Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

2022-11-18 • Updated

Information is not investment advice

Learn how to make real profit using the trading strategy of the world famous trader.

Today we’ll discuss the strategy called “Three wise men and the alligator” created by Bill Williams. Williams is a famous trader, the author of the bestselling book “Trading Chaos” and of many MetaTrader indicators. He managed to increase his capital from 10,000 to 200,000 dollars during 2 years of trading in the stock market. Quite impressive! Let’s have a look at his strategy, that is also called the Profitunity trading strategy.

The idea of this strategy is to capture a trend and entry it at the start. The Alligator indicator is responsible for the first part: it helps to catch big trends and differ them from fake ones. While, Three Wise Men are in charge of the second part: they set entry rules.

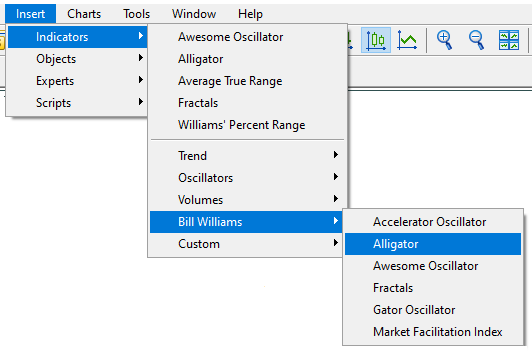

Now we need to add the Alligator indicator to the chart in order to understand how it works. Below you’ll find configurations to build the Alligator indicator.

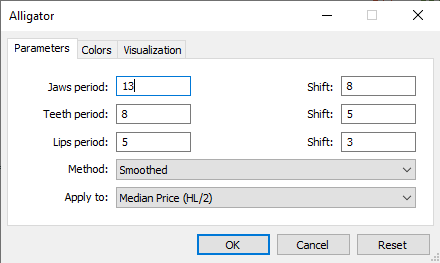

Often, before the big trend movement, all lines are intersected. This state is called "sleeping alligator". When the Alligator lines start separating, it means that the alligator is “hungry”, as it looks like it opens the mouth. This is the right moment to capture the move.

Remember!

The alligator sleeps, when all moving averages converge. Take a break!

The alligator is hungry, when all moving averages diverge. Be ready for downtrend/uptrend!

When you’ve built the alligator, move to the next step: Three Wise Men. They will help to find out where is the right entry.

The divergent bar determines the reversal in a ranging market.

Important! You should look at the area that is far away from the Alligator lines.

Signal to buy:

The bar has a lower low than the previous bar, and closes in the upper half of its range.

*It signals that when the bar opening, bears dominated the market, but they gave the way to bulls by its close.

Bullish divergent bar

Bullish divergent bar

Signal to sell:

The bar has a higher high than the previous bar, and closes in the lower half of its range.

* It signals that when the bar was opening, bulls dominated the market, but they gave the way to bears by its close.

Bearish divergent bar

Bearish divergent bar

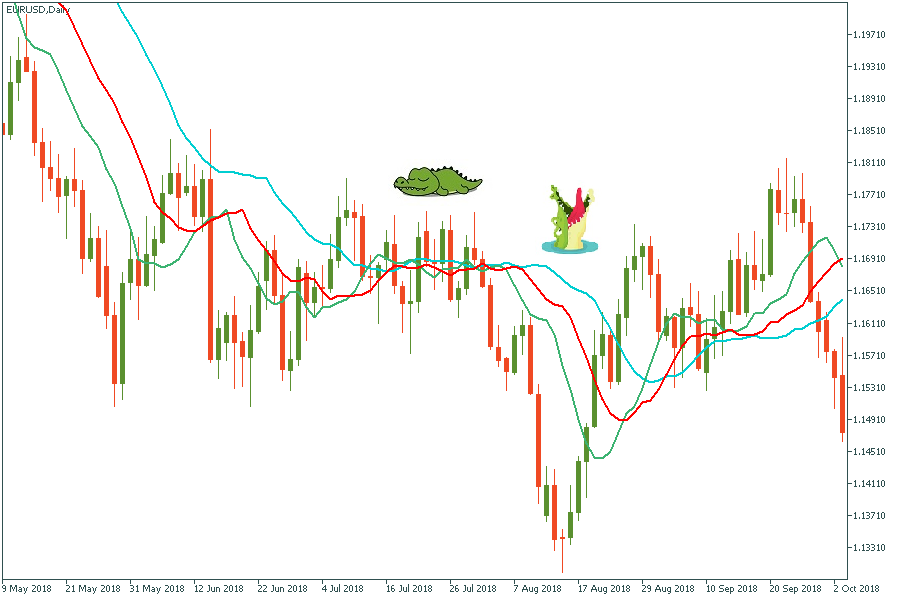

This is the extra condition to the first one. Then the Awesome Oscillator forms the third consecutive bar with a color similar to the first wise man trade direction. In other words, if your first wise man signals to buy, you’ll add on after three consecutive green bars. Otherwise, if your first wise man signals to sell, you’ll add on after three consecutive red bars.

Most traders start trading with the first wise man, they use the second one just to prove that their first signal was right and they add on to their position.

Fractals help to identify breakouts on previous high or low. An up fractal is a signal to buy, a down fractal is a signal to sell.

The perfect moment is when the wise men gather together and it’s called the Profitunity signal.

Firstly, look if the first wise man is formed above/below the alligator’s lines. Then, wait for the “bullish”/” bearish” pattern to appear. Once you’ve entered the market, look at the second wise man – the Awesome Oscillator (there should be 3 consecutive green/red lines). Then, we address to the third wise man – wait for the formation of fractal. Once the fractal appeared, you should place the take profit near the high/low and the stop loss at the lowest minimum or the highest maximum.

Exit the market if the opposite signal appears – when the reversal pattern appears or when there are three similar consecutive bars on the histogram of the AO.

Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Trend strategies are good - they may give significantly good results in any time frame and with any assets. The main idea of the ADX Trend-Based strategy is to try to catch the beginning of the trend.

Counter-trend strategies are always the most dangerous but also the most profitable. We are pleased to present an excellent counter-trend strategy for working in any market and with any assets.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later