Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

2022-09-02 • Updated

Information is not investment advice

Technical analysis is the base instrument for a trader. Although not all traders rely on technical indicators, we highly recommend combining different methods to get a higher profit.

So today we want to tell you how technical analysis appeared.

A “father” of the technical analysis is Charles Dow, who created the world famous Dow Jones Industrial Average Index together with Edward Jones. Moreover, he was a head editor in the Wall Street Journal where he was publishing his Technical Analysis from 1900 to 1902 as a series of articles. Later in 1932 Robert Rhea collected his works and published The Dow Theory.

Although technical analysis has developed, it is based on the Dow theory.

Let’s look at the basic tenets.

I. The price (average) discounts everything.

The main idea is that any factor that affects a price - economic, political, psychological - is already taken into consideration by a market and included in prices.

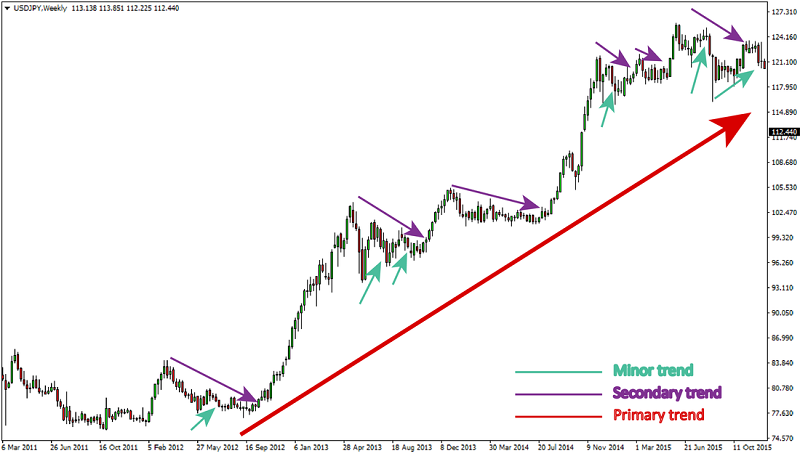

II. The market has three trends.

Firstly, it is worth to clarify what a “trend” is. Trend is the general direction of a market or a price. It can vary in length from short to intermediate, to long term.

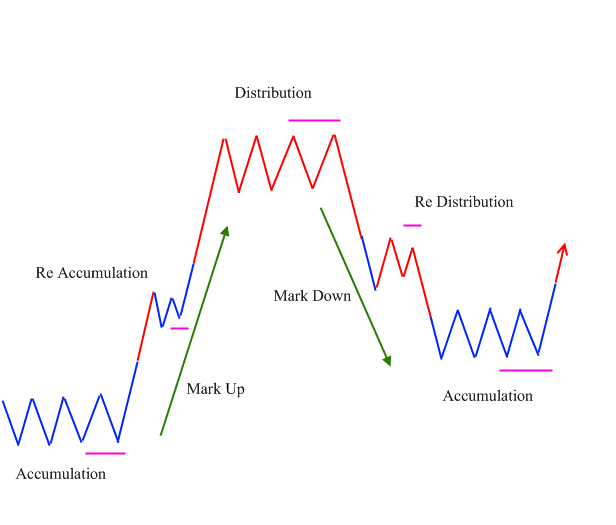

III. The market trends have three phases.

They are:

IV. Volume must confirm the trend.

Dow assumed that volume should increase in the direction of the main trend. So while upward trend, the volume should grow with an increase in price. Vice versa, in major downward trend, volume should expand together with falling prices.

V. A trend is assumed to be in effect until it gives a definite signal of reversal.

Dow believed that trend remains until the specific signal of reversal appears.

The logic is: an upward trend is created when every next pick and dip are higher than previous ones. A downtrend, on the contrary, has decreasing peaks and dips. So an obvious signal for the upcoming reversal is the formation of a lower minimum within the upward movement. In the case of the downward trend, the situation is reversed.

There are other reversal signals such as resistance/support, price patterns, trend lines and moving averages.

Making a conclusion, we can say that although nowadays technical analysis and markets have developed, the Dow theory had a huge influence on them. Also, the idea of emotions in the marketplace still remains a characteristic of market trends. Furthermore, its aspects were incorporated into other theories, such as Elliott Wave theory. So we can say that the Dow theory played an enormous role in the trading theory.

Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Trend strategies are good - they may give significantly good results in any time frame and with any assets. The main idea of the ADX Trend-Based strategy is to try to catch the beginning of the trend.

Counter-trend strategies are always the most dangerous but also the most profitable. We are pleased to present an excellent counter-trend strategy for working in any market and with any assets.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later