Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

2022-09-09 • Updated

Information is not investment advice

Sometimes a chart or a candlestick pattern may provide a decent entry signal if it is located at a certain level. A pin bar is one of the most reliable and famous candlestick patterns, and when traders see it on the chart, they expect the price to change its direction soon. If you understand how to recognize this pattern and use it in trading strategies, it will serve as an excellent instrument for making reasonable decisions.

A pin bar is a type of candlestick that signals the reversal of prices. It consists of a long shadow, a small shadow, and a body between them. Fun fact: this pattern’s name is short for Pinocchio, as it has a long wick similar to Pinocchio’s nose.

However, besides a long shadow, there are also special market conditions to call a candlestick pattern a pin bar.

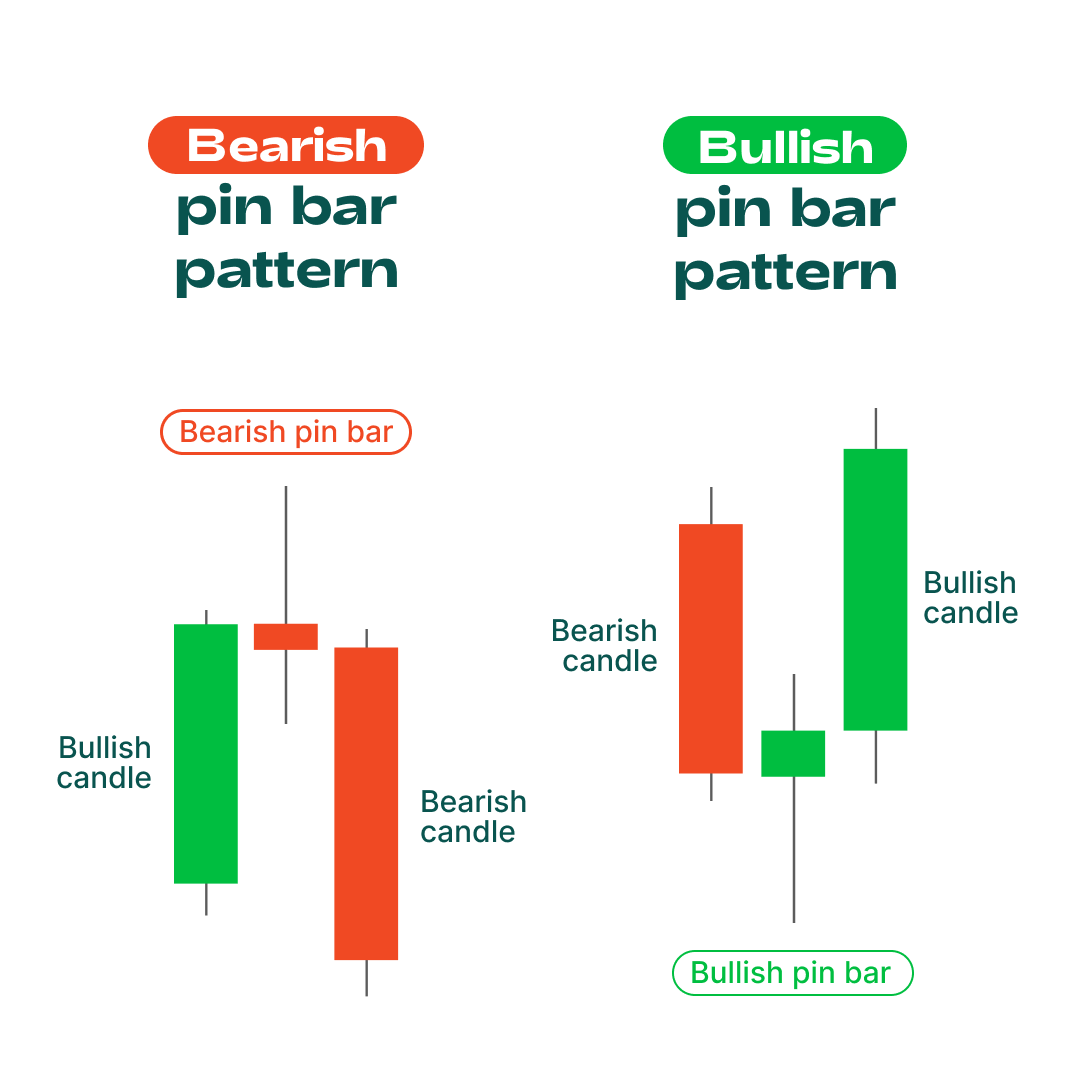

In the picture above, you can see two types of pin bars: bearish and bullish.

