Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

2022-08-26 • Updated

Information is not investment advice

In a world full of information, we face new facts every day. Regular people usually observe the news without a single thought. At the same time, traders scroll headlines for opportunities and identify their impact on the markets very well. In order to see the connections between the markets and the news, a newbie needs to understand the main principles of fundamental analysis.

In trading, there are two well-known and completely different approaches: technical and fundamental. Technical analysis uses financial charts to forecast the future performance of an asset’s price. On the other hand, fundamental analysts focus on a macro picture and find correlations between economic conditions and prices. Whose analysis is correct? This is the main stumbling block of the whole trading science. Despite the long-lasting disputes over the importance of each type of analysis, modern experts agree that the best thing is to use a combination of them. They observe the technical picture and look for potential fundamental market drivers. For now, let’s dive deep into understanding the main elements of fundamental analysis.

In general, fundamental factors represent macro data, which shows the weak and strong sides of the domestic economy. This data includes the following factors:

Now, let’s review the sources of information for trading. This is the time when you need to start loving calendars, even if you only have one on your phone. That’s because one of the most important tools of any fundamental analyst is an economic calendar. Well, this is not just a regular calendar. In fact, this is the list of the most important releases and events that have the potential to move the markets. Each indicator has a forecast, which shows the average expectations of different analysts.

The simplistic rule of trading on the economic calendar may be described as “choosing a better-looking economy”. Simply put, you wait for the release and compare it with the forecast. If the indicator is better than the forecasts, that means that the economic conditions of a country are strengthening and a country’s investment climate improves. Therefore, the currency of that country becomes more attractive for investors. That’s the time when you hit the “buy” button in your terminal.

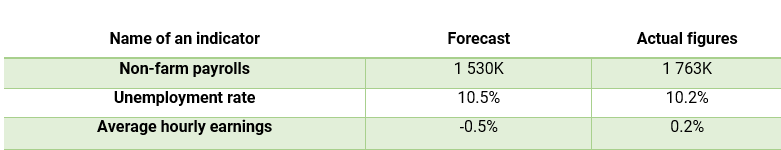

For example, let’s take the NFP release on August 7, 2020. The expectations and the actual figures of the US indicators are listed in the table below.

The data in the table shows that the actual figures are higher than the analysts’ expectations. That is, the non-farm payrolls and average hourly earnings are higher and the unemployment rate is lower than the forecasts. As a result, EUR/USD drastically fell lower.

Above, we showed you an ideal example of the market reaction. You should keep in mind that not every release equally affects the market. Sometimes, when there is mixed news from one country coming out at the same time, the reaction of the domestic currency will be mixed as well.

As we mentioned before, economic releases comprise important, yet not the only group of factors that affect the market. The other factor is, of course, connected with the news. Trading on the news has become extremely relevant amid the coronavirus pandemic and the US-China trade war.

Let’s consider a quick example of a correlation between the news and the market which appeared on August 11. After the news on the first coronavirus vaccine being registered in Russia, the gold dropped to the lows of the beginning of June.

Last but not the least factor, which affects the market, is, of course, monetary policy decisions of central banks. A central bank plays a very important role in the economy of a country, as it controls the money supply, interest rates and can affect the national currency. As traders, we keep an eye on the following updates by the central banks:

A central bank sets the interest rate to maintain the stability of the country’s financial system. Its main goal is to keep inflation within the target and to sustain a healthy economic environment. If inflation is going up in line with rising GDP and employment figures, a bank will raise the interest rate. This way, the bank increases borrowing costs, making credits and investments more expensive. In the meantime, the domestic currency is strengthening. On the other hand, if a country’s economy is struggling, the bank cuts the interest rate. A lower interest rate makes borrowing cheaper and stimulates spending. As for the country’s currency, it loses its strength against other currencies.

Another part of the central bank’s monetary policy is bond buying. If the economy needs greater help and the interest rate is already low, the central bank starts purchasing bonds aiming to increase the amount of money in circulation. By doing this, a regulator tries to make credit cheaper and boost spending. Another name of this measure is called quantitative easing. How does it affect the performance of a currency? In theory, an increase in the money supply leads to a cheaper currency. However, the pandemic of 2020 shows that this rule doesn’t work in all cases.

The Federal Reserve purchased nearly $2 trillion Treasuries since the start of coronavirus’ spreading. The fact that the US dollar was moving lower on this news from May till August is not so surprising. What is more interesting, similar policy measures by other major central banks resulted in the strength of the domestic currencies against the USD. For example, below we can see the behavior of the euro after the European Central Bank increased its emergency bond-buying program by 600 billion euros on June 4. EUR/USD jumped up despite the fresh inflow of money into the economy of the Eurozone.

Why did that happen? The first reason may be linked to the actions of investors. Due to the weak US currency, they are moving part of their capital outside of the United States. Secondary, the rise of the euro may be connected with the reverse of carry trades. In the times of uncertainties, traders take their money out of the currencies with higher rates (emerging markets’ currencies) and buy back the major currencies, such as the euro.

The nature of the market is indeed very unique. Therefore, you should not be blindfolded while trading. Having a certain algorithm may be good, but knowing a bigger picture, the fundamental behavior of the markets will definitely help you to avoid mistakes and understand the markets better.

Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Trend strategies are good - they may give significantly good results in any time frame and with any assets. The main idea of the ADX Trend-Based strategy is to try to catch the beginning of the trend.

Counter-trend strategies are always the most dangerous but also the most profitable. We are pleased to present an excellent counter-trend strategy for working in any market and with any assets.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later