Bill Williams est le créateur de certains des indicateurs de marché les plus populaires : Awesome Oscillator, Fractals (fractales), Alligator et Gator.

Ne perdez pas votre temps - analysez l'influence du NFP sur le dollar américain!

Avis de collecte de données

Nous conservons un enregistrement de vos données pour gérer ce site web. En cliquant sur le bouton, vous acceptez notre politique de confidentialité.

Guide pour débutant Forex

Votre guide ultime dans le monde du trading.

Consultez votre boîte de réception !

Dans notre e-mail, vous trouverez notre guide Forex. Appuyez simplement sur le bouton pour l'obtenir !

Avertissement sur les risques : Les ᏟᖴᎠ sont des instruments complexes et ils présentent un risque élevé qui peut vous faire perdre de l'argent rapidement en raison de l'effet de levier.

68,53 % des investisseurs particuliers perdent de l'argent lorsqu'ils tradent des ᏟᖴᎠ avec ce fournisseur.

Vous devez vous demander si vous comprenez le fonctionnement des ᏟᖴᎠ et si vous pouvez vous permettre de prendre des risques élevés qui peuvent mener à d'importantes pertes d'argent.

2022-08-26 • Mis à jour

Les informations données ne sont pas des conseils en investissement

Nous vous avons déjà présenté les "Tortues Traders" qui prenaient leurs décisions de trading en suivant un ensemble de règles prédéterminées. Avec l'aide de Richard Dennis et de William Eckhardt, ils ont réussi à gagner environ 100 millions de dollars en peu de temps. Plus tard, leur expérience a été adaptée aux réalités changeantes du marché par une autre célèbre trader de matières premières et de contrats à terme, Linda Bradford Raschke. Elle a créé une stratégie nouvelle et efficace appelée "Soupe de tortue".

L'idée principale de cette stratégie est basée sur la découverte de fausses ruptures. En cas de rupture à court terme, le bénéfice sera minime ou égal à zéro. Toutefois, si vous êtes confronté à une rupture à moyen ou long terme, vos chances d'atteindre un profit élevé peuvent être assez élevées.

Intervalle de temps : pas moins que M15

Paire de devises : Toutes

Prenons un exemple. Sur le graphique H4 de la parité AUD/USD, nous avons mis en évidence la consolidation sur 20 périodes. Le point le plus élevé se situe ici à 0,6645, tandis que le plus bas se situe à 0,6433. La fausse rupture est apparue le 9 mars avec le long chandelier tombant en dessous du range. Nous avons placé un ordre "buy stop" à 0,6443, un "stop-loss" à 0,6302 et un "take profit" à 0,6620. L'ordre a été implémenté avec succès.

Pour un ordre de vente, nous adoptons une procédure alternative.

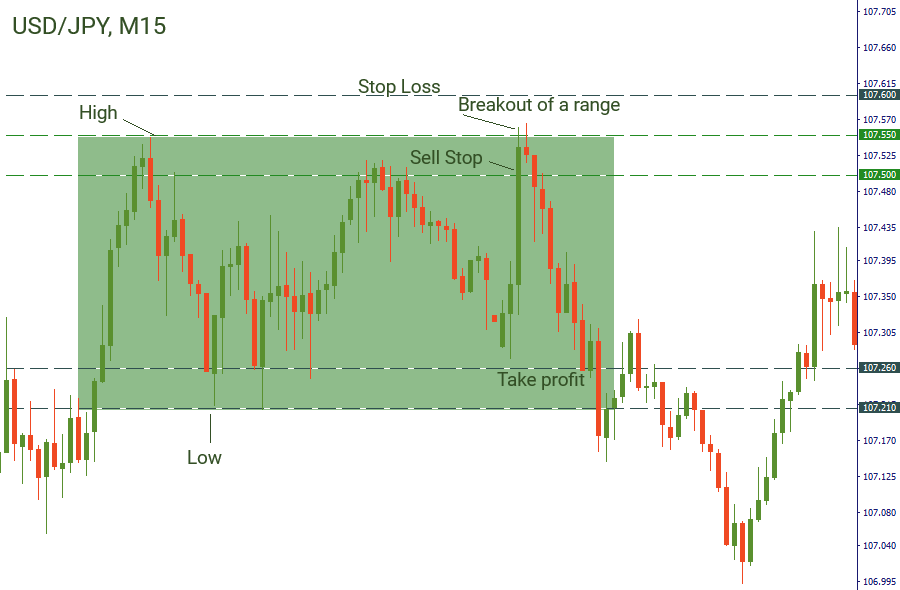

Prenons la situation sur M15 de la parité USD/JPY. Le niveau le plus élevé est ici placé à 107,55, tandis que le plus bas se situe à 107,21. Après une poussée le 15 juin, la paire a brisé la résistance d'un range. Nous avons placé un ordre sell stop à 107,5. Notre stop loss se situe à 107,6, tandis que le take profit va à 107,26.

Est-il nécessaire que l'ordre ne soit déclenché qu'à l'intérieur de la bougie qui a provoqué la rupture d'une portée ? Eh bien, selon les règles de la stratégie de la "Soupe de tortue", c'est le cas. Mais il y a aussi la stratégie "Soupe de tortue + un". La principale différence entre la stratégie originale et la stratégie modifiée réside dans le moment de l'entrée. Pour la deuxième stratégie, le chandelier doit se refermer en dehors du range après la rupture. Ensuite, vous placez un ordre de 5 à 10 pips au-dessus du niveau le plus bas de 20 bougies pour un ordre d'achat ou en dessous du niveau le plus élevé de 20 bougies pour un ordre de vente.

La stratégie de la "Soupe de tortue" nous montre que suivre des règles simples peut nous permettre d'obtenir des résultats efficaces. Alors, pourquoi ne pas l'essayer ?

Bill Williams est le créateur de certains des indicateurs de marché les plus populaires : Awesome Oscillator, Fractals (fractales), Alligator et Gator.

Les stratégies de tendance sont intéressantes, elles peuvent donner d'excellents résultats sur tous les intervalles de temps et avec tous les types d'actifs. L'idée principale de la stratégie ADX basée sur les tendances est d'essayer d'identifier le début de la tendance.

Les stratégies de contre-tendance sont toujours les plus hasardeuses mais aussi les plus rentables. Nous avons le plaisir de vous présenter une excellente stratégie de contre-tendance qui fonctionne sur tous les marchés et avec tous les actifs.

Votre demande a été acceptée.

Nous vous appellerons lors de l'intervalle de temps que vous aurez choisi

La prochaine demande de rappel pour ce numéro de téléphone sera disponible dans 00:30:00

Si vous avez un problème urgent, veuillez nous contacter via le

Chat en direct

Erreur interne. Veuillez réessayer ultérieurement