Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

2020-06-18 • Updated

Information is not investment advice

Economic calendar is one of the basics for fundamental Forex analysis. The dynamics of a currency pair depends on the economic news published daily. Each currency is affected by different events. You should know the most important ones to be ready for any changes on the market.

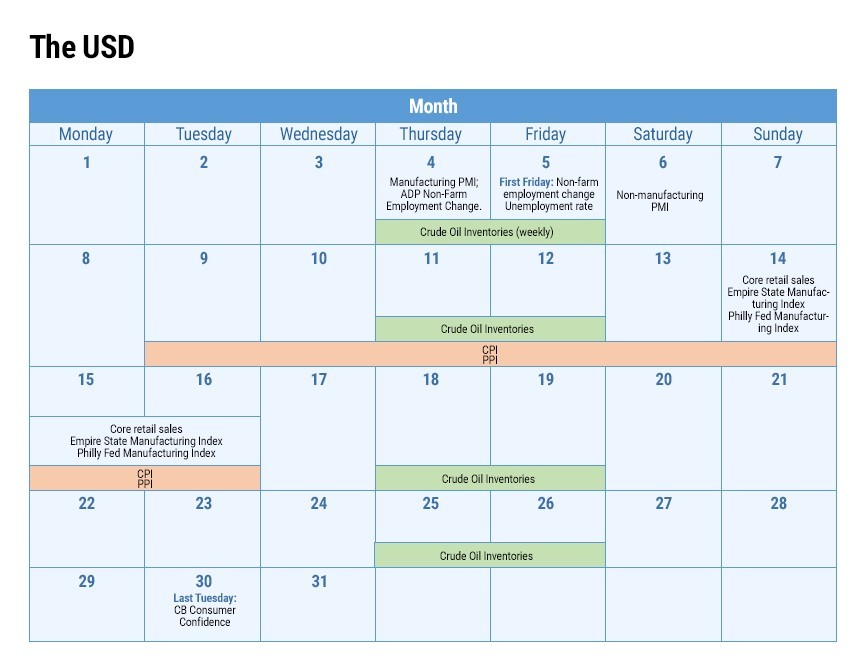

Economic calendar for the US dollar (USD)

The month on the currency market for the US begins with two leading indicators of America’s economic health: manufacturing and non-manufacturing PMI from the Institute of Supply Management (ISM), which are released on the 4th and 6th of the current month.

The first week is also important as there is a non-farm employment change (NFP). The official NFP, unemployment rate and average earnings are announced on the first Friday of a month. Take a note, that the level of unemployment rate lower than in the forecast is good for currency.

Around the middle of a month it’s necessary to keep an eye on the indicators of inflation – producer price index (PPI) and consumer price index (CPI). Around the same time the report for retail sales and core retail sales is released. The difference between the two indicators is that core retail sales excludes the volatile automobile sales. The better retail sales, the higher the economic growth.

The middle of the month is important as there are two big announcements of manufacturing indexes: Empire State index from the Federal Reserve Bank (FRB) of New York and Philly Fed index from FRB of Philadelphia.

The last Tuesday of the month is the time for the release of the consumer confidence level. High indicator means that consumers spend a lot thus encouraging production and economic growth.

The changes in crude oil inventories are published every week and influences the USD volatility as well.

The GDP per quarter is reported in three forms: advance (the earliest), preliminary and final. There is a one-month difference between each of them. The earliest release is the most important for the currency. The advance reading for the previous quarter is published up to 30 days after it ends.

Below you will find some non-monthly activities, which influence the currency’s level heavily.

