Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

2022-08-26 • Updated

Information is not investment advice

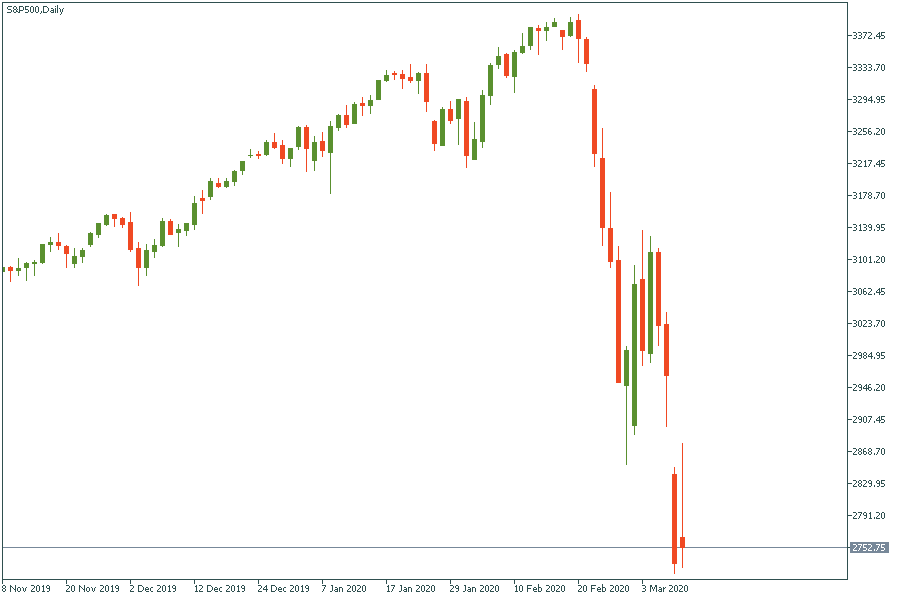

We can repeat on and on until it becomes clear to everyone. The current situation in the market does not mean the end of the world. On contrary, you should take a deep breath and calm down. Yes, the recent plunge looks dramatic, but the market managed to recover from even bigger falls. And let’s not forget that we do trading here. That is, we can both go short and long on the assets. In other words, we can both sell as well as buy.

Even when the market goes down, traders can get profit.

S&P 500 corrected to the downside. It’s a natural move: the market can’t go up all the time. When corrections happen, it’s necessary to do technical analysis and follow the news. Trading counter trend is also a strategy.

For now, let’s distract ourselves from the technical part of the question, and look at the problem at a personal level. Below, we bring you some pieces of advice which you should follow instead of retweeting fake news and panicking.

To keep your nerves stable during these shaky times, we recommend you to follow the advice of the World Health Organization. In its report, it advises people to stay away from watching/listening to upsetting media coverage and gather the information about the COVID-19 only from reliable sources (such as the WHO itself). Financial advisers are sure that the same rule may be applied when dealing with markets. That is, media coverage should not go from multiple sources at the same time. Try to avoid clickbait headlines and follow only trusted sites or newspapers. Most of the news sources try to present the information in the most intense manner as they care about viewers and subscribers. Simply put, they care only about their money. Carry about your money as well: filter the endless flow out.

The outbreak of coronavirus has already affected economic sectors, including industrial and touristic ones. That’s not a surprise: due to the quarantine measures people stay home and go out less. But we can say for sure that it won’t last forever. Sooner or later, the top researchers will invent a vaccine and the world will get better. For now, the market is only pricing in the further spread of the disease. It’s worth mentioning that China has already reported some of its cities returning to normal conditions soon.

Don’t even think about making investment decisions that you are going to regret soon. Have a plan. Analyze the risks. Don't buy without seeing a confirmation that the market conditions are oversold. Don't let your emotions ruin your capital. Apart from basic rules, the current situation provides you with a wonderful opportunity to buy many assets at a solid discount.

Clever traders use the times of high volatility to benefit from the big swings of the price. The most important thing is to stay calm and rational, analyze charts and adhere to the rules of risk management. Remember that safe-haven assets like the JPY, the CHF, and XAU (gold) tend to strengthen when people have doubts about the future.

The uncertainty attracts no one, and both analysts and governments may only contemplate what will happen in the future. For now, the best thing to do, apart from diversification of your money, is to make investments into your health. The basic rules you need to follow are washing your hands, not touching your face and taking care of yourself.

Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Trend strategies are good - they may give significantly good results in any time frame and with any assets. The main idea of the ADX Trend-Based strategy is to try to catch the beginning of the trend.

Counter-trend strategies are always the most dangerous but also the most profitable. We are pleased to present an excellent counter-trend strategy for working in any market and with any assets.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later