What is Forex Trading?

Information is not investment advice.

Forex is also known as FX, currency market, or foreign exchange. It is a decentralized market where you can profit from a buy-sell difference in the price of various currencies.

While trading in the FX market, you will see noticeable benefits

1. Affordable start

Anyone around the globe can trade in the Forex market that is considered to be the largest and most liquid in the world. Foreign companies and individuals have the same conditions irrespective of their income.

2. Accessibility

Since it has trading centers in all time zones, the trading never stops – the market is open 24 hours a day, five days a week. The market opens on Sunday at 21:00 GMT and closes on Friday, 21:00 GMT. You only need the Internet connection to trade from any country at a convenient time.

3. Transparency

You have access to all the market data. The essential task here is to know how to operate it to gain control over your operations.

Keep in mind that to trade in the market, you will need to turn to a Forex broker. It will make your trading reliable and efficient. Brokers provide access to the most prominent trading platforms, support your activities with useful tips, market analysis, and 24/7 support. Besides, FX brokers are usually regulated by different safety commissions that protect your best interests.

Basic Forex Terms

Even though Forex has been an option for quite some time, it is still surrounded by confusing myths and may cause significant losses to inexperienced traders. That’s why you must obtain some more information about what Forex is and learn basic terms that may lead you to your first success story.

Currency Pairs

Currency pair contains the two currencies that you plan to exchange for one another. The first is called a base currency, the following - a quote currency. You either buy or sell inside currency pairs – this is how trading in the Forex market works.

Since the exchange rate for currencies is continually fluctuating, you can profit from a stronger position. Typically, you buy when assuming that the base currency will rise in price, and you sell when it will lose value.

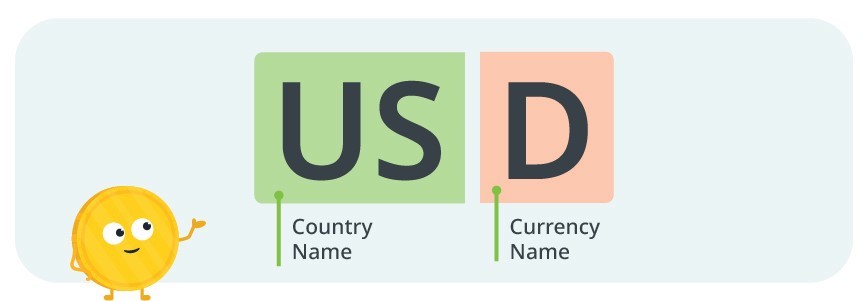

The currency name always goes in three symbols. In most cases, it starts from the two that stand for the country, and one letter that shows the currency type.

Example

USD – US United States; D Dollar

GBP – GB Great Britain; P Pound

With so many countries and currencies around the world, the variations for exchange can be numerous. However, you have to remember that only several pairs can potentially bring profit to traders. To simplify and narrow the use of currency pairs, they are categorized into majors, minors, and exotics.

To simplify and narrow the use of currency pairs, they are categorized into majors, minors, and exotics.

Majors

These are seven currencies that are most widely traded. They all include USD on one side of the deal.

| AUD/USD |

| EUR/USD |

| GBP/USD |

| NZD/USD |

| USD/CAD |

| USD/CHF |

| USD/JPY |

Minors

They are also known as cross-currency pairs and crosses. These are the currencies that do not contain USD and are made up of other most popular currencies:

| EUR/AUD | CHF/JPY | GBP/NZD |

| EUR/CAD | EUR/JPY | AUD/CHF |

| EUR/CHF | GBP/JPY | AUD/CAD |

| EUR/GBP | NZD/JPY | AUD/NZD |

| EUR/NZD | GBP/AUD | CAD/CHF |

| AUD/JPY | GBP/CAD | NZD/CHF |

| CAD/JPY | GBP/CHF | NZD/CAD |

Exotics

Though you might have thought about alluring remote towns or unusual fruit, the name has nothing to do with this. Exotics are currency pairs that contain one major currency together with a currency that is not typically traded in the Forex market.

If you are a beginner, you’d better avoid trading exotics because they are highly volatile.

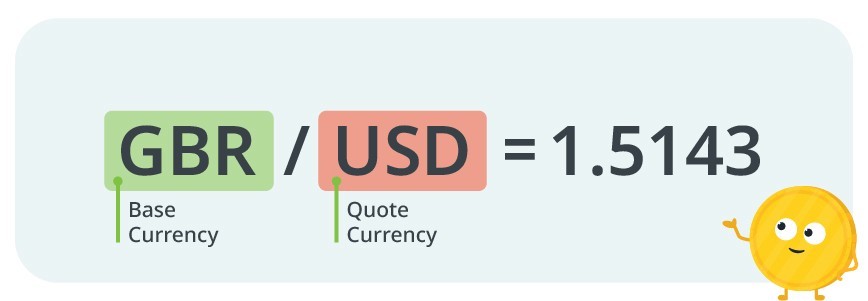

Forex Quote

Currency pairs are an essential notion in terms of the Forex quote. Let’s see what it is and how it looks like. The quote shows a base currency (BQ), a quote currency (QC), and the exchange rate.

