Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

2022-08-26 • Updated

Information is not investment advice

We often get a lot of requests from FBS traders on how to do scalping professionally. This is indeed a difficult trading style that requires a good reaction and skills. That is why we have thorough coverage of this topic on our website. You can already find a strategy with Bollinger Bands and a 5-minute scalping strategy with two moving averages in the “Tips for Traders” section. They have something interesting in common: they both are implemented on the M5 timeframe. On this timeframe, a trader can execute multiple trades within one hour. Of course, trading at such a small timeframe requires your total attention and patience.

What if we say that you can trade even faster on the M1 timeframe? Yes, it’s possible! However, you need to follow certain steps to avoid the danger of misleading signals.

First of all, have a straightforward strategy with entry and exit rules.

Secondly, know how much risk you can take. Be sure that your take profit is at least twice bigger than your spread.

Thirdly, choose the most liquid pairs with tight spreads (EUR/USD, GBP/USD, USD/CHF, USD/JPY).

If you are good with the rules we declared above, let’s look at the strategy!

Trading setups: Bollinger Bands with 100 periods, Bollinger Bands with 20 periods, MACD (12; 9; 26).

Trading instruments: EUR/USD, GBP/USD.

Let’s look at the example.

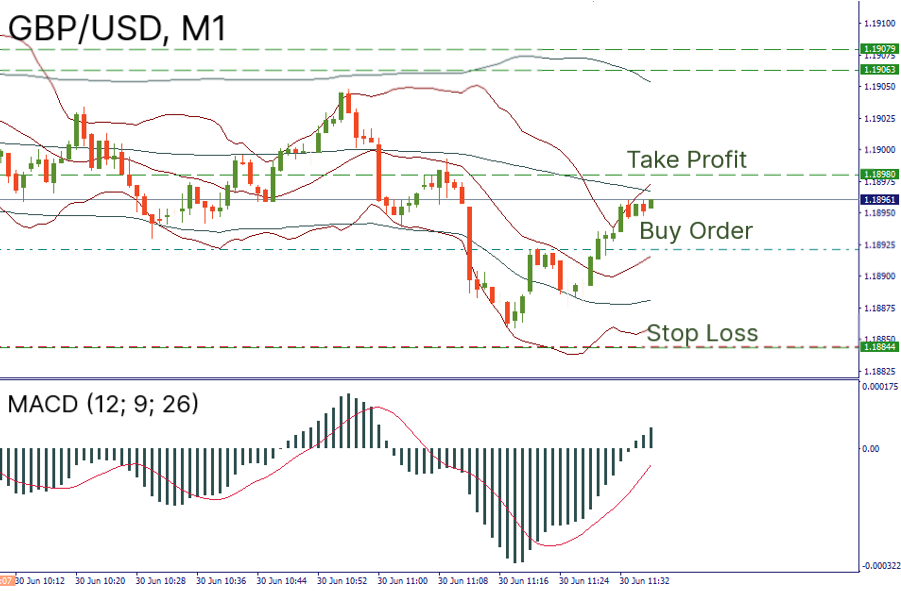

On June 30, we traded GBP/USD. The fast Bollinger Band was moving below the slow one. Approximately at 11:16, we entered a trade at 1.1892 after the signal line of MACD crossed the indicator in the oversold zone. Stop Loss was located at 1.1884 (lower Bollinger Band (20)), while Take Profit was placed near the upper Bollinger Band (20) at 1.1898.

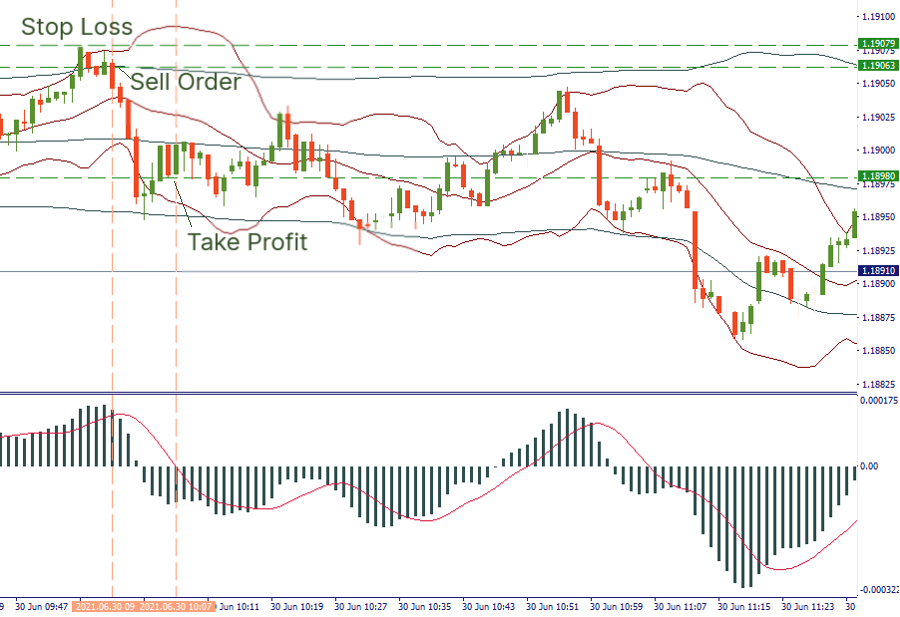

On the same chart, a situation on June 30 allowed us to sell the pair. After the signal line of MACD crossed the indicator in the overbought zone and fast BB (20) started moving above the slow (100) one, we opened a position at 1.1906. We located Stop Loss at 1.1907 and Take Profit at 1.1898.

Scalping on the M1 timeframe is not a popular technique given the risks involved. You need to be a cold-blooded, quick decision-maker who thinks ahead and understands the action he does. We recommend you master the trading strategy above on a demo account first. This way, you will definitely become a pro in scalping.

Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Trend strategies are good - they may give significantly good results in any time frame and with any assets. The main idea of the ADX Trend-Based strategy is to try to catch the beginning of the trend.

Counter-trend strategies are always the most dangerous but also the most profitable. We are pleased to present an excellent counter-trend strategy for working in any market and with any assets.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later