Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

2022-08-26 • Updated

Information is not investment advice

This article will describe a strategy called ‘HHLL’. You might have seen similar strategies with other names as this one is based on classic forex principles. The great part of it is that you don’t need to use any indicators. The main point is to follow the price action. However, some indicators still can be helpful for better visualization. Besides, feel free to add anything you want to this strategy, personalize it to your liking! By the end, you can even come up with a new, your own strategy, which suits your trading approach and vision.

To start with, let’s remember the definition of trend. A trend is the general direction of the price of an asset on the market. Uptrend (bullish trend) consists of a series of higher highs and higher lows – prices are moving up. Downtrend (bearish trend) is classified as a series of lower lows and lower highs – prices are moving down. The best moment to enter the market is the trend reversal.

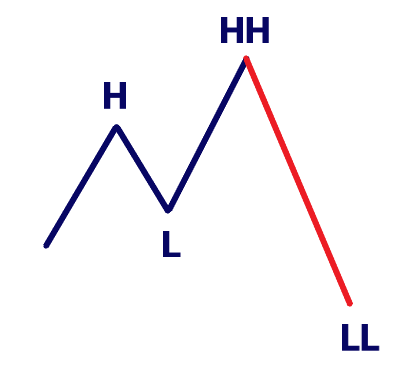

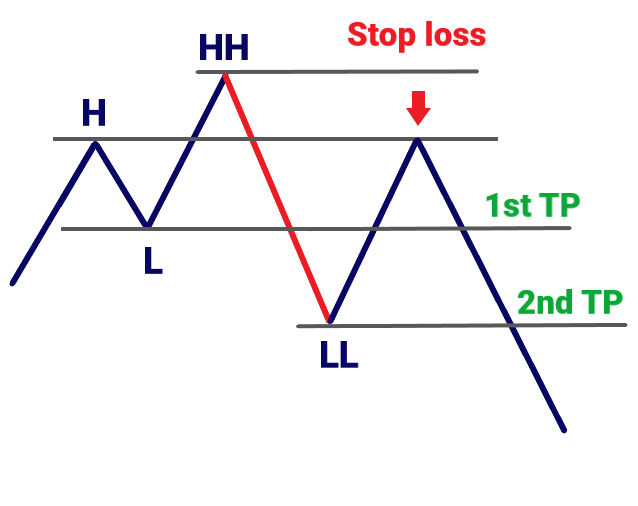

Let’s say there is an uptrend on the chart. The first high (H) is followed by the first low (L), which in turn is followed by the second high (HH – higher high). After that, if the price drops out of the trend structure and forms a lower low (LL), a trader should be ready to sell, when the price reaches a certain level, which we will discuss later.

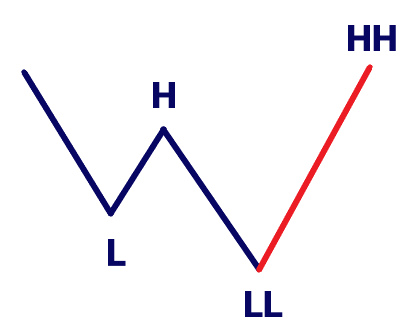

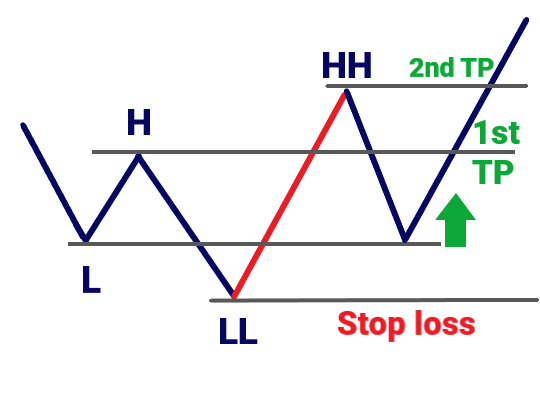

Let’s look at the opposite case: a downtrend. The first low (L) is followed by the first high (H), which in turn is followed by the second low (LL – lower low). After that, if the price breaks the trend structure and forms a higher high, a trader should be ready to buy, when the price reaches a certain level, which we will discuss later.

