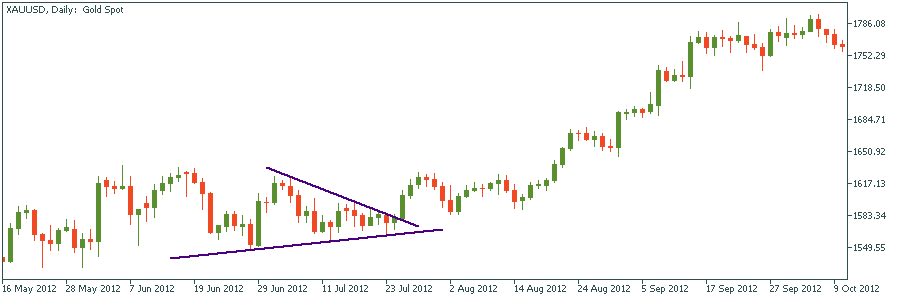

A trader who wants to confirm a strong trend will find continuation chart patterns extremely useful. There are triangles, flags, pennants, wedges, and rectangles. Triangles and flags are the easiest to spot.

There are three types of triangle patterns: ascending, descending, and symmetrical. If you face an ascending pattern, the uptrend will likely continue. In case of a descending pattern, you need to prepare for a downtrend. In the case of a symmetrical triangle, neither bulls nor bears dominate the market.

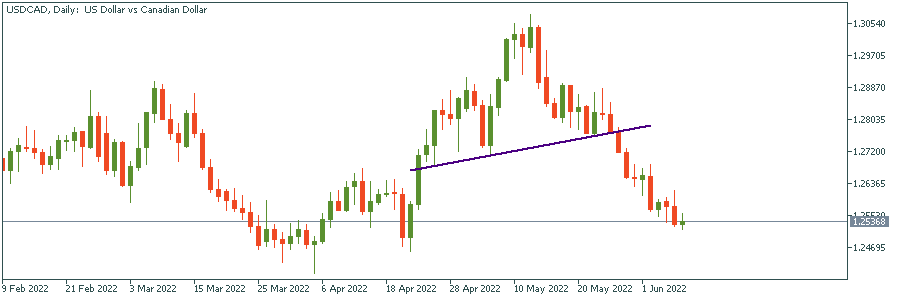

In the picture above, you can see an example of a symmetrical triangle pattern. If you place entry orders above the lower highs and below the higher lows, you will catch the right one. Don't forget to cancel the alternative order when one of them is hit.

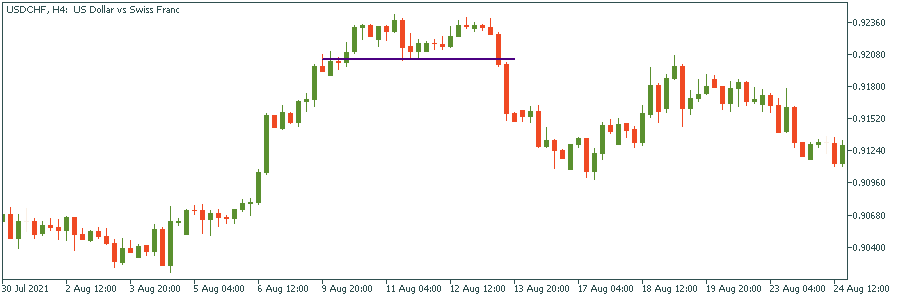

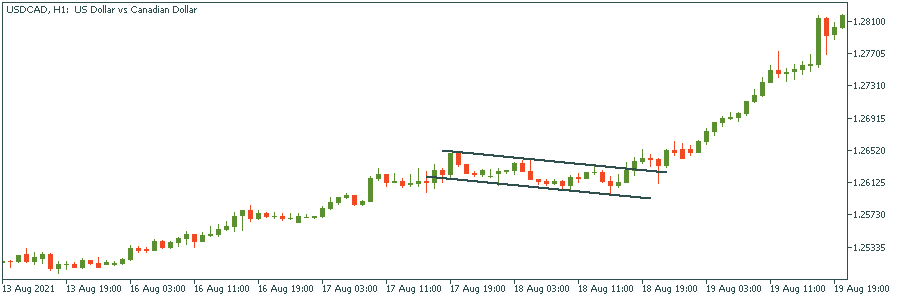

The flag pattern is formed when a consolidation phase follows a substantial price movement. It consists of two parallel lines and a flagpole. A bullish flag appears during the uptrend (see the picture below). Vice versa, a bearish flag signals the continuation of a downtrend.

As you can see on the picture above, the bullish flag is an ideal confirmation of a further bullish momentum. If it appears on the chart, you need to hold your long position.

While knowing the chart patterns help traders to trade within a trend, the best trend trading setups are made as parts of trading strategies. Let's look at how to trade with trend strategies correctly!

There are a lot of trend trading strategies, but not so many have strict entry rules. Some say "buy lower and sell higher”; others have only one indicator in their set (RSI, for example) and don't require placement of a Stop Loss.

This article will give you an example of an efficient strategy with easy entry rules and appropriate risk management. Take a look at the setups!

Instruments: Any.

Timeframes: Daily or H4 are the most suitable.

Indicators: 200-, 20-, and 50-period Simple Moving Averages, Average True Range

Rules for a long entry:

Let’s consider an example. On the H4 chart of EURUSD, the pair was moving above the 200-period SMA (brown line). Thus, the price was moving within an uptrend. After it touched the 20-period SMA (red line) for the third time, we considered opening a long trade. The first candlestick after the test of the 20-period SMA closed in green. We opened a “Buy” order at the close price of that candlestick at 1.2847. After that, we calculated the Stop Loss distance as entry level – 2*ATR:

Entry level = 1.2847

ATR= 0.0024

Stop Loss = 1.2847-0.0048=1.2799

After the price falls below the 50-period SMA (yellow line), we close the trade at 1.3250. We earned 4030 points.

Rules for a short entry:

On the same chart of EURUSD, the price started moving below the 200-period SMA (brown line). After the third touch of the 20-period SMA (red line) by its high, we opened a sell order at the close price of the bearish candlestick at 1.5387. The Stop Loss was calculated as 1.5387+2*0.00468=1.5481.

After the price broke above the 50-SMA (yellow line), we closed trade at 1.4841. We earned 5460 points.

Trend following trading is a common approach that can bring good results. Follow the market trend and know how to ride it right, and you won't be disappointed. And, who knows, maybe you will be the next trend-trading millionaire?

Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Trend strategies are good - they may give significantly good results in any time frame and with any assets. The main idea of the ADX Trend-Based strategy is to try to catch the beginning of the trend.

Counter-trend strategies are always the most dangerous but also the most profitable. We are pleased to present an excellent counter-trend strategy for working in any market and with any assets.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later