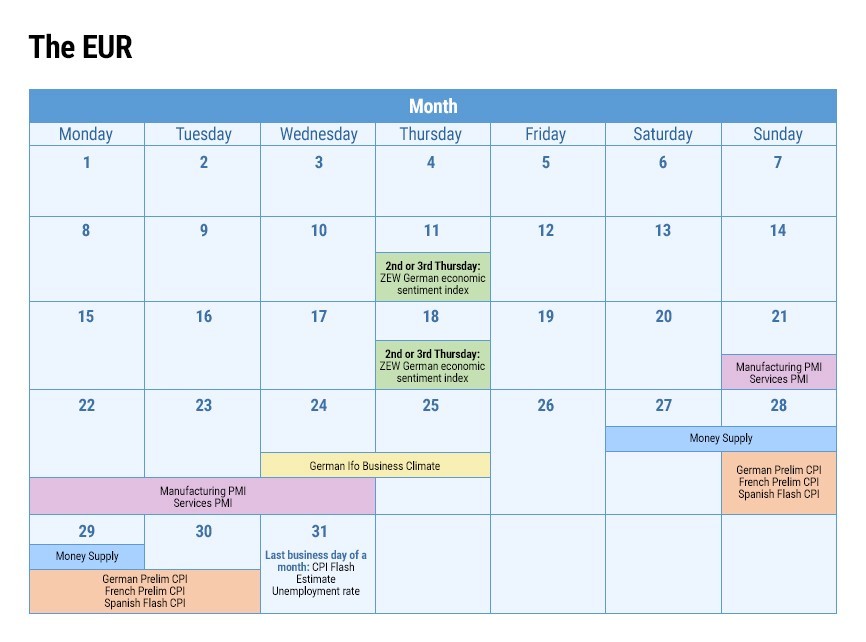

Economic calendar for the euro (EUR)

On the second or the third Tuesday of the month the ZEW economic sentiment index for the Eurozone and Germany is published.

Local events in the European countries can also impact the single currency. The biggest role here belongs to Germany, as it has the strongest and the largest economy in the region. The market pays attention to speeches of the Bundesbank president (German central bank). They are scheduled on the official website of the central bank.

The third week of the month is important for two preliminary indexes: manufacturing PMI and services PMI. These indexes are also announced for the German and French economies. The composite German index for business climate is made public around the same period of time.

The end of the month contains the figures concerning preliminary CPI for Germany, Spain, France, Italy and the Eurozone as a whole. The level of money supply in the Eurozone is published 28 days after the end of the month. The last working day of the month is when the region’s unemployment rate comes out.

European GDP growth is released quarterly. There are three types of the release: preliminary flash, flash, and revised. The most important is preliminary flash, which is published the earliest, that is around 30 days after the end of the quarter.

The non-regular events, which may affect the currency are:

3 times a year the European Union also publishes fresh forecasts for the economy of the region.

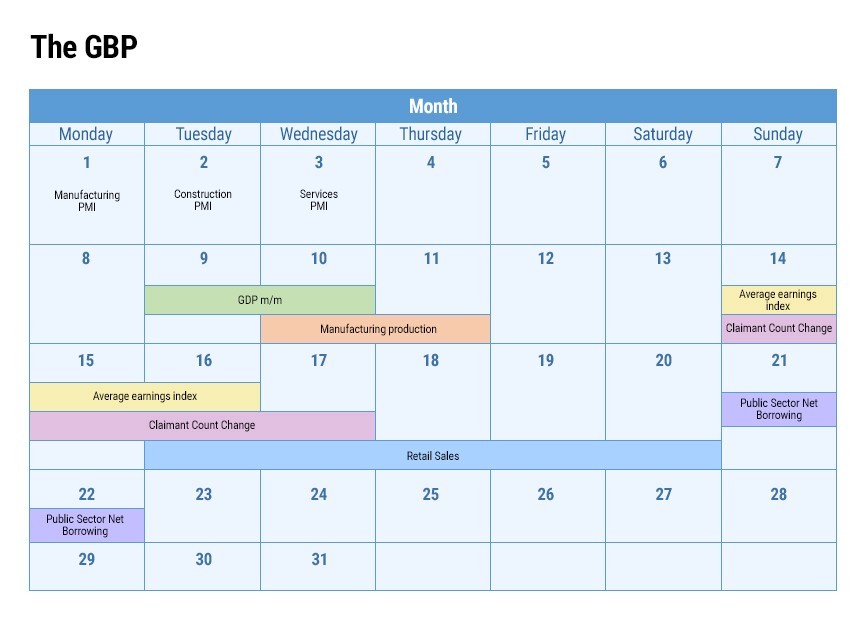

Economic calendar for the British pound (GBP)

The first three business days in Britain are the days when manufacturing, construction, and services PMI are announced. The indexes are based on surveys of hundreds of purchasing managers and represent the promptest data about the condition of British economy.