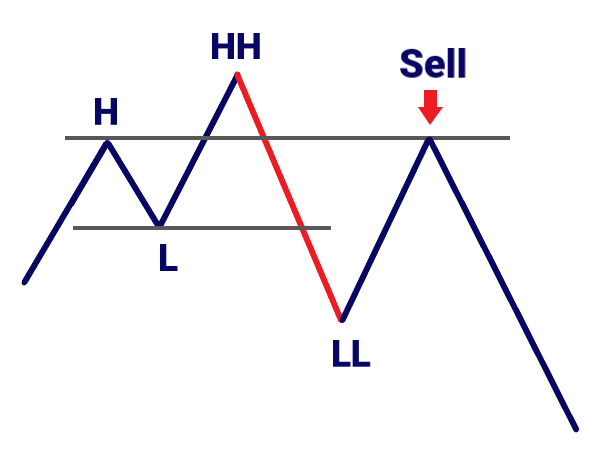

Let’s discuss where and how to open the sell order. The perfect moment for entry is the rollback to the first high (look at the picture below). This structure works as there are some so-called ‘big players’. To make a huge selling, they need an enormous number of buy orders to make their trades more profitable. The area between H and HH represents the zone of increased liquidity. Thus, there are many buyers as they believe in the further continuation of a trend.

The better way to enter is to use a pending order. First, you should wait for the formation of the lower low (LL). Secondly, you should place Sell Limit at the level of the first high (H).

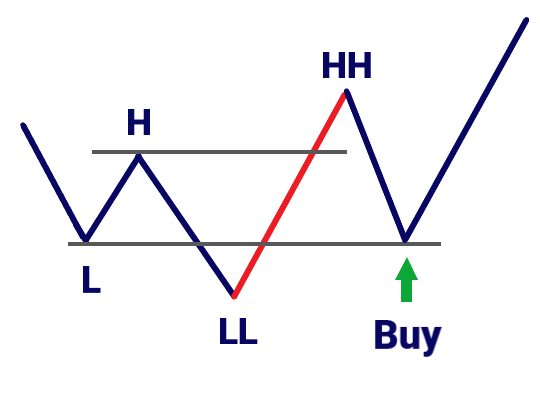

By the same logic, in the case of buying, the zone of increased liquidity is located between the first and the second lows (L and LL on the picture below). Here are a lot of sellers, who believe the downtrend will keep going. Some traders buy too early, some of them panic and close their orders, also most have Stop Losses in this area. Therefore, a big player sees a great opportunity to buy at this moment. What do we do? Enter with ‘big players’! Wait for the formation of the higher high (HH) and set Buy Limit at the level of the first low (L).

Just to remind you, a Stop Loss is an exit order, which is used to limit the amount of loss that a trader may take on a trade if the trade goes against him.

In the case of selling, it’s a good idea to place Stop Loss slightly above the HH point. On the flip side, in case of buying – put Stop Loss just below the LL point.

Similar to Stop Loss, Take Profit order is an exit order. However, unlike SL that limits a trader’s loss on a trade, TP indicates a particular price at which a profitable trade will automatically close. In other words, TP is a profit target. You need to place TP at the level you expect the price to reach.

There are two targets for every case. As for selling, the first Take Profit should be at the first low (L) and the second Take Profit – at the second low (LL).

As for buying, the first Take Profit should be at the first high (H) and the second Take Profit – at the second high (HH).

That’s it! Try this strategy in your trading!

Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Trend strategies are good - they may give significantly good results in any time frame and with any assets. The main idea of the ADX Trend-Based strategy is to try to catch the beginning of the trend.

Counter-trend strategies are always the most dangerous but also the most profitable. We are pleased to present an excellent counter-trend strategy for working in any market and with any assets.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later