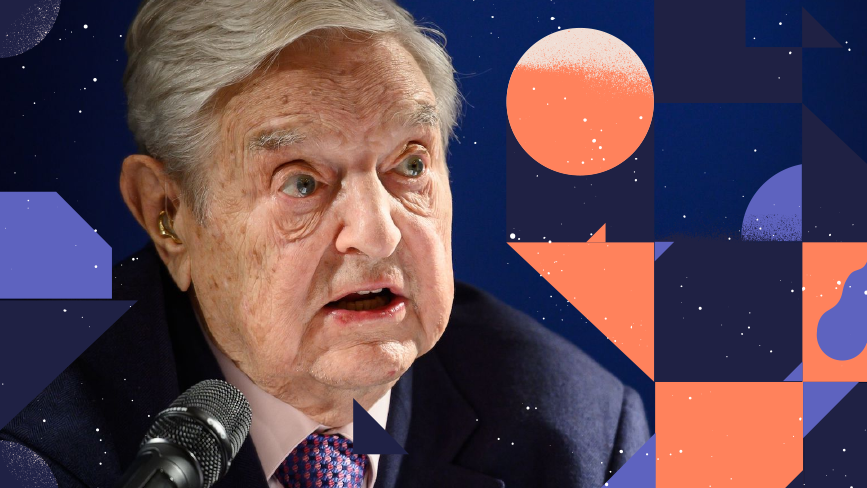

George Soros – A billionaire Unspoiled By Money

Information is not investment advice.

Investor, philanthropist, social activist, writer, the 56th richest person in the world, according to Forbes, and definitely the legend. Yeah, you have a hunch whom we are talking about. All these titles were given to the American financier George Soros, or it's better to say were deserved by this icon for 89 years of his life. You may call him as you prefer, but the crucial thing remains the same – he is a person whom people have discussed through the decades. Especially after that night when he earned a billion. Yeah, guys – one may lose count of zeros while writing this number.

How did Soros manage to do so? What else did he went through and achieved? And why people all over the world and the FX community, in particular, keep admiring this man? Today, we recall the story of the world-famous and probably the most generous trader of all time.

Bright child, dark life

Initially, Soros's case should not have been a "from-zero-to-hero"-like story. Born in 1930 under the name György Schwartz, he comes from the upper-middle-class Jewish family who lived in Budapest and would have provided a prosperous future to their ambitious son. However, considering his roots and the time he was growing up, some "if only" needed to interfere. So, the war brought its corrections to György’s life.

The other surname, fake documents, hiding and splitting up of the family to avoid the Anti-Semite prosecution, and continuous fear of being caught and killed... In these horrible conditions, Soros's relatives still managed to help those who were facing the same terrible events. Fortunately, the family survived, and at the age of 17th, Soros immigrated to England, aimed at studying and becoming a philosopher.

London salad days – both sweet and bitter

Guess what London university did George Soros enter? Some of you may think of a low-ranked university that the Jewish boy experienced enormous deprivation during the war could afford. The others still figure out hardly how he could even study instead of working hard to ensure his living. First, why instead of? He was working part-time as a waiter and a railway porter to support his studies. Second, the university he got enrolled in was the London School of Economics (LSE).

Not bad, huh? So, staying at his uncle's Soros was studying in one of the most prestigious universities of England under the famous philosopher Karl Popper. While consuming the ideas of the great teacher that were close to his own views, Soros eventually realized he had been more interested in economics. After two years of experience in working at the merchant bank Singer & Friedlander and successfully finished both Bachelor and Master programs in LSE, 26 years old graduate moved to New York. And there, the exciting adventure began.

English...Oh, sorry, Jewish man in New York

In the US, Soros started as an arbitrage trader and was specializing in the European stocks gaining popularity at that time. Then, he worked at several Wall Street firms as a trader and analyst, not giving up studying philosophy and developing the ideas rooted in Popper's ideology. In 37, he managed his first offshore fund, First Eagle Fund, trying out the trading strategies. The experiment was successful, and the second hedge fund – the Double Eagle – was created two years after. In 1973, it had $12 million of investors' money. But Soros and his assistant Jim Rogers decided to leave and established the Soros Fund afterward renamed to the Quantum Fund. In nine years, it had grown to $381 million.

Apart from his trading activity, Soros got involved in philanthropy. He was not that rich and greedy man that one is likely to become being so successful – a good portion of his fortune has been stably invested in helping other people. Thus, at the age of 54 he established the Open Society Foundations to fund global initiatives related to developing education, public health, business, and supporting freedom of speech, equality, and justice all over the world. What a good influence of surviving war and escaping prosecution, huh?

The day of glory

To finance others in such a volume, one should have feet on the ground. Well, Soros has been very successful in that. His investment funds stably generating an enormous percentage of annual average return (once, it reached 122%!). But there was one day that was especially profitable for Soros. In 1992 he played on the UK currency crisis betting a considerable amount against the British pound and got one billion of profit in one night. That very moment he earned not only money, but the title of the man who broke the Bank of England, respect of many economists and top politics, including leaders of the countries, and even the power to affect the economic and political events happening in the world arena. This achievement has not been vanished by even big fails as losing money on the wrong bet on the Japanese yen's value in 1994 or being fined for the insider trading on the shares of the French bank Société Générale.

The star that is still shining

Trying out new strategies, speculating on many market moves and 2008 crisis, Soros has earned the net worth of $8.3 billion as of February 2020. For around forty years period 1969 to 2009, he compounded his investments at the rate of 26.3%, which is bigger than Warren Buffett's return over the same period (21.4%).

Now, he remains the chairman of Soros Fund Management LLC that has become a privately owned family office after returning outside investors' money. Moreover, Soros keeps donating money to the Open Society Foundations that launch programs in more than 100 countries, having 37 regional offices. He keeps being aware of the key social, economic, and political events, expressing his views and opinions by giving interviews and posting at his twitter (at the age of 89, yeah). His numerous books are still being sold all over the world, as well as the ones on his biography.

We didn’t have that much room to describe Soros’s life. But hopefully, our moderate article let you understand why this story has been so noteworthy and instructive. It is always possible to achieve success in trading even if all conditions seem to be too unfavorable.