Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

2021-07-14 • Updated

Information is not investment advice

Every time you click a “new order” button, you open a new trade. Each trade can be broken into such elements as entry and exit. When you trade consciously, you make entry/exit decisions based on some conditions and considerations. In this article, we will discuss what is needed for a confident entry in the market.

How to find an entry signal

You should start by scanning the charts. Some traders focus on certain pairs, others go through all the charts their open in MetaTrader one by one to see whether there are any interesting setups or patterns. Whatever your case is, notice that for each currency pair or another asset you will need to check several timeframes to find and confirm a relevant trade idea.

If you plan to hold your trade for days, you should probably open the weekly or the monthly chart first and then move to the daily timeframe. If you are looking for an intraday trading opportunity, start with D1 and then switch to H4 and H1. Scalpers will require a timeframe set starting from H4 or H1 and then they will go to smaller timeframes. You can read more about choosing the right timeframe for trading here.

While scanning the charts look at trends (series of higher highs and higher lows - uptrends; or series of lower highs and lower lows - downtrends) first: the general direction of the price is important. The mere visual analysis of the chart can be very efficient: the more often you practice it, the easier you will notice important things. You may also check some technical indicators. It’s convenient to have a MetaTrader template which contains one or two simple indicators. After you have established this template on one chart, you can save its settings and apply it to other charts in no time. It’s good to use a trend indicator together an oscillator, for example, Moving Average and MACD. The indicators will help you to make a quick judgment about the phase and state of the market (movement in line with a trend or correction/consolidation, potential reversal).

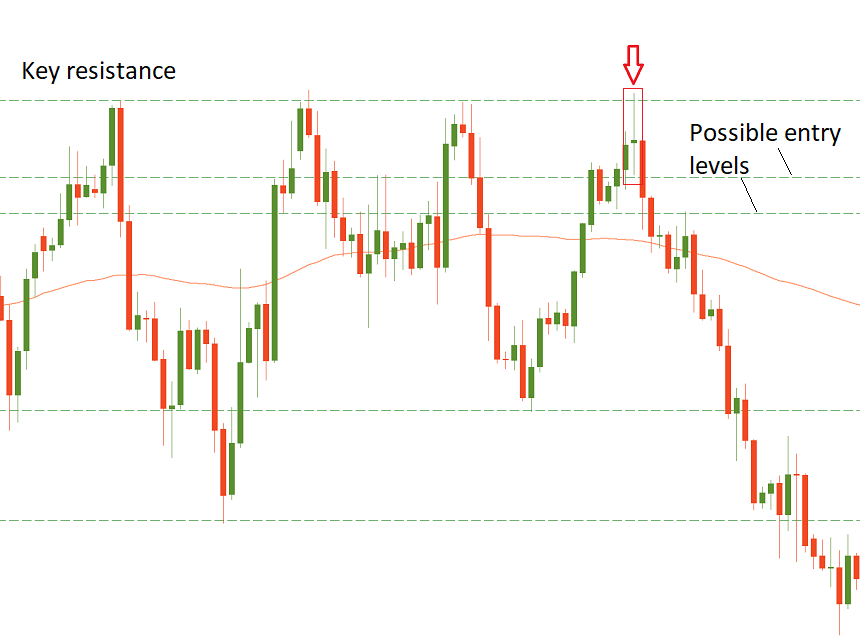

Then try to spot important levels of support and resistance as well as candlestick and chart patterns. Mark the key price levels you have distinguished with horizontal lines. Focus on the most obvious levels because they are what really matters. The same goes for patterns: reversal patterns are usually the easiest to notice, for example, pin bars (candlesticks with small bodies and long upper/lower shadows) or double tops/bottoms. All in all, for a superb entry you need a combination of horizontal levels and hints from price action. Trends and patterns will help you determine with the high probability where the price will go, while the horizontal levels you have marked will help you pinpoint the exact entry level at which you will open your trade.

At the picture above, the price formed a candlestick with a long upper wick near the key resistance level. This is a good trade setup. Entry is possible at some level below the highlighted candlestick.

It’s always necessary to find a balance. Imagine that you have determined a support level, the decline below which will give you a sell signal. In many cases, the price makes a false break of support and then turns back up. As a result, it’s better to place an entry order (in this case, it will be a sell stop) several pips below the support, but not too low so that you could have enough pips of profit. Use pending orders to open your trade precisely where you want it to start.

Remember that trading in the direction of the trend is generally preferable, but sometimes the market is not trending. Even so, there still might be some candlestick patterns that will give you an understanding of the upcoming price moves.

Finally, don’t forget to check the economic calendar: the currencies you have chosen to trade may be affected by the release of some economic news. If so, you may need to adjust your plans taking into account the potential spike in volatility. Some traders who trade specifically on news, look in the economic calendar first to learn about the currencies which have the biggest potential to move and only then check the charts of these currencies.

When you place an order in MetaTrader, carefully check all the parameters of your trade: you wouldn’t want all your planning and analysis to be ruined by inattentiveness that may lead to stupid mistakes.

Other important things

A good entry is the one but not the only element that is required for a trade to bring you profit. The other two elements are the proper risk management and a good exit. The former implies that you should aim for an optimal position size (not too big, not too small), have a sensible risk-reward ratio (the possible profit in a trade should be bigger than any possible loss) and use a protective stop loss order. The latter means that from the very beginning you should plan at which level you will close your trade with profit. To learn more about this, read up on take profit orders as well as trailing stops.

Conclusion

The market constantly offers traders various entry opportunities. Don’t be afraid to miss out a trade: there will always be more. Stay patient: if you don’t see a good entry setup right now, take a break and make another scan of the charts afterward. For entries, you can use the price action approach described in this article or an indicator-based trading system, just make sure you enter the market only when all the required conditions for a trade are in place. Good luck in your trades!

Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Trend strategies are good - they may give significantly good results in any time frame and with any assets. The main idea of the ADX Trend-Based strategy is to try to catch the beginning of the trend.

Counter-trend strategies are always the most dangerous but also the most profitable. We are pleased to present an excellent counter-trend strategy for working in any market and with any assets.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later