A bearish pin bar is formed after a solid movement upwards or at the end of an uptrend. Its body is entirely contained within the body of a previous bullish bar. It has a long upper tail that could be three or more times longer than the body size. It can be either bearish or bullish, but the bearish one is believed to provide a stronger signal. The pattern should be confirmed by the bearish candle that opens below the body of the pin bar. This signal shows that bulls tried to push the price higher, but their attempts got rejected.

A bullish pin bar appears at the end of the downward movement or downtrend. It opens within the body of the previous bearish candlestick and has a long lower tail and a small body. The pattern must be confirmed by the bullish candlestick that opens above the closing price of the pin bar.

Now, as you know the main element of the strategy, let’s move on to the setups.

Instruments: Major currency pairs with tight spreads and high liquidity available on the standard or the ECN accounts. Since we will talk about a scalping strategy, we must be attentive to this detail.

Timeframe: M15 or M30.

Technical setups: key levels, trend lines, pin bar formation.

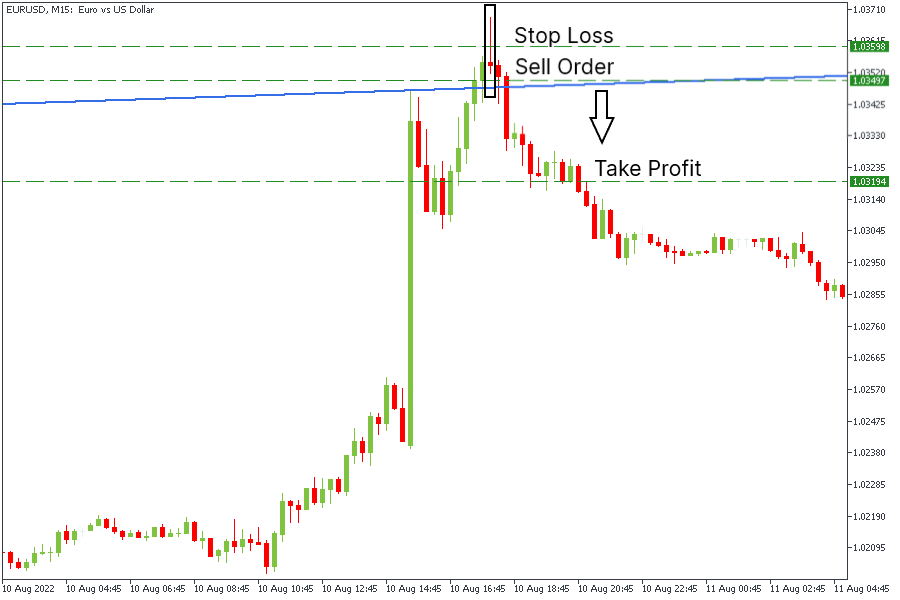

The chart above shows that EURUSD tried to spike higher after it reached a local trend line on the M15 chart. However, bulls could not hold the positions for a long time. As a result, the pin bar was formed. After confirming it, we placed a sell order below the low of the pin bar at 1.03497 and a Stop Loss above the recent resistance line at 1.03598. We put a Take Profit level at 1.03194. As a result, we earned 302 points.

On the same chart of EURUSD, we considered a buy scenario. After the price slid below the psychological level of 1.2000 and tested the area near the 1.1900 support zone, the pin bar pattern was formed. We opened a buy order above the high of the pin bar at 1.20058 and placed a Stop Loss at 1.19870. With a 1:3 risk-reward ratio, we set a Take Profit at 1.20619. With this strategy, we earned 560 points.

Watch the video below to delve more into the pin bar strategy.

Now you know a new scalping strategy for trading. To test the strategy first, you can try it out with a Demo account.

Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Trend strategies are good - they may give significantly good results in any time frame and with any assets. The main idea of the ADX Trend-Based strategy is to try to catch the beginning of the trend.

Counter-trend strategies are always the most dangerous but also the most profitable. We are pleased to present an excellent counter-trend strategy for working in any market and with any assets.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later