Trend strategies are good - they may give significantly good results in any time frame and with any assets. The main idea of the ADX Trend-Based strategy is to try to catch the beginning of the trend.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

2024-03-27 • Updated

Information is not investment advice

Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Most of these indicators are used in the trend market.

Let us present you with a new trend strategy based on Williams’ indicators.

Instruments: any

Indicators: Williams Alligator and Williams Fractals with the default settings

Timeframe: >30M

It is recommended to use the Stop Loss at the level of the nearest local minimum before receiving the signal.

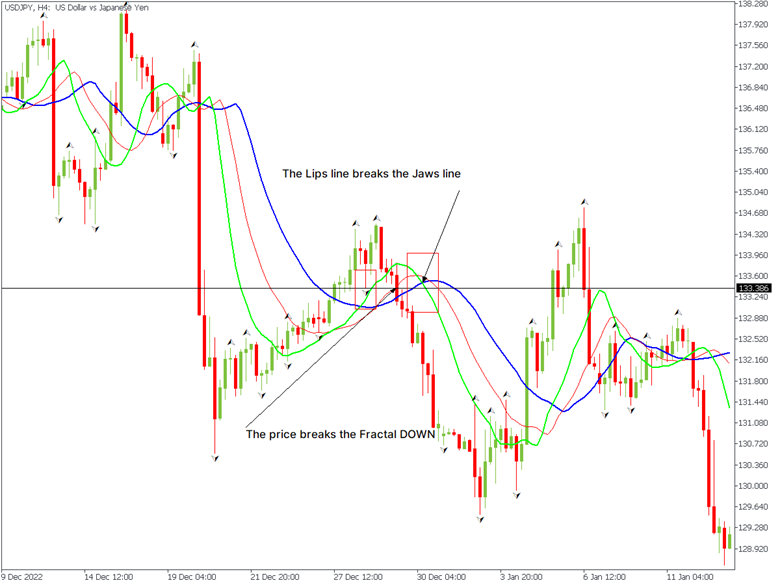

Let’s look at the USDJPY chart. As you may see, the price started rising in February 2023 on the Daily time frame.

Two things happened simultaneously: the Lips line of the Alligator indicator broke the Jaws line up; the price broke the fractal resistance level up and continued rising.

Opening a long position with a Stop Loss lower than the previous local minimum became possible at 134.360. For conservative traders, it would be possible to set Stop Loss slightly lower than the last fractal line, which became a support level.

It is recommended to use a Stop Loss at the level of the nearest local maximum before receiving the signal.

The same chart of USDJPY made it possible to open short positions at the pair when the price broke the last fractal support line, and then, the Alligator lines confirmed the signal – the Lips line broke the Jaws line at 132.620.

Note that we got the signal from the Alligator indicator after the Williams’ fractals. That’s okay for this strategy too.

The rule of setting a Stop Loss is precisely the same as in the previous time – higher than the local maximum or slightly higher than the resistance fractal line for those who are not too risky.

The choice of take-profit is possible based on the ratio 3:1, i.e., a trade should bring 3 points of profit for one lost profit point.

It’s essential to pay attention that the strategy works only in trends. When there is a flat in the market, the strategy may give a lot of false signals.

This is for informational purposes only and does not contain — or to be considered as containing — investment advice, suggestion, or recommendation for trading.

Legal disclaimer: The content of this material is a marketing communication, and not independent investment advice or research. The material is provided as general market information and/or market commentary. Nothing in this material is or should be considered to be legal, financial, investment or other advice on which reliance should be placed. No opinion included in the material constitutes a recommendation by Tradestone Ltd or the author that any particular investment security, transaction or investment strategy is suitable for any specific person. All information is indicative and subject to change without notice and may be out of date at any given time. Neither Tradestone Ltd nor the author of this material shall be responsible for any loss you may incur, either directly or indirectly, arising from any investment based on any information contained herein. You should always seek independent advice suitable to your needs.

Trend strategies are good - they may give significantly good results in any time frame and with any assets. The main idea of the ADX Trend-Based strategy is to try to catch the beginning of the trend.

Counter-trend strategies are always the most dangerous but also the most profitable. We are pleased to present an excellent counter-trend strategy for working in any market and with any assets.

As we know, strong trend movements are important on the market. We present you a trending strategy that will allow you to identify the very beginning of a solid incipient trend and open a deal.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later