Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

2022-08-26 • Updated

Information is not investment advice

How many times did you make a decision without even thinking about it? Let’s face it – too many. Among these decisions, there are probably a lot of those you regret. On the other hand, thorough analytical thinking takes more time but helps you to understand complicated tasks. The difference between intuitive and analytical decision-making is the main topic of "Thinking, Fast and Slow", the book written by the famous economist and Noble prize winner Daniel Kahneman. This book describes how people make their decisions and why errors happen during this process. In this article, we will try to apply the main take-aways from the book to trading activity.

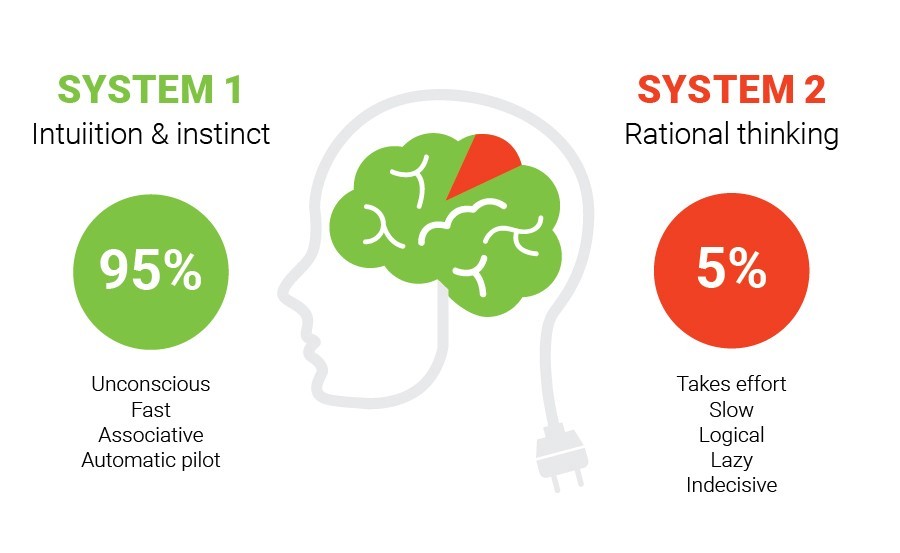

According to the book, we have two systems of thinking – System 1 and System 2. The former system is automatic, and you implement it immediately. This is how your brain works: it sees the problem, compares it with the experience in the past, and offers you a solution. In some of the daily life situations, it takes only one blink of an eye to come up with a final decision. For example, how long does it take for you to understand that the smell that you feel comes from your favorite donuts? We guess, just a few seconds. Alternatively, system 2 requires more complex analysis. Here, you need to use your skills, knowledge, and a deeper work of your brain.

Let's look at how these two systems work in trading. For example, what an experienced trader may think of when he reads the news pictured below?

The first thought which springs to the mind of any trader is “It’s time to buy risky assets!” Your mind sorts out every risky asset you know (including stocks, commodity currencies, indices, etc.)

But what should you buy to avoid mistakes? To answer this question, System 2 turns on, and you start to analyze which assets are really worth trading right now. You look for confirmations, such as candlestick patterns, chart patterns, and significant levels. Only after a thorough analysis processed through System 2 you make your decision.

Even though System 1 is generally accurate, there are situations when it lags. In fact, System 1 sometimes seeks an easier answer to questions than it was asked.

For example, after hearing about a bullish rally in the markets, you may jump into a trade without a second thought, followed by emotions and the fear of missing out. But despite your anticipation of success, the market turned in a different direction. That's because you skipped the important signals indicating the change of a trend.

Another interesting aspect which Mr. Kahneman pays attention to is called WYSIATI – “what you see is all there is”. This phrase reflects a phenomenon of making conclusions based on limited information. As a result of WYSIATI, a trader may create false conclusions about the market based on a limited amount of information. Due to the automatism of System 1, our mind identifies seeming connections between the events. After that, the formed judgment or impression is confirmed by System 2.

As a result of WYSIATI, the following errors happen pretty often.

Remember the support or resistance level you considered too strong to break while expecting a rebound? All of sudden, that level got broken, and you lost your trust in statistics. As Kahneman wrote, “many facts of the world are due to chance, including accidents of sampling”. Hence, you should always see the bigger picture and understand what is going on in the market, what events are happening right now and track the risk sentiment. To read more about it, check the economic calendar and our tips on understanding risk sentiment.

You open a chart of S&P500, wait for the gap, and…open a sell order. You forget that there are various types of gaps, including continuation and common gaps. The famous fact about filled gaps is related to common gaps, while continuation gaps happen during a strong uptrend/downtrend. As you trade S&P500 which is moving within an uptrend, you faced a continuation one and lost your money. So, we recommend you to get familiar with all the facts possible before entering a trade.

To conclude the article based on Mr. Kahneman’s study, let’s remember five important tips to avoid the mind tricks caused by System 1.

Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Trend strategies are good - they may give significantly good results in any time frame and with any assets. The main idea of the ADX Trend-Based strategy is to try to catch the beginning of the trend.

Counter-trend strategies are always the most dangerous but also the most profitable. We are pleased to present an excellent counter-trend strategy for working in any market and with any assets.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later