Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

2022-03-30 • Updated

Information is not investment advice

As you know, technical analysts rely on the past of the price to predict its future. Some traders try to prove this way of trading to be wrong and unprofitable. But we want to show you the Ross Hook, the pattern, that is proven to be profitable for 32 years already.

The Ross Hook (RH) trading strategy is a 100% price action strategy based on the retest of 1-2-3 pattern breakout. If you haven’t read about the 1-2-3 reversal pattern, be sure to check it out first!

Also, I must warn you, if you are new in trading, trying to find a ross hook pattern on your chart may be quite difficult at first. Why? Because you need to identify 1-2-3 pattern correctly, and after that wait for Hook to emerge. That can be confusing at first but I’m sure you can deal with it!

I don’t want you to get confused here because RH pattern is really useful, so I’ll explain everything as simply as I can. Look at the ordinary 1-2-3 pattern, and then at the Ross Hook.

Now, look closely at the RH.

Do you see it? The Ross Hook is just a smaller 1-2-3 pattern that is formed after the bigger one!

Now, everything you need to do is to find this “double 1-2-3 pattern” (that’s not an official name, but simplicity is the key).

To trade the RH pattern, we need to follow several steps:

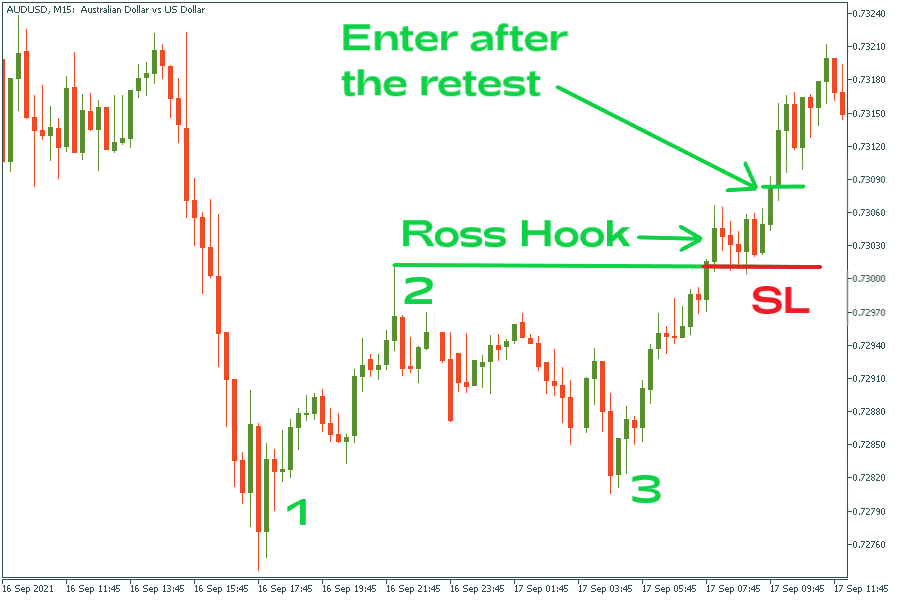

Look at the picture to get it right. We have waited for the 1-2-3 pattern to emerge, then we opened a trade after the retest and put stop loss (SL) below the retest level.

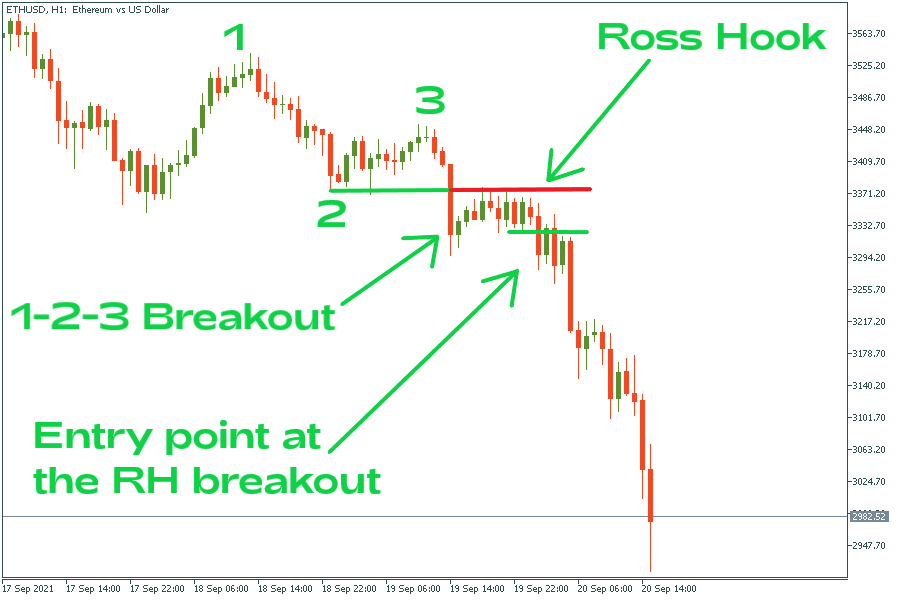

Now, let’s analyze a short trade:

We have identified a pattern, waited for Ross Hook to form, and entered after the retest.

You can measure your take profit differently:

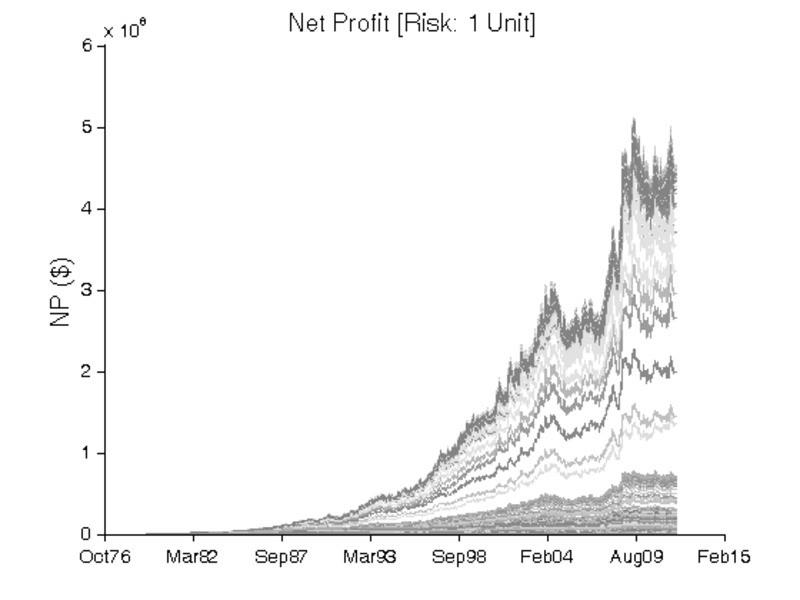

First of all, I want to prove the usability of the pattern. Analysts from Oxford University have tested this strategy on 42 different assets (including forex pairs, futures, and stocks) over 32 year period. Starting with $1 million and having a risk of 1% per trade the strategy has proven to be profitable. If you have traded with this strategy, you would have made more than $5 million net profit.

Let’s sum up:

Pros:

Cons:

Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Trend strategies are good - they may give significantly good results in any time frame and with any assets. The main idea of the ADX Trend-Based strategy is to try to catch the beginning of the trend.

Counter-trend strategies are always the most dangerous but also the most profitable. We are pleased to present an excellent counter-trend strategy for working in any market and with any assets.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later