Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

2021-10-19 • Updated

Information is not investment advice

The financial market, just like any other market, is working because someone wants to buy something, and someone wants to sell it. But in food or goods markets you can only sell things you own. The same goes for most of the brokers, you can’t sell what you don’t have. And why would you even need this? From this article, you will know, how to earn, when others lose, and how to become a bear. Now you will learn to short sell!

How’s that even possible to sell something you don’t have? Well, some brokers, like FBS, allow you to use your deposit like you have assets instead of them. To make things clear, let’s go through the short-selling process step-by-step.

So once again: you goal is as usual to buy low and sell high, but with short selling you do it in reverse order: firstly sell and then buy.

There are several reasons for you to consider short-selling stocks. The first and the most important is that no asset grows forever. The economy has cycles and at some point, there won’t be any growth in shares. With weak indices and the understanding of future downtrend movement why not short sell?

Another reason for short-selling is a hedge of your risks. Let’s say, for example, that you have enough opened long trades, and you think that markets will rise in a month or two. But also, you think that some plunge may occur in the next hours. It’s much wiser to short sell rather than close your long position and re-enter lower because trading is a probability game, and the price may surge against your forecasts.

Note that short selling is different from regular investing because you need to have access to leverage and margin trading if you want to short sell. Investing can be done without any leverage, thus, there are no risks that your position gets closed automatically when margin levels are critically low.

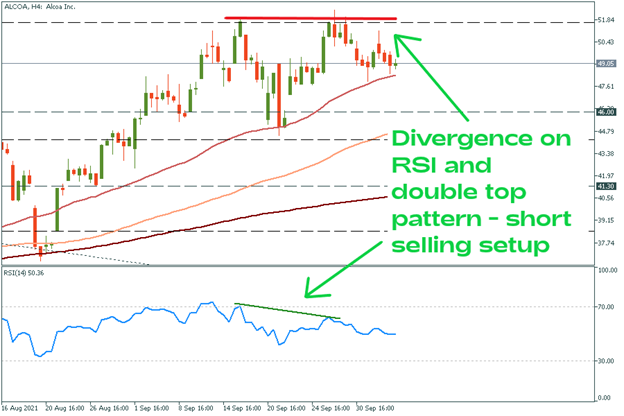

If the investor bought one Alcoa share at $51.5, the maximum they could lose is $51.5 because the stock cannot drop to less than $0. In other words, the maximum value that any stock can fall to is $0. If an investor shorts a stock, there is technically no limit to the amount that they could lose because the stock can continue to go up in value indefinitely. In some cases, investors could even end up owing their brokerage money. Good for you, FBS will never act like this. Control your risks and you will never see a loss of the whole deposit at once.

While short selling does present investors with an opportunity to make profits in a declining or neutral market, it should only be attempted by sophisticated investors and advanced traders due to its risk of infinite losses. Short selling is not a strategy used by many investors largely because the expectation is that stocks will rise in value. The stock market, in the long run, tends to go up although it certainly has its periods where stocks go down.

To sum up, it’s amazing to have means that allow you to earn money on every movement in the market. This way volatility is the thing that matters the most. The only thing you will need is to predict the future price movement. But be aware of risks and always maintain sufficient funds in your account, or the broker will have to close your position automatically. The history remembers cases of Short Squeezes (an article about them will be released shortly), events when the price of the stock skyrockets because of the unusually high interest for the stock and an enormous number of short-sellers, that are closing their positions in awe of horrific losses.

Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Trend strategies are good - they may give significantly good results in any time frame and with any assets. The main idea of the ADX Trend-Based strategy is to try to catch the beginning of the trend.

Counter-trend strategies are always the most dangerous but also the most profitable. We are pleased to present an excellent counter-trend strategy for working in any market and with any assets.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later