Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

2021-07-13 • Updated

Information is not investment advice

One of the most frequently asked questions during our webinars is “How can I choose a timeframe for trading?”. Let’s sort it out in this article!

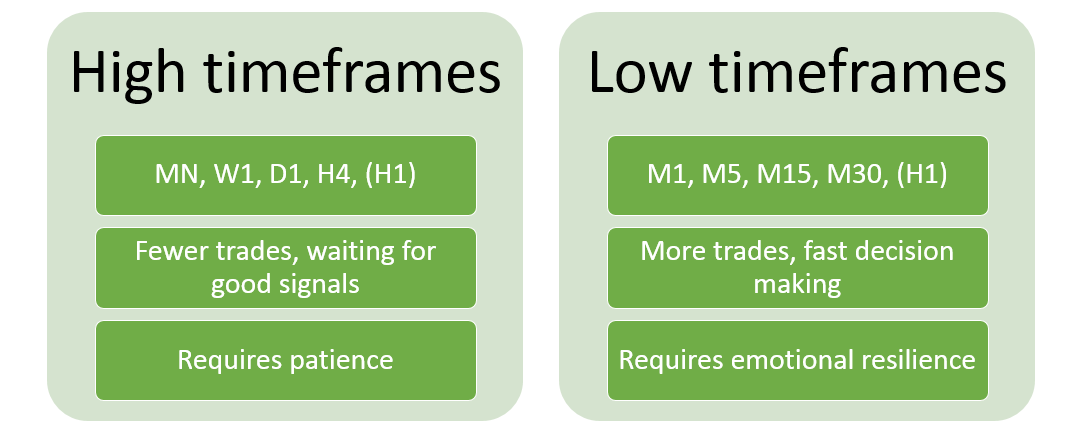

First of all, we should make a distinction between the so-called “higher” and “lower” timeframes. The border between them goes through the 1-hour timeframe (H1). Timeframes with bigger periods are referred to as high, large or big (4-hour, daily, weekly, monthly), while timeframes with smaller periods are considered low or small (30-, 15-, 5-minute).

Factors of choice

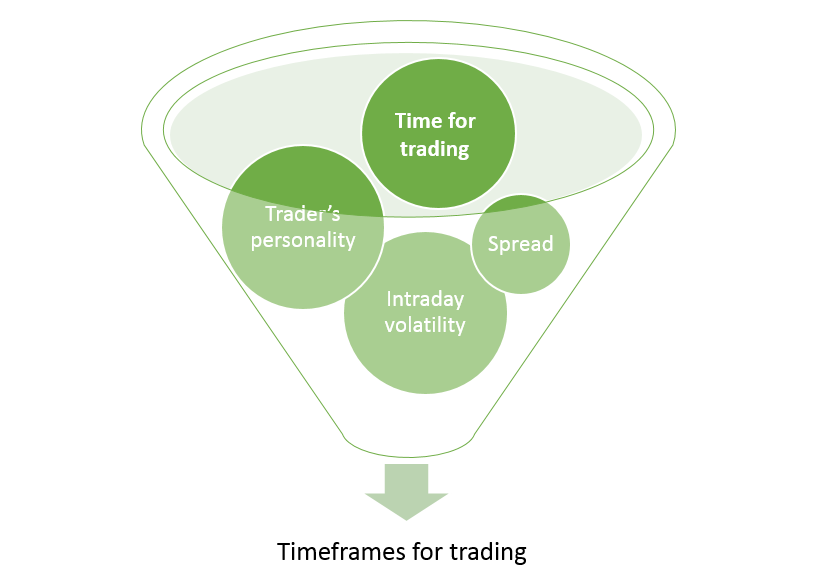

The time you have for trading. The time you are willing to spend on trading is the main factor. If you want to make many trades during the day, choose smaller timeframes and become a scalper or a day trader. If you can’t be a full-time trader and plan no more than 1-3 trades a week, decide in favor of larger timeframes. Is it simple? You bet!

Each set of timeframes have their benefits. Higher timeframes will allow you to eliminate “market noise” and catch the big and “tasty” price swings. At the same time, you will probably make more trades on lower timeframes. This can allow you getting money just by scale: the more trades you open, the more chances of good trades you will have.

Your personality. When trading, you need to make sure that you feel comfortable. Analyze your personal strengths and weaknesses and make both work to your advantage.

If you are ready to deal with higher levels of stress and pressure and make decisions fast, you can choose to trade on lower timeframes. You will need an ability to stay cold-headed, recover from losses quickly and resist the temptation of taking revenge on the market if you lost. On the other hand, you will also require some emotional resilience in case you get big profit so that you don’t get carried away and start betting too much on one trade. Short-term trading on lower timeframes will let you feel the pulse of the market and be a very active trader.

At the same time, if you have patience and a propensity for deep thinking, consider higher timeframes. Here you will have to wait firstly until a good signal appears and then until the price reaches your target. If you don’t want to hurry and wish to take your time analyzing each trade and its result, this is the best option for you.

Technical analysis. Is this really a factor? If you are shown 2 charts, you probably won’t be able to say which one is a large timeframe and which one is a small one. The principle of indicators like MACD and moving averages, patterns like Head and Shoulders or Double Top and things like support and resistance is the same no matter on which timeframe you trade. Although it may seem that using the same tools brings different results on different timeframes, that usually depends on the actions of a trader and his/her skills.

Intraday volatility. The difference between M30 and D1 timeframes is that a technical pattern will form much faster on the former than on the latter. In addition, trades on lower timeframes are much more sensitive to news releases, though you can always check economic calendar and make a decision whether to avoid trading in times of events or, on the contrary, try trading on news.

Spread. It’s natural that you will think about spread if you trade on lower timeframes. You will open and close more trades. Your profit on a single short-term trade will likely be lower than the profit on one longer-term trade, so spread will be a larger part of it. Be aware of this and choose instruments with lower spreads for trading lower timeframes.

How many timeframes to pick?

The market may seem very different on different timeframes. It can be a downtrend on W1 and an uptrend on H4.

Some traders are searching for a single ideal timeframe. Others attempt to look at all the timeframes for every trade. They try to finetune a trade on M5 but the situation keeps changing fast there and they forget what ideas they had from the daily chart.

Using several timeframes allow you to see the whole picture. This is called “multiple timeframe analysis”. When you decided which timeframes are you focusing on (large or small), choose 2-3 of them you will use. For example, you can be a swing trader and use daily charts for making decisions. Weekly charts can help you define the main trend, while H1 will show you the short-term trend. In this case, there’s no need to go all the way down to M5.

The main idea of multi-timeframe analysis is to analyze the larger timeframe first and then move to the smaller ones. This way you’ll get the bigger picture and then will be able to find the best place for your order. If you want to know more about using several timeframes, read our article about a triple screen trading system.

Conclusion

As you can see there’s no universal recipe of the best timeframe but there are recommendations for choosing a set of timeframes to trade on. Use these tips to find timeframes that suit you most. Good luck in your trading!

Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Trend strategies are good - they may give significantly good results in any time frame and with any assets. The main idea of the ADX Trend-Based strategy is to try to catch the beginning of the trend.

Counter-trend strategies are always the most dangerous but also the most profitable. We are pleased to present an excellent counter-trend strategy for working in any market and with any assets.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later