Preliminary business investment index, GDP growth and manufacturing production are released on the 10-11 days of a month (40 days after a month ends).

It takes a little bit longer (around 45 days) for the National statistics office to release an average earnings index and an unemployment rate.

Consumer, producer and retail price indexes (CPI, PPI and RPI) are published around 14-16 days after the end of a month. The claimant count change, which shows how many people asked for unemployment benefits during the previous month, is also published during this period.

The change of retail sales’ total value is released around 20 days after the end of the month. After that, it is necessary to keep an eye on the volume of public sector net borrowing, as it’s announced around 22-23 days after the end of the month.

The announcement of the Official bank rate is made monthly after the vote. The vote is conducted by the 9 members of the Monetary Policy Committee (MPC). They decide whether the Bank of England (BOE) should increase, decrease or hold interest rates unchanged. Alongside with the rate, the monetary policy summary comes out. At the same time, BOE publishes the amount of asset purchase facility.

The amount of money, showing the difference between imported and exported goods, services, its net earnings on cross-border investments, and its net transfer payments (current account) releases quarterly, around 85 days after the end of the month. Once in a quarter, the Bank of England (BOE) publishes an inflation report, which is being discussed in the British Parliament afterwards.

The preliminary GDP per quarter are released about 40 days after the end of the quarter. Credit condition survey comes out at the end of each quarter.

The main events without fixed schedule for the GBP are:

The BOE financial stability report is published twice a year.

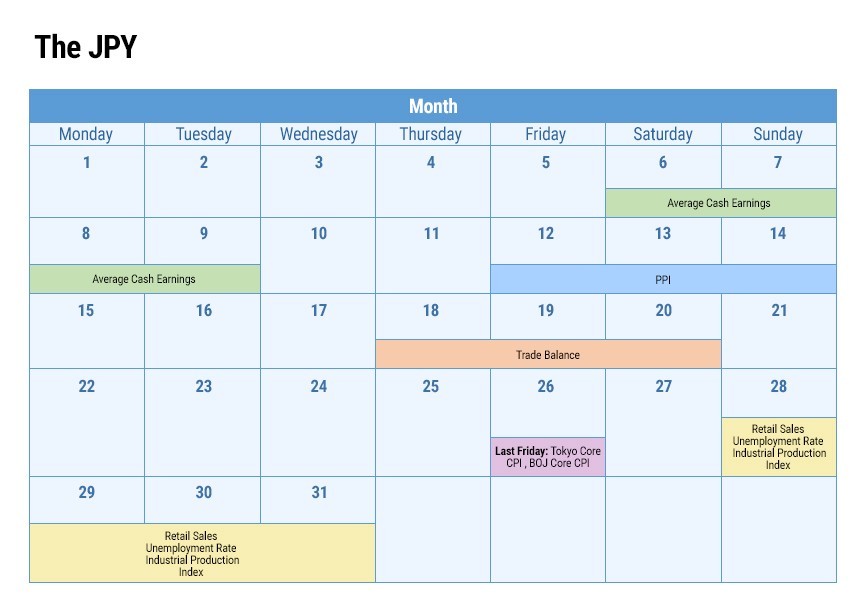

Economic calendar for the Japanese yen (JPY)

The beginning or the middle of a month is the release of the average cash earnings indicator (35 days after the end of the month). It shows the change in the total value of employment income collected by workers. The trade balance is made public around 20 days after the month ends.

Usually, the third Friday of the month is the time when inflation data is published (national Core CPI). This is the key indicator that affects the BOJ policy. PPI, in its turn, releases on 11-12 days in the middle of the month. Take a note, that Tokyo core CPI reflects the level of inflation for the current month, while national core CPI shows the data for the previous month. Moreover, we can expect releases for retail sales, unemployment rate and industrial production index at the end of the month (27-30 days after the previous month finishes).

The schedule for the Bank of Japan (BOJ) meetings is available on the official site of the regulator. It’s planned 8 times per year and is usually followed by the BOJ press conference and the official rate announcement.

The non-regular events also include speeches of the BOJ governor.

