Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

2022-08-26 • Updated

Information is not investment advice

“To be successful in trading, I need years of experience!”

How many of you think the same? Well, you probably haven’t heard about Richard Dennis, who trained a group of novice traders, called “Turtle traders”, and who made 100 million dollars in a short period. They proved that by following a simple set of rules even a beginner can earn a good sum of money.

The unusual name has nothing to do with the speed of trading. Like most of the genuine ideas, the plan to train non-skilled traders was born in dispute between Richard Dennis and William Eckhardt, two American commodity traders. They argued about the importance of great skills and experience in trading. While Dennis believed that he could train people to become great traders, his friend Eckhardt thought about the power of genetics. To solve this dispute, traders decided to make a huge advertisement in Barron’s, the Wall Street Journal and the New York Times. They chose 23 candidates and invited them to Chicago for trading with small accounts.

“We are going to grow traders like they grow turtles in Singapore”, - Mr. Dennis said.

Thus, traders were called “turtles”. You’ve probably heard the “turtle” reference in the book “Street Smarts: High Probability Short-Term Trading Strategies” by Laurence Connors and Linda Raschke. Indeed, the authors developed a strategy called "Turtle soup" based on Chicago studying.

Richard Dennis, known as the “Prince of Pit” is a well-known commodities trader. Reportedly, he made $200 billion out of $1,600 in about 10 years. In 1974, he became successful with trading in the soybean market and earned $500,000. He doubled that sum of money by the end of that year, turning himself into a millionaire. William Eckhart is his friend and a founder of an alternative investment management firm "Eckhardt Trading Company”, which manages over $1 billion in managed accounts, offshore and onshore products. Being a mathematician, he believed that a strong set of analytics and statistics is necessary for the achievement of great trading results.

Let’s look at the easy strategy our millionaires taught the “turtle traders”.

“The turtles” preferred to trade the liquid markets. So, you can choose any major currency pair, commodity (oil, gold, silver) or even a stock index futures (S&P500, DAX30).

To identify the perfect entry, traders had to trade on the daily timeframes.

The magic of the “Turtle strategy” was based on a simple formula:

Trends + Breakouts = Profits.

Generally, “the turtles” were trend-followers and breakout-observers. They opened a long or a short position after the breakout to the upside or the downside and then kept their position open as long as a trend remained strong. As you may guess, they opened a long position on an upside breakout, or sold in case of a break to the downside. The turtles would go long or short whenever a breakout condition was implemented if it did not exceed their risk limits. There were two systems for entering the market.

1 – The short-term system based on the 20-day breakout.

“The turtles” entered the market when the price broke the 20-period high or low. The breakout was confirmed with 1 pip above the 20-day high/low. The 20-day breakout entry was made only if the previous breakout failed. This belief is called a “contrarian rule” and it means that the crowd expects the same thing to happen again. The stop loss is a 10-day low for long positions and 10-day high for short positions.

2 – The long-term system based on the 55-day breakout

This pattern was traded when a trader followed larger market trends. If traders chose this pattern, they had to stick to the 55-day rule and always enter in case of a breakout.

When "the turtles" traded, they opened a position with one risk unit. After that, it accumulated in equal units depending on a direction the trend moved. The risk units were the key element of “the turtles’ system”. Let’s see how they worked.

The traders adjusted the size of their position based on the volatility of an asset. The basic rule sounded as follows: a trader had to choose the correct position size for a certain asset in dollar terms. Each position of “the turtles” could be increased or reduced in so-called risk units. Mr. Dennis provided the turtles with a formula, which helped to identify the number of risk units. It was based on the calculation of “N”, which represented the volatility of a particular market. It was the 20-period average true range (ATR).

