Currency pairs. Base and quote currencies. Majors and crosses

Information is not investment advice

Currencies on the FX market are always traded in pairs. In order to find out the relative value of one currency, you need another currency to compare. When you buy one currency, you automatically sell another currency.

Currency pairs in Forex are given in abbreviations. For instance, EUR/USD stands for the euro versus the US dollar, and USD/JPY stands for the US dollar versus the Japanese yen. If you buy EUR/USD, you are buying euros and selling dollars. If you sell EUR/USD, you are selling euros and buying dollars.

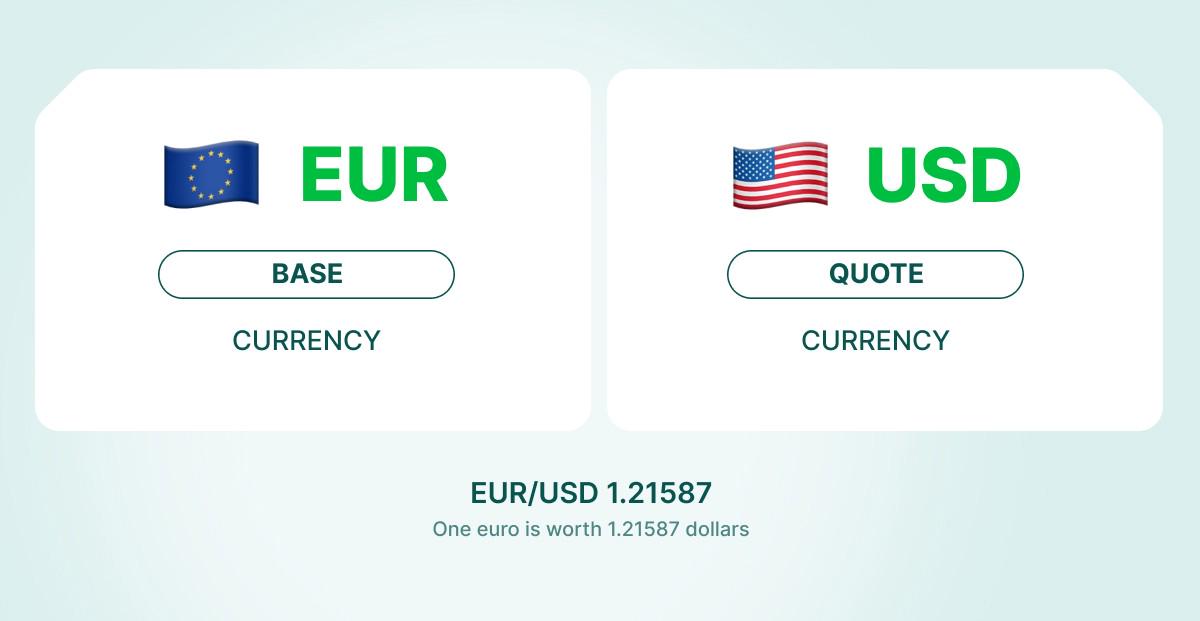

Base and quote currencies

The first currency in the pair is called the base currency, while the second currency is called the quote or counter currency. The price of the base currency is always calculated in units of the quote currency.

For example, the exchange rate for the EUR/USD pair is 1.1000. It means that one euro costs 1.1000 US dollars (one dollar and 10 cents).

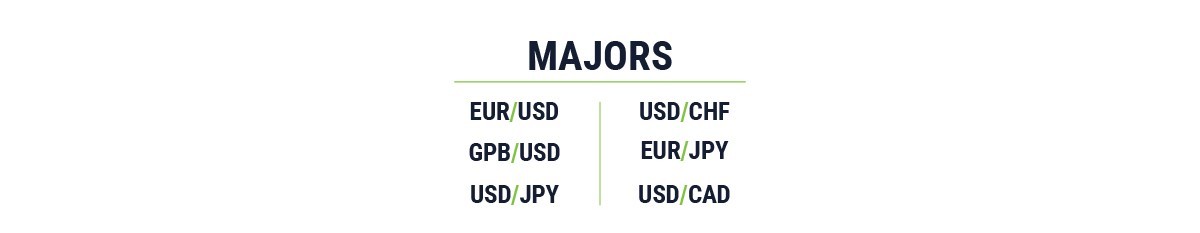

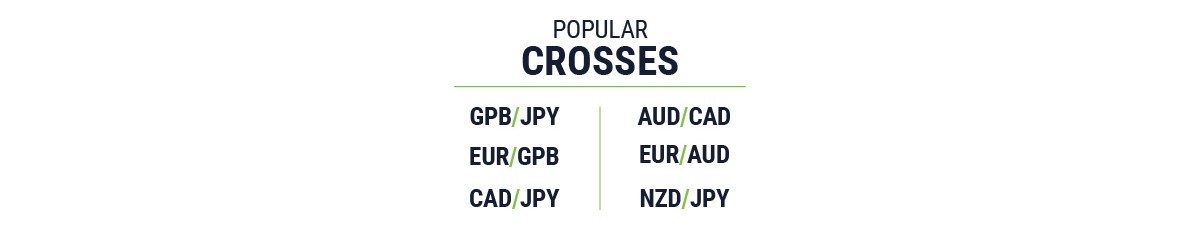

Majors, Crosses, Exotic pairs

Currency pairs are usually divided into majors, crosses, and exotic pairs. All the major pairs include the US dollar and are very popular among the traders: EUR/USD, GBP/USD, USD/JPY, USD/CHF, AUD/USD etc.

Crosses consist of two popular currencies, but do not include the US dollar. The most common crosses include the euro, the yen, and the British pound: EUR/GBP, EUR/JPY, GBP/JPY, EUR/AUD etc.

Exotic currency pairs consist of one major currency and one currency, representing the developing (Brazil, Mexico, India etc.) or small (Sweden, Norway etc.) economy. Exotics are rarely traded on Forex and usually have less attractive trading conditions.

Other articles in this section

- How to start trading on Forex?

- How to open a trade in MetaTrader?

- How much money do I need for Forex trading?

- Demo accounts

- MACD (Moving Average Convergence/Divergence)

- How to determine position size?

- Transaction, profit, loss. Types of orders

- Economic calendar

- When is Forex market open?

- Calculating profits

- How to trade?

- What technical tools do I need for trading?

- The advantages of Forex market

- What is Forex?