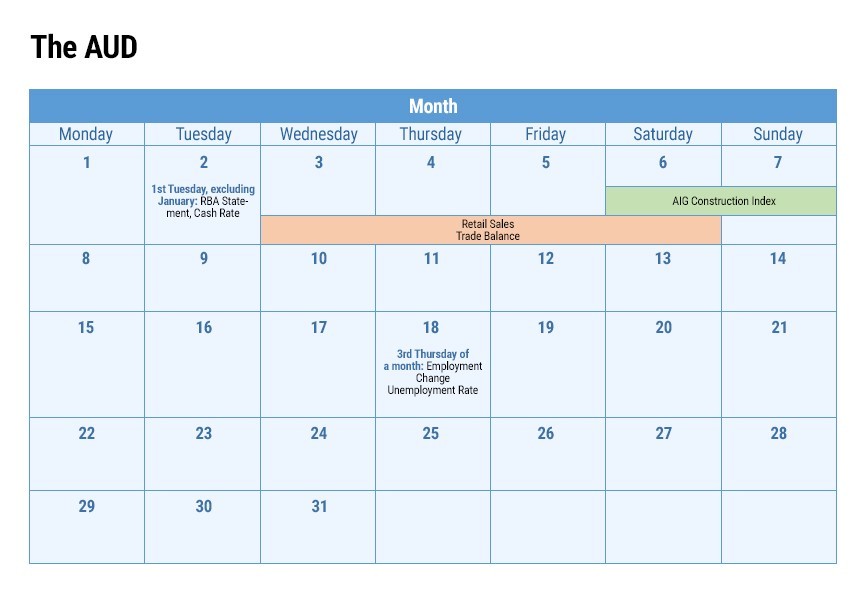

Economic calendar for the Australian dollar (AUD)

The first Tuesday of the month, excluding January, is the time for the statement of the Reserve Bank of Australia (RBA). The RBA announces the level of Cash rate (Australian benchmark interest rate) and discusses the main challenges for the economy. Two weeks afterwards the central bank releases monetary policy meeting minutes containing the detailed record of its meeting.

The information concerning unemployment rate and employment change is published around 14-16 days after the month ends. This is also the period when National Australia Bank (NAB) publishes its indicator of business confidence.

Around the 5th day of the month (after 35 days the month ends) the retail sales index, trade balance and AIG сonstruction index are released.

Keep an eye on the level of inflation, which is released on the 25th day after the end of the quarter and on the private capital expenditure on the about 55th day after the end of the quarter.

The main non-monthly and non-quarterly events are:

Economic calendar for the New Zealand dollar (NZD)

Most of the important data for New Zealand are reported quarterly. The first or the second Tuesday after a quarter ends is the time for NZIER Business confidence to be announced. 18 day after that the consumer inflation rate (CPI) is released. 15th till 16th days after the end of a quarter is when retail sales reading is published. Inflation expectations are released 50-55 days before a quarter ends.

Among the important indicators published per month are manufacturing index from Business NZ (releases about 13-16 days after the end of a month), trade balance (around 26-30 days after a month ends) and ANZ Business confidence index (around the end of the month, excluding January). Twice a month the information concerning change in the average price of milk products sold at auctions is published (GDT Price index).

The meetings of the Reserve bank of New Zealand (RBNZ) are conducted not every month, but only 8 times a year. The decision regarding the interest rate is followed by the RBNZ press conference and the speech of its governor. The minutes (protocols) of this meeting are not published.

Twice a year (in November and May) there is a release of the Financial stability report, which includes the bank’s forecasts for the main economic indicators.

Economic calendar for the Chinese yuan (CNY)

(The data influences the AUD and the NZD as Australia and New Zealand have close trade connections with China)

The official trade balance of the country is published on the 8-10 days of a month. Around the same period the data regarding consumer inflation comes out. Around the 14-16 days of the month, excluding February, the industrial production and fixed asset investment levels are released.

The last day of a month is the time for the announcements of manufacturing and non-manufacturing PMI. The 3rd business day of a month is the time when preliminary PMI from Caixin Services is published. This is more informal and, as thought by others, more exact assessment of the conditions of production sector. That is why many traders are skeptical about the official index.

Probably the most anticipated indicator by the currency market is Chinese GDP growth. It is published about 18 days after the quarter ends.

