Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

2024-03-26 • Updated

Information is not investment advice

Gold trading is one of the oldest investment vehicles in the world. The precious metal plays an important role in the global economy. This metal is valued far beyond its industrial uses, as gold deposits are rare and difficult to find. In Forex trading, gold is one of the most popular asset to trade.

Why do traders prefer gold? There are many reasons for that. In this article, we’ll discuss the reasons for choosing gold as a trading asset, what moves gold prices, and how to trade gold via CFD.

Gold trading refers to the buying and selling of gold in order to profit from price movements. Because gold price is considered to be highly volatile, traders try to make market profits by buying the commodity when the price is low and selling when it is high, or going short the precious metal when prices are expected to fall.

Gold trading requires careful consideration due to large price fluctuations and the wide range of instruments available, from gold derivatives such as futures and contracts for differences (CFDs) to gold mining stocks.

Before you start trading gold, you should be aware that the market can be extremely volatile, resulting in a high degree of risk. The chances of making a profit when trading gold go hand in hand with the risk of loss.

Gold, monthly chart since 1996

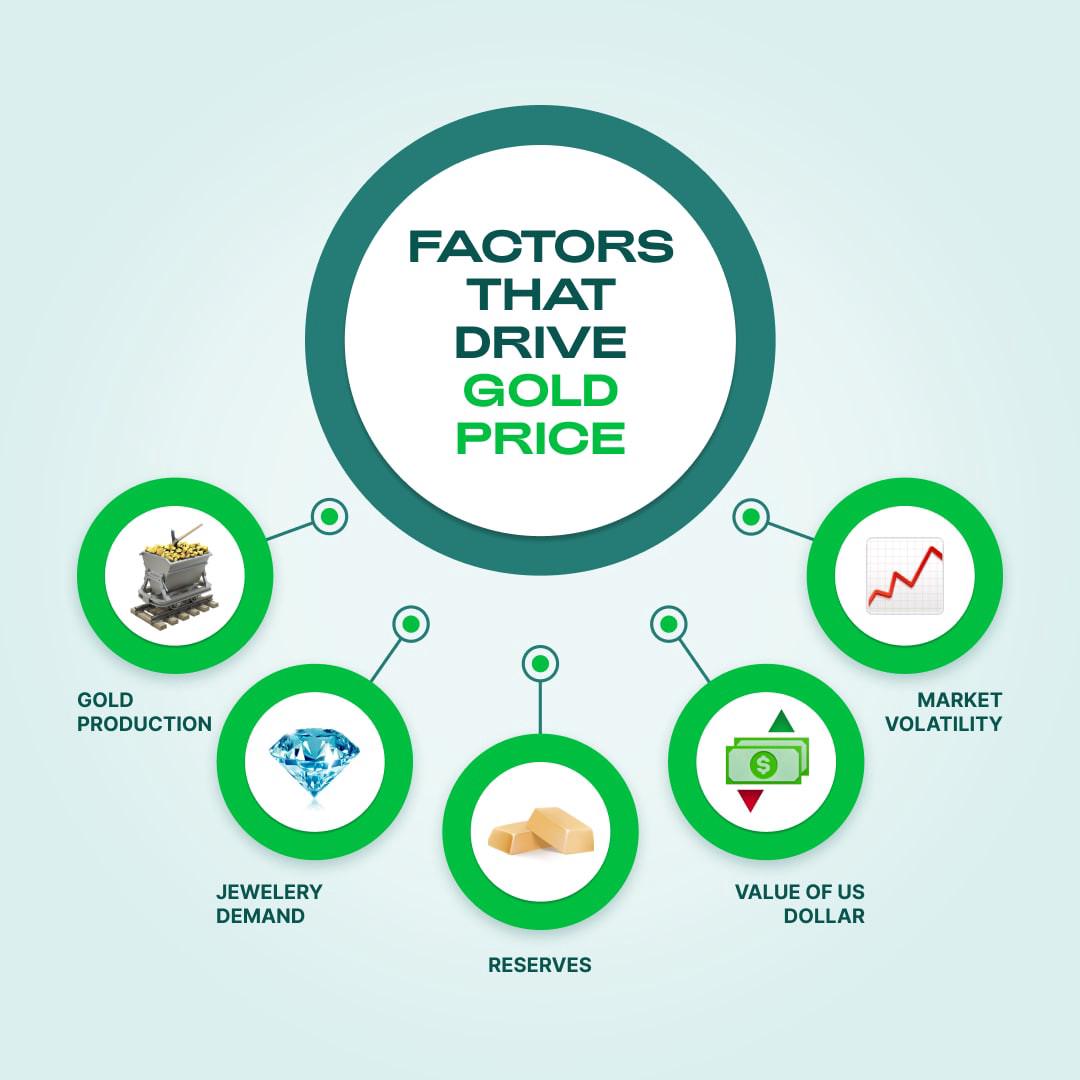

Before learning how to trade gold, it’s important to understand what influences the gold price. This information can help you make logical trading decisions and reduce your risk of loss. What drives gold prices may change at different times depending on the prevailing sentiment in the financial markets. Let’s look through them.

Gold price movers

Central banks hold fiat money and gold in reserve. As central banks diversify their monetary reserves — from the fiat currencies they have accumulated to gold — the price of gold tends to rise.

While the US dollar is no longer pegged to gold, prices of the precious metal and the USD tend to move in the opposite directions. As the US dollar appreciates against other currencies, gold becomes more expensive for non-US dollar buyers and the demand for it falls. On the other hand, the depreciation of the dollar makes gold cheaper for foreign buyers, and demand increases.

Gold prices can be influenced by simple supply and demand; as demand for consumer goods such as jewelry and electronics increases, the value of gold may rise. In fact, India, China and the US are major consumers of gold for jewelry in volume terms.