Example

EUR/USD = 1,1315 or 1/1,1315

It means that when you buy one unit of the base currency (EUR), you get 1,1315 units of the quoted currency (USD).

Lots, Pips and Leverage

Now that you are aware of what currency pairs stand for, what types exist, and how to read a Forex quote, it is high time you learned some other very essential terms – pips, lots, and leverage.

Pips

A pip is a unit that shows a difference in the price movement of a quote.

Example

You trade USD/CAD with a quote 1,3305. If the quote rises to 1,3307, the difference will be 0,0002. So, the last decimal of the quoted price is a pip, here it is 2 pips.

Notice that for the Japanese yen, the quote goes to two decimals places.

Lots

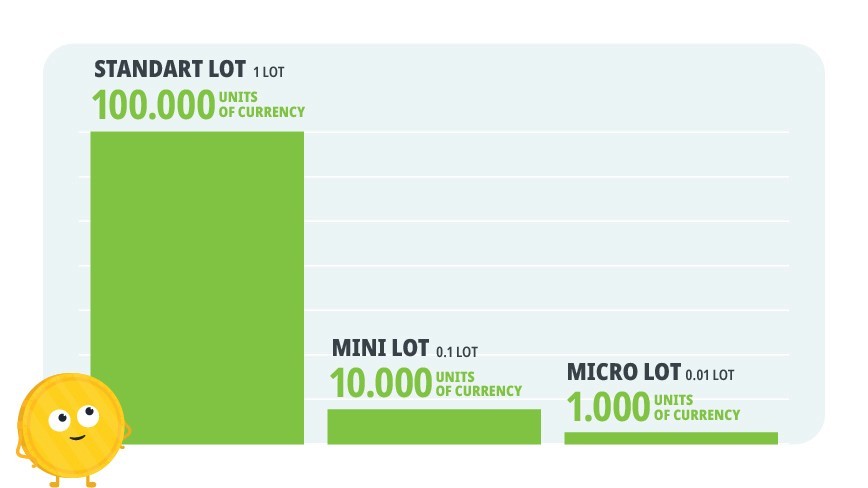

A lot is a number of base currency units which you buy or sell.

It is commonly accepted that lots are classified into the following types:

| Lot Type | Units |

| Standard | 100 000 |

| Mini | 10 000 |

| Micro | 1 000 |

The standard lot is the most popular type.

Leverage

We can define leverage as the ratio between the amount of money you have and the amount of money you can trade. Your broker usually provides you with this additional money. Leverage results from using borrowed capital as a funding source.

Leverage is an investment strategy of using borrowed money. It increases your trading power and allows you to open positions larger than you could open having only your private funds.

Example

All the terms described above are interconnected. Now that you know the definitions, we’ll see how they are all function together in a real market example.

| Currency pair | Standard lot | Exchange rate | Pip |

| USD/JPY | $100 000 | 110,09 | 0,01 |

The lot amount helps you to calculate the pip value in your currency.

Pip value: (0,01/110,09) x 100 000 = $9,08

Imagine that at some point during the day the exchange rate rises to 110,13 which is 3 pips more.

If you decide to sell at this point, your profit will be 9,08 x 3 = $27,25.

Your Forex Adventure Starts Now

My word! A lot of information there. Now you know how to buy and sell in the Forex market in really simple terms. But here comes the most exciting part. Today you become a Forex trader. Follow the steps below to start your journey nice and easy:

1. Take all the time you need to learn other essential terminology. FBS offers a comprehensible Forex course that will answer all your questions and destroy the ridiculous myths that float around FX trading.

2. Create your FBS account. Since you are a beginner, we recommend you to start with a Demo Account. With such an option, you can trade without risk, see how this or that decision affects your virtual deposits, and try out the interface. Trade using Demo Account until feeling sure that you are ready. Do not open the real account if you take Forex lightheartedly. However, trading via demo account will never give you the real taste of risks. So, start depositing small sums of money to see how you feel both in profiting and losing.

3. Download a trading platform for fast and efficient deals. When you are a newbie, it is especially important to constantly follow the price movements precisely and analyze every tiny fluctuation. It gives you a deeper understanding of the market and trains your attention.

4. Now you can do it – start trading with FBS!

5. Never stop learning and self-improving. The Forex market is extremely flexible, so you must follow its trends via Forex market news. We advise you to read additional educational materials, analyze how political and economic events influence exchange rates, see how other traders earn a profit and start creating your trading strategy.

To sum it all up, make the knowledge your best weapon in the exciting and promising world of Forex. Before diving into the wild waters of the real market, learn the basics, and try demo trading. Discover a new possibility of income with determination and no fear. Join FBS – we’ll solve all of the issues mentioned above!