Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

2020-03-25 • Updated

Information is not investment advice

When you read or watch the analysis, you often face with the following statement: “it is recommended to trade on the market sentiment.” Are you surprised that the market has its actual feelings? Of course, it does! As the market is literally a crowd of different players, most of which are actual human beings, it has a really strong psychological basis. Financial markets are driven by emotions, which are used by smart traders to earn money. In this article, we are going to help you to understand the types of market sentiment and its measurements.

What is market sentiment?

Generally speaking, the term “market sentiment” refers to the “mood” of the market during the current trading session. We can compare the sentiment in the market with the mood of individuals. It can change quickly for different reasons, as it is affected by different thoughts, feelings, and actions.

A sentiment determines the demand and supply for a particular currency, stock or commodity. If the market is positive about the current outlook, then bulls start to buy more, increasing the demand and, therefore, pushing the price to the new highs. We may call it a bullish market. Alternatively, if the market is pessimistic, the price is expected to fall. In this case, the market is bearish.

The main feeling in one market usually dictates the overall market sentiment. That is, the strong bullish or bearish sentiment will take over the markets sooner or later. Imagine, that you decided to open a short position for AUD/USD. At the same time, the positive news was released and improved market sentiment. Risk-on sentiments result in the rise if the risk-weighted assets. You decided to follow your suggestions and did not take into account the market sentiment. The currency pair started to go up and you lost money because you needed to pay attention to the market sentiment. Understanding the importance of the sentiment in the market may help you to avoid this type of mistakes.

The difference between market sentiment and fundamental factors

Market sentiment is often described as a form of fundamental analysis. However, it is not always based on fundamentals. The main difference between them lies in time. Sentiment tends to drive the market in a short term. During a small period of time, the movements in the market are completely based on traders' feelings and the news. When you trade on larger timeframes, you need to pay attention to fundamentals, which include the overall economic scenario, monetary policy of the central banks and the economic conditions of a country.

Suppose, the United States has strong economic conditions and the Federal Reserve projects several rate hikes in the upcoming months. This makes the USD more attractive to investors and traders in a long-term period. However, we know that the prices do not move in a straight line from point A to point B. As a result, the price for the USD has its ups and downs within the long-term uptrend. There are several reasons behind these movements, and the market sentiment is one of them. The market sentiment is usually based on short-term data or important news.

Now, let’s take a look at the types of risk sentiment.

The market sentiment is divided into two types: risk-off and risk-on sentiment. Both of them describe a situation in the market when the majority of large investors move their money in response to global economic conditions or geopolitical events.

Risk-on sentiment

Risk-on sentiment refers to an environment where the investors and traders do not afraid to operate with risky assets, such as stocks and currencies that have a high-interest yield and emerging market currencies. Currencies that offer a higher interest rate yield (the Australian dollar and the New Zealand dollar) become more attractive in the risk-on environment because the buyer of the currency gets to participate in that interest yield. Emerging market currencies, such as the Turkish lira, the Brazilian real, the South African rand and the Mexican peso can benefit in the risk-on times too. Stocks are considered the risky asset as well, oppositely to the US dollar or the US Treasury bonds.

Risk-on sentiment may last from several minutes to several weeks depending on its strength. It can also change instantly in response to the information flows that traders pay close attention to.

The risk-off sentiment (risk-aversion)

The risk-off sentiment is the opposite of the risk-on situation in the market. During the risk-off environment, investors and traders avoid operating with risky assets due to the fear of losing money. They move their money from the risk-weighted assets to the safe-haven assets.

Ideally, the safe haven currency is the currency that belongs to a country that has a current account surplus combined with a stable political and financial system with low debt to GDP ratios. However, in real life, every country has a high debt to GDP ratios. That is why traders look for the least bad place to put their money. During the risk-off sentiment, trader tends to buy the Japanese yen, the Swiss franc, the US dollar, gold, and the US Treasury bonds.

Ways to identify market sentiment

Volumes. If you trade stocks, you can use volumes to evaluate the current conditions of the market. For example, if a share price of a stock has continued to rise, but the volume is low, this could mean the weakening market sentiment.

On the Forex market, you can apply volume indicators, such as money flow index or on-balance volume to measure market sentiment. OBV shows more reliable results. It is the cumulative volume addition during the periods when the market closed bullish minus the sum of volume during the periods when the market ended bearishly.

If any changes (increases or decreases) occur to the OBV line without being accompanied by simultaneous price changes, this may indicate that an existing trend run will reverse course in the near future. This situation is illustrated on the H4 chart of USD/CAD. However, you should take into account other confirmations before making any spontaneous decisions.

Also, you can use other ways to assess market sentiment.

Here we listed the most widely used out of all:

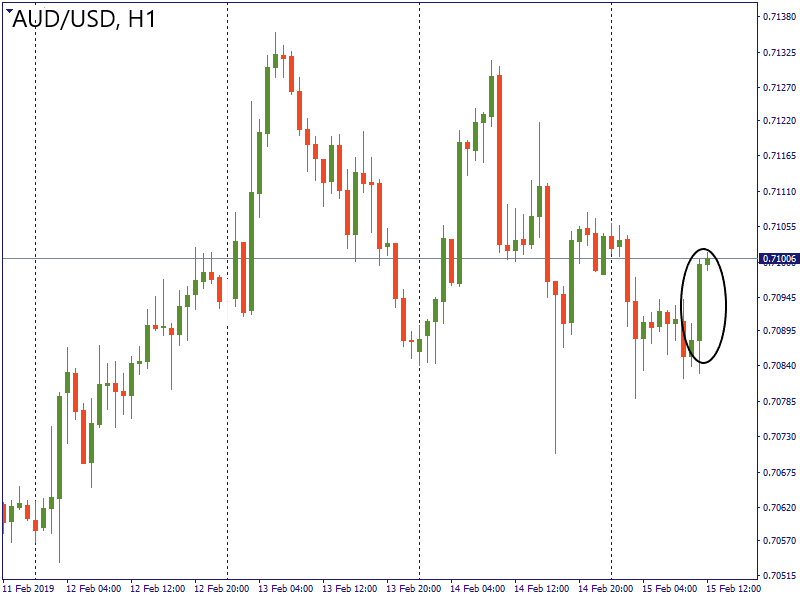

On the chart above we can see that the volatility has been falling, which shows the confidence of players in the current market situation and increased risk-on sentiment, as confirmed on the AUD/USD chart.

Conclusion

It's not a secret that most of the good traders in the last century were professional psychologists. That was because they needed to understand the behavior of the crowd and tried to predict the market sentiment. Nowadays, you don't need to be a professional psychologist to suggest the future direction of a price, as there are a lot of indicators which may help you to guess the current mood of the market. Though, the deep understanding of the market sentiment is needed to protect yourself from unexpected outcomes.

Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Trend strategies are good - they may give significantly good results in any time frame and with any assets. The main idea of the ADX Trend-Based strategy is to try to catch the beginning of the trend.

Counter-trend strategies are always the most dangerous but also the most profitable. We are pleased to present an excellent counter-trend strategy for working in any market and with any assets.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later