Investors were always into gold, and over the past 50 years, the price of this metal has risen substantially. In total, gold purchases from various investment instruments in 2019 amounted to 1,271.7 tons, representing more than 29% of total gold demand.

In times of economic uncertainty, such as an economic downturn or political instability, more people are turning to invest in gold because of its enduring value. Gold is often considered a safe haven for investors during turbulent times.

Gold supplies are mainly driven by mining, which has stabilized since 2016. World gold production affects the price of gold, which is another example of supply matching demand. Moreover, getting less gold costs more. The gold mining industry is suffering from rising costs in all areas. While some of these costs have declined over the past few years due to falling oil prices, they are likely to increase in the future as ore quality continues to decline. In addition, as global oil production begins to decline in the future, gold production will be negatively impacted, even with much higher gold prices. This increases the cost of extracting gold, sometimes leading to higher gold prices.

Gold reaction to the world’s events.

There are certain reasons why traders prefer gold for trading. And here are the reasons why.

Of course, there’s no perfect asset, and gold has its disadvantages as well.

Before you start trading the yellow metal, it’s important to clearly define your strategy. There are different gold trading strategies that can help you determine when to enter and exit a trade and how to manage a position while it’s open rather than basing decisions on pure speculation. A trading strategy designed for another asset, such as a stock or a currency pair, may not work the same for gold. Here are some of the most popular technics.

The trader keeps a trading position open for weeks and months to benefit from the movement in the price of gold over an extended period.

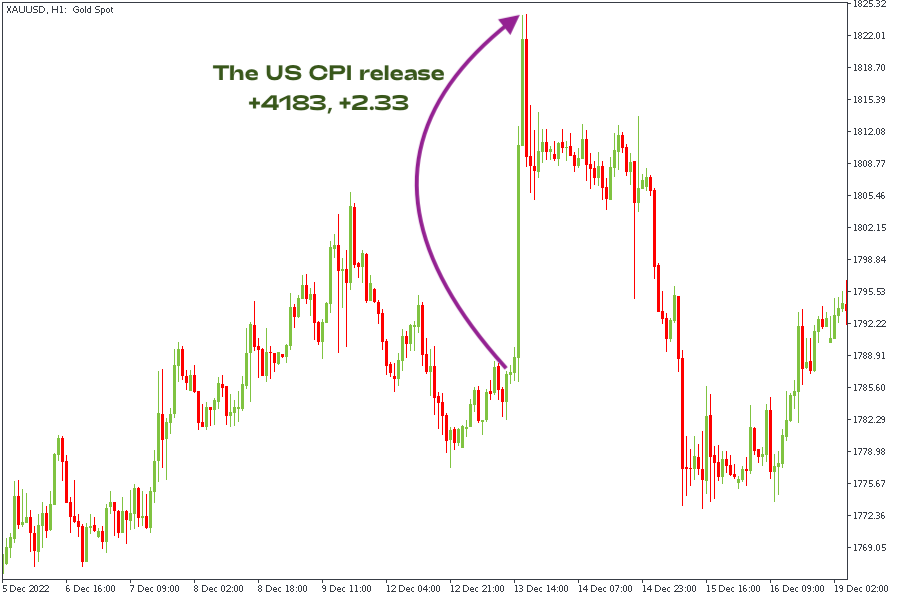

A short-term gold trading strategy based on news such as central bank policy statements or economic data.

On December 13, 2022, the US Inflation Rate was lower than expected, 7.1% vs.7.3% expected. That result led to the USD drop, and gold, which reversely correlated with USD, vice versa, gained 4183 bp.

Traders look for patterns in the movement of the gold price in order to identify strong trends. When the price is in an uptrend, a trader expects further rise and opens a buy trade. When gold is in a downtrend, the price may continue falling, so a trader opens a sell order.

Traders often use technical analysis to identify and confirm price trends. Technical indicators can help them determine a potential change in an uptrend or a downtrend so that traders may adjust their position accordingly. Trend following can also be part of a gold CFD trading strategy.

Day traders hold a position open for one trading session, acting on intraday fluctuations in the price of gold. Since gold is a highly liquid asset with small spreads between the bid and ask price, it is well suited for intraday trading. Day traders can use news events to focus on buying or selling gold during a specific time of the day.

A price action strategy is a gold trading system in which traders look at price action to decide at which level to open or close a position. Unlike strategies based on technical indicators, traders focus on Japanese candlestick patterns and chart patterns to make their decisions.

FBS gives you an opportunity to profit on gold. You will find gold under the symbol of XAUUSD in FBS Trader App and MetaTrader 4 or 5. Look up contract specifications for trading gold at FBS website.

The gold trade has ingrained itself quite well over the years. Considering trading it for beginners can be a great start. Try gold trading with FBS! We can help you to execute your trades comfortably.

Legal disclaimer: The content of this material is a marketing communication, and not independent investment advice or research. The material is provided as general market information and/or market commentary. Nothing in this material is or should be considered to be legal, financial, investment or other advice on which reliance should be placed. No opinion included in the material constitutes a recommendation by Tradestone Ltd or the author that any particular investment security, transaction or investment strategy is suitable for any specific person. All information is indicative and subject to change without notice and may be out of date at any given time. Neither Tradestone Ltd nor the author of this material shall be responsible for any loss you may incur, either directly or indirectly, arising from any investment based on any information contained herein. You should always seek independent advice suitable to your needs.

Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Trend strategies are good - they may give significantly good results in any time frame and with any assets. The main idea of the ADX Trend-Based strategy is to try to catch the beginning of the trend.

Counter-trend strategies are always the most dangerous but also the most profitable. We are pleased to present an excellent counter-trend strategy for working in any market and with any assets.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later