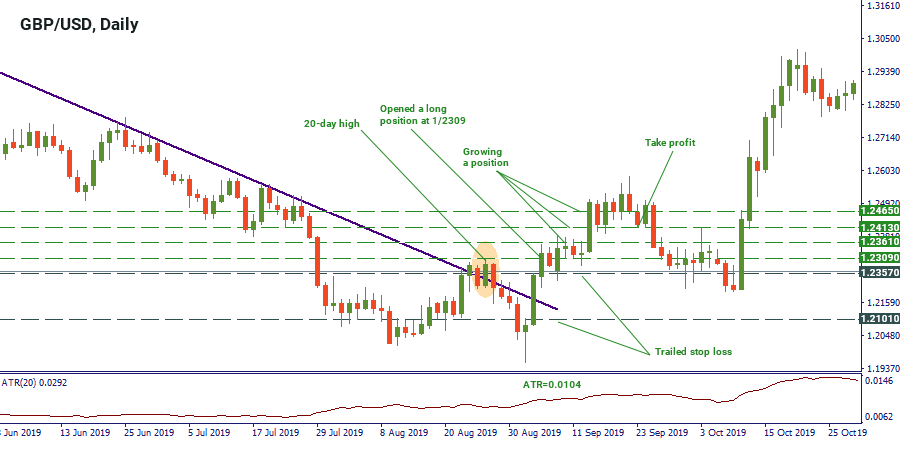

For September 5, 2019, the ATR value for GBP/USD was 0.0104. This is our N. That means that the average daily movement of GBP/USD is 104 pips. Let’s convert the data we have to the USD. With a contract size of $1,000, we will have:

Dollar Volatility = 0.0104*1000=$10.4

If the quote currency is not USD, then it had to be converted to USD.

"The turtles" always adjusted their positions using equal "risk slices", known as units. One unit represents 1% of the risk. For example, with an account of $10,000, one unit has a monetary value of $100.

So, let’s calculate how many contracts “the turtle system” requires for trading GBP/USD:

Unit size = $100/$10.4= 9 contracts.

So, for trading GBP/USD the turtle system would trade in multiples of 9 contracts for this type of account size.

If the conditions allowed, turtles grew their position to a maximum allocated risk. This again was based on the volatility and calculations of "N". "The turtles" grew their positions in increments or half increments of N or ½ N.

“The turtles” followed very strict rules on stop losses. They also calculated it based on the “N” measure. The 2% rule was used to limit the risks. Therefore, if the position moved against a trader by more than 2*N, it was always closed. They also trailed stop losses.

The students of Richard Dennis were instructed to use limit orders instead of the market orders. This way, the orders were expected to fill at a price better, than the current market price.

Placing perfect take profits was hard for “the turtles”, as they were afraid to skip good price movements. According to their rules, if a trader holds a long position and the price starts to go down, he/she should exit at a 10-day low. Alternatively, if a trader holds a short position, and the price starts to rise, he/she should exit at a 20-day high.

Let’s consider the short-term system. We will take the GBP/USD chart as an example. As we can see from the chart below, the price has been moving within a downtrend. The price broke the descending trendline on the 4th of September and reached the 20-day high on the next day. The 20-day high was the 1.2308 level. Thus, we opened a long position at 1.2309 (1 pip above the high). After that, we pointed out where we needed to add to our initial position. With the N equaled 0.0104, we had the following measures:

+1 unit: 1.2309+1/2*0.0104 = 1.2361

+ 1 unit: 1.2361+1/2*0.0104= 1.2413

+1 unit: 1.2413+1/2*0.0104=1.2465

At the prices above, we added units (opened more positions). In the beginning, our stop loss was placed at 1.2309-2*N=1.2101. But we trailed it as we opened more positions. The last one was placed at 1.2257.

After several days of rising, the price started to pull down. When it fell below the 10-day low at 1.2412, we closed our position.

It may be hard to wait for the 20 days when the price will reach a certain point. As a result, you may enter the trade and exit too early. Luckily, on the official MT site, you can find a link to the "Turtle trade" indicator, which counts the days for you and helps to identify the correct entry.

The "Turtle trade" strategy was revolutionary for the times of the experiment and showed that traders don’t need any skills to earn money on trading. Still, you must stay patient, and wait for as many confirmations as possible. The markets tend to be choppier right now than in the XX century. That's why you always need to make reasonable investment decisions.

Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Trend strategies are good - they may give significantly good results in any time frame and with any assets. The main idea of the ADX Trend-Based strategy is to try to catch the beginning of the trend.

Counter-trend strategies are always the most dangerous but also the most profitable. We are pleased to present an excellent counter-trend strategy for working in any market and with any assets.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later