Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

2021-07-13 • Updated

Information is not investment advice

If you don’t know where to invest your money, the oil market is a great option for you. Oil attracts the attention of investors all around the world. In this article, we will tell you why it is like that and how to boost your income on the oil market.

Considering investments into the oil market, you will see three magical letters CFD.

CFD is an abbreviation of the contract for difference. We know that oil is counted in barrels. But you should understand that when going to the oil market, you won’t get the real oil in a container. But what will you get? The idea is to predict the price of the asset and win on the right forecast. As a result, when you come to the market, you earn money but not buy goods.

How does the price of the CFD form? The price matches with the prices of the so-named futures on the Intercontinental and New York Mercantile Exchanges.

Did you know that you won’t find just a single chart of the oil market? There are two major oil benchmarks you can invest in. They are Brent and WTI.

Brent is a standard for European and Asian markets. This benchmark consists of more than 15 oil grades produced on the Norwegian and Scottish shelf blocks of Brent, Ekofisk, Oseberg, and Forties.

WTI is a mark for the Western Hemisphere. It is produced at US oil fields, primarily in Texas, Louisiana, and North Dakota.

There are two differences between these benchmarks. The first one is a location, the second one is a chemical formula. That’s why they differ in price. WTI is cheaper than Brent. However, if you look at their charts, you won’t see significant differences in their moves.

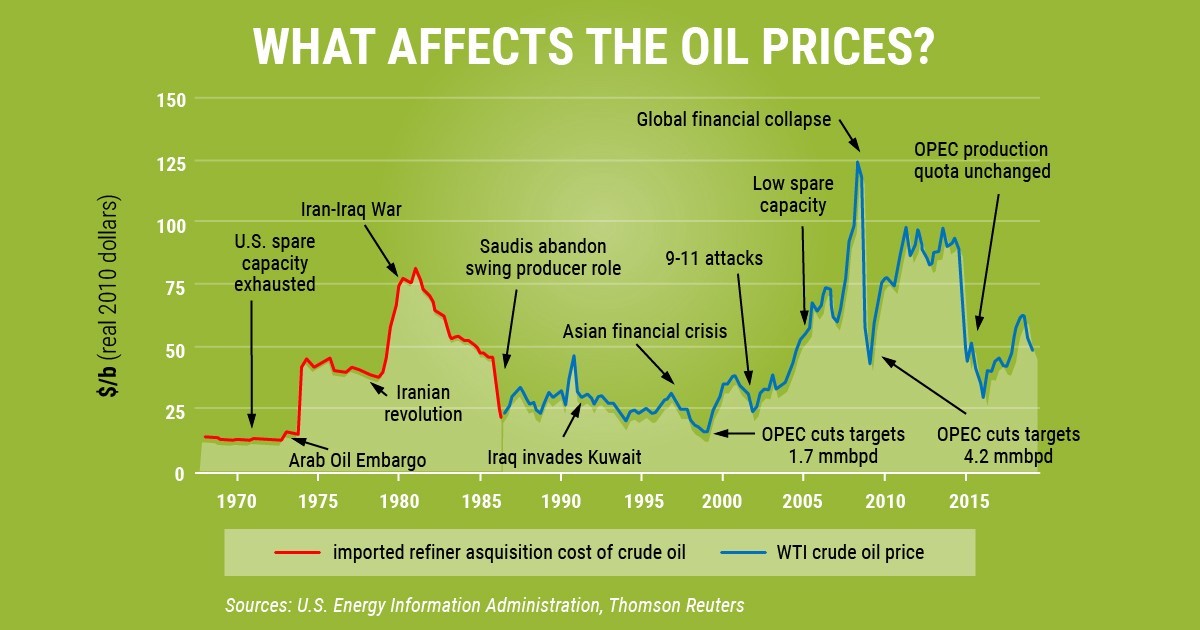

Although there are differences between the oil benchmarks, there is no difference in factors that affect them.

The factor that affects every market is demand and supply. Just remember a simple rule: when the supply declines –price goes up, when the supply increases – price goes down. Vice versa, when the demand declines – price goes down, when the demand increases – price goes up.

Why demand/supply may change? A decline in the demand is caused by the weakness of economies of the biggest oil importers.

A decline in the supply is caused by conflicts, sanctions, and problems with oil drilling rigs. A rise of the supply always depends on the decision of the oil exporters to increase the production.

Demand and supply are the fundamental factors and all other drivers are based on them.

Uncertainties, conflicts, sanctions related to the biggest oil producers always affect the oil prices positively. The idea is clear: conflicts lead to the cut of the supply, a decline in the supply boosts oil prices. All you need to do is to follow the news to be up to date.

The market sentiment is an ensuing factor from political events. A feature of the oil market is that prices change based on the news not on facts. For example, as soon as there is the news on possible problems with a future supply, prices rise immediately. The market even doesn’t need a data confirmation on the decline in the supply.

As the oil market is affected by the market sentiment, oil producers use it in their favor. You should always remember this factor while investing in oil. Following the market sentiment is the best strategy for the oil investor.

News. As I mentioned above the price depends on the market sentiment. To catch this sentiment, you need to read the news and follow the comments of the US, OPEC and its non-OPEC allies such as Russia.

Reports. To learn more about the demand/supply issue, you should follow reports of the US Energy Information Administration. Here you should take into consideration crude oil inventories data that is published every week (check the economic calendar) and different kinds of forecast on the demand and supply that you can find on its website. Of course, you also remember about the OPEC. The organization delivers reports as well.

Volatility is the main factor that attracts the attention of investors. With big daily moves, the market gives great opportunities to boost your income. However, at the same time, you should remember that the high volatility may lead to losses. To avoid negative results, you should remember about the risk management. What is more, the market is highly interesting for gamblers. You will never be bored investing in the oil market. News, reports come daily and the price jumps up and down. If you are inspired by games, investing in the oil market is definitely for you.

Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Trend strategies are good - they may give significantly good results in any time frame and with any assets. The main idea of the ADX Trend-Based strategy is to try to catch the beginning of the trend.

Counter-trend strategies are always the most dangerous but also the most profitable. We are pleased to present an excellent counter-trend strategy for working in any market and with any assets.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later