Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

2022-08-26 • Updated

Information is not investment advice

In the unstable market realities, we obviously tend to pay more attention to the movements of S&P and NASDAQ in order to get a complete picture of the situation in the stock market. At the same time, we forget that these indices reflect mostly the performance of the American equities. That is, for assessing markets of specific countries and for taking advantage of the regional news, you need to consider the domestic indices. These indices comprise the best-capitalized companies of a particular country.

For example, the main barometer of the economic conditions in Germany is DAX30, which tracks the value of the 30 biggest companies trading on the Frankfurt Stock Exchange (FSE). Traders like this index for many reasons. One of them is, of course, Germany’s status of the leading economy in the Eurozone. That is, the index takes into account the situation in Europe as well as in Germany.

The Deutscher Aktien Index (DAX) represents 30 of the largest companies with the most liquidity. The success of these companies is hard to underestimate as they demonstrate the result of the “German Economic Miracle” – the economic rebirth of Germany after World War II. These companies are multinational and they represent a wide range of industries: from pharmaceutical to automobile and financial services. Have you heard about such companies as Adidas, BMW, Siemens, or Volkswagen? Well, they are just a small part of the top-30 DAX giants.

There are several rules required for a company to be featured in DAX.

The index is capitalization-weighted, which means that companies with the highest market cap affect the index the most. The calculation is based on a free-float method, which accounts for only the number of readily available shares into account. Thus, this method ignores the equities which can't be bought or sold.

Of course, it’s impossible to buy or sell actual indices. Instead, you can take advantage of their movements by trading CFD futures contracts. They are financial instruments provided by brokers, which give you a great opportunity to trade on the changes of indices with leverage. With FBS, you can trade DAX30 as well as other indices in both MetaTrader 4 and MetaTrader 5.

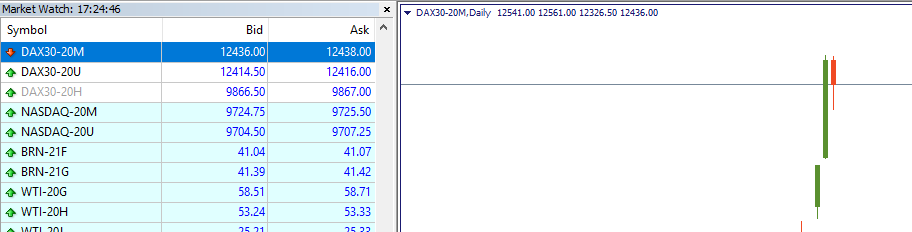

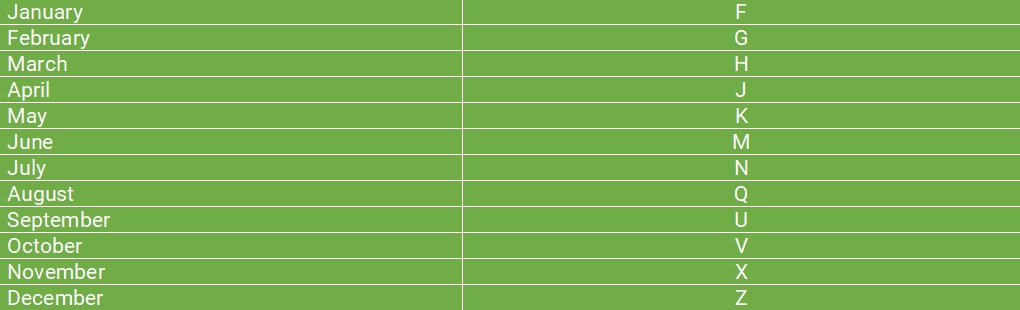

After you’ve installed the platform, look at its left side where all the assets are listed. This is the “Market Watch” window. Typically, you can’t see all trading instruments available right after the first launch of the platform. The right button click on the “Market Watch” window will reveal different options, one of them is “Show all”. After clicking this button, you will see CFD futures contracts with different letters and numbers. They inform you about the expiration date. For example, for trading contracts expiring in June 2020, you need to choose the DAX30-20M contract.

FBS allows you to trade DAX30 from 3:15 to 22:55 MT (MetaTrader) time.

Important notice: indices may form big gaps after the opening due to a large number of accumulated orders during the closed market. Also, volatility increases during the working hours of the Frankfurt Stock Exchange (9:00-21:00 MT time).

If you consider DAX30 as one of your potential investments, you need to know what drives it.

After the slump to the levels below 8,200 in March 2020, things are going pretty well for the German index. The positive risk sentiment across the markets due to the easing of the lockdown measures and stimulus measures by the German government resulted in a V-shape recovery of DAX30. Since the end of March, it has been moving up very sharply, finally establishing the ascending channel. The beginning of June has been extremely positive for DAX30, as it crossed the 12,000 level and nearly touched the resistance at $12,500. Good opportunities for buyers will occur after the breakout of that level. In that case, the index is set to rise as high as 13,000. The stochastic oscillator as well as RSI are overheated, so the short-term correction to the 12,000 level is possible. Sellers will activate after the breakout of the 11,900-12,000 levels, where their potential target will lie at 11,600.

Find out the analysis of DAX30 for the current period.

Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Trend strategies are good - they may give significantly good results in any time frame and with any assets. The main idea of the ADX Trend-Based strategy is to try to catch the beginning of the trend.

Counter-trend strategies are always the most dangerous but also the most profitable. We are pleased to present an excellent counter-trend strategy for working in any market and with any assets.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later