Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Join Us on Facebook

Stay on top of company updates, trading news, and so much more!

Thanks, I already follow your page!

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

69.21% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

2022-08-26 • Updated

Information is not investment advice

Cryptocurrency is all around us. More and more companies have started accepting crypto as the means of payment (Tesla made so with Bitcoin in Spring 2021 and Dogecoin in January 2022). This article will help you to stay on the edge of technology and, most importantly, get the most from this emerging market. So get yourself comfortable, and let’s start our journey into the world of crypto pairs.

Naturally, they are similar to currency pairs. Just as it used to be, there are base and quote currencies. The only difference is that they are both cryptos. Pairs have a very simple structure: the first is the base crypto, and the second is the quote crypto, also known as the counter crypto.

For example: if you buy a BTC/USD, it means that you bought Bitcoin and sold Tether against it, and vice versa. Why Tether and not United States Dollar, you would ask? It is because trading crypto can only happen in the cryptocurrency world. And there is no USD in there. But don’t worry, Tether (also known as USDT or TET) is quite the same as the dollar. This is because they correspond in 1:1 proportion: for $100, you will get $100 in USDT (TET). With FBS, you don’t need to worry about transferring your Tethers in the USD, it happens automatically. Besides, you can deposit to your account both in the USD or Tether (and in the other currencies and cryptos as well).

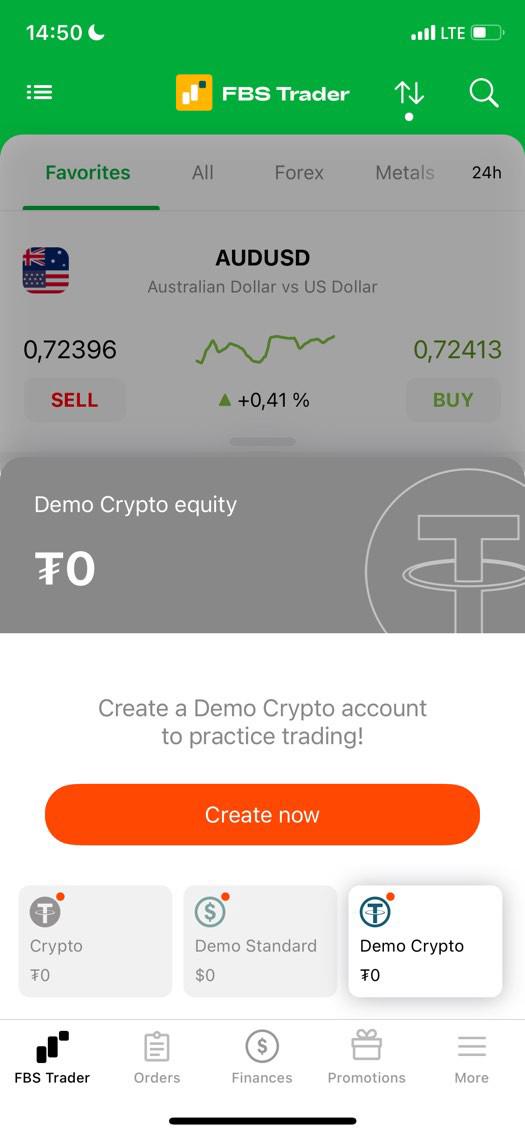

To create a crypto account all you need to do is to open a FBS Trader application, choose crypto account (or demo crypto account) and tap “Create now”. And that’s all, you are ready to go!

We have numerous cryptocurrency pairs in FBS, starting from classic crypto against the dollar. Moreover, with CFD trading, you can trade unusual pairs that you won’t see on ordinary exchanges. Here is what pairs you can trade:

Yes, you can trade Bitcoin for gold and catch movements of two drastically different instruments. Isn’t that cool?

It is simple. If you think Bitcoin will rise against Litecoin (LTC), you need to buy BTC/LTC. And if you think Bitcoin should fall, you sell the pair. Crypto pairs enable you to analyze the prices of various cryptocurrencies. These pairs help illustrate the relative value of coins – for example:

As more pairs become available, traders have a larger variety of transactions they can perform. To successfully exchange one cryptocurrency token for another, you either need to find an exchange that supports that trading pair, or you will need to perform several transactions between different pairs in order to reach the final result you are looking for.

For example, if a trader wants to exchange Ethereum (ETH) for Ripple (XRP), he needs to find an exchange that supports this pair. In the worst-case scenario, the trader will first have to trade ETH for USD and then exchange that amount of USD for XRP. Unfortunately, the trader will have to pay more in taxes and fees in this scenario, as he has to perform two different transactions. Instead, if the exchange supported an ETH/XRP trading pair, the trader would have achieved the result in a single transaction.

The main risk you can face while trading cryptocurrencies is volatility. As you know, crypto is an emerging market with pros and cons. There are days when Bitcoin can make a 20% move, and you need to manage your risks to trade cryptos. There are several tips for you to get the most from cryptocurrency trading:

The choice of crypto pairs depends on your trading strategy, tolerance to volatility, and personal tension to specific instruments. If you understand Dash to USD movements (DSH/USD), it is the perfect pair for you.

Some cryptocurrencies are more volatile than others. For example, Dogecoin (DOG) and Shiba Inu (SHB) are used to have greater moves. The reason for their movements is Elon Musk’s tweets. One of them boosted Dogecoin by 500% in January 2021.

To start with, here are some short explanations of the most popular cryptos available with FBS:

To choose a cryptocurrency pair, you need to do some research:

If you complete these two steps, you are ready to go! Trade smart, and good luck in cryptocurrency pairs trading!

Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Trend strategies are good - they may give significantly good results in any time frame and with any assets. The main idea of the ADX Trend-Based strategy is to try to catch the beginning of the trend.

Counter-trend strategies are always the most dangerous but also the most profitable. We are pleased to present an excellent counter-trend strategy for working in any market and with any assets.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later