Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

2019-11-11 • Updated

Information is not investment advice

It’s now time to step into the game. You learned how to open and close trading orders In Metatrader. Now you are ready to trade on the Forex market. But how to decide what to do – buy or sell? Is there an answer?

Luckily there is! You buy a currency if you think that its exchange rate will rise in the future and you sell it if you predict its price to decline.

To make such a forecast, you need to look at two things – a chart in Metatrader and an economic calendar. Below you will find a quick guide on how to analyze the Forex market and use this knowledge in your market performance.

Fundamental analysis doesn’t mean that you will have to do a hard and exhausting job. Fundamental simply means ‘economic’. If an economy is doing fine, all things equal, its currency will appreciate.

To make a forecast about the future value of the EUR versus the USD, we need to compare the economies of the eurozone and the United States: whichever is doing better, that currency will strengthen. For example, imagine that the European economy rose by 0.5%, while the US economy increased by 2% during the same period. The strength is clearly on the side of the US, so traders will expect the EUR to decline versus the USD. Therefore, they will sell EUR/USD.

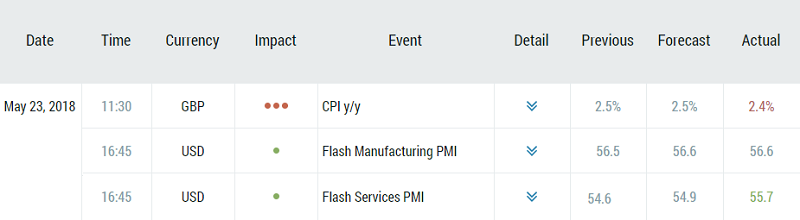

Every day the world’s most important countries release their economic statistics. You can find the calendar of these releases, the forecasts for them and the actual figures in the economic calendar. If you check it regularly, you will get a lot of great trade ideas.

Have a look! On May 23, 2018, a British indicator came out below the forecast, while the US figures were fine. As a result, GBP/USD declined during that day. Opening a sell trade would be a clever move in such conditions.

How to predict the exchange rate with technical analysis

Technical analysis is also simpler than it sounds. It doesn’t require the knowledge of math or mechanics. All you need to do is to draw lines and watch the indicators – the same way that you look at your car’s speed gauge.

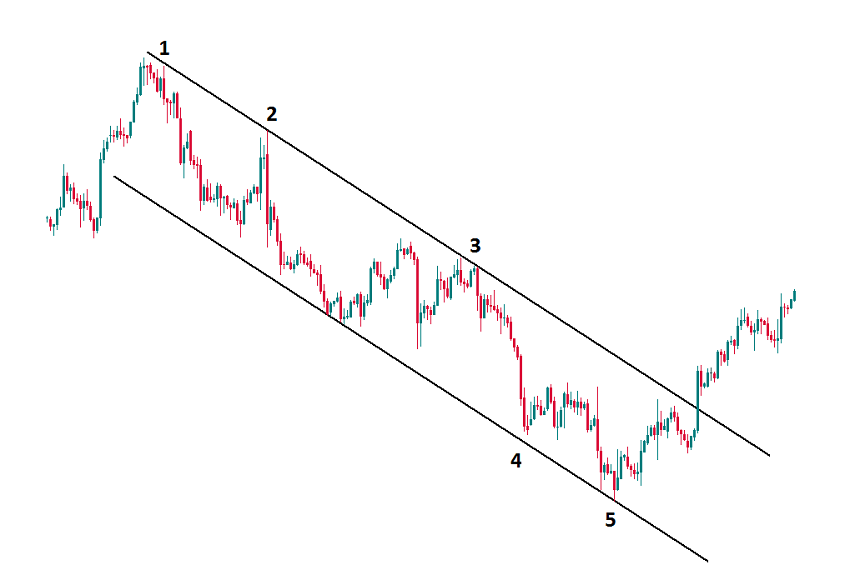

The main principle is that you buy at low levels and sell at high levels. Moreover, a trend is your friend. A trend is when a chart moves in one direction – up or down – for a considerable time. Traders buy during an uptrend and sell during a downtrend. An uptrend is a situation when the price constantly sets higher lows and higher highs. A downtrend is when the price forms a series of lower highs and lows. Below you can see an example of a downtrend.

Notice that traders usually connect chart highs and lows by the so-called trendlines as we did at this picture. You can tell that it’s a downtrend when you connect two highs with a descending line (points 1 and 2). Technical analysis allows you to expect that the next time the price comes to this line (point 3), it will reverse down and you will be able to sell. You will be able to close your trade at points 4 or 5.

This is just one of the techniques you can use. To see more options for the market actions, check our tutorials.

The logical question now is when to use fundamental and when to use technical analysis. Some traders are trading only on economic news, while others feel that they need only the price chart for success. Both types of analysis have their advantages. There’s also an opportunity to take the best out of both methods: choose to buy or sell with the help of economic analysis and then determine the optimal level to enter your trade with MetaTrader technical tools. Combining the methods can help you to perform better on the market!

Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Trend strategies are good - they may give significantly good results in any time frame and with any assets. The main idea of the ADX Trend-Based strategy is to try to catch the beginning of the trend.

Counter-trend strategies are always the most dangerous but also the most profitable. We are pleased to present an excellent counter-trend strategy for working in any market and with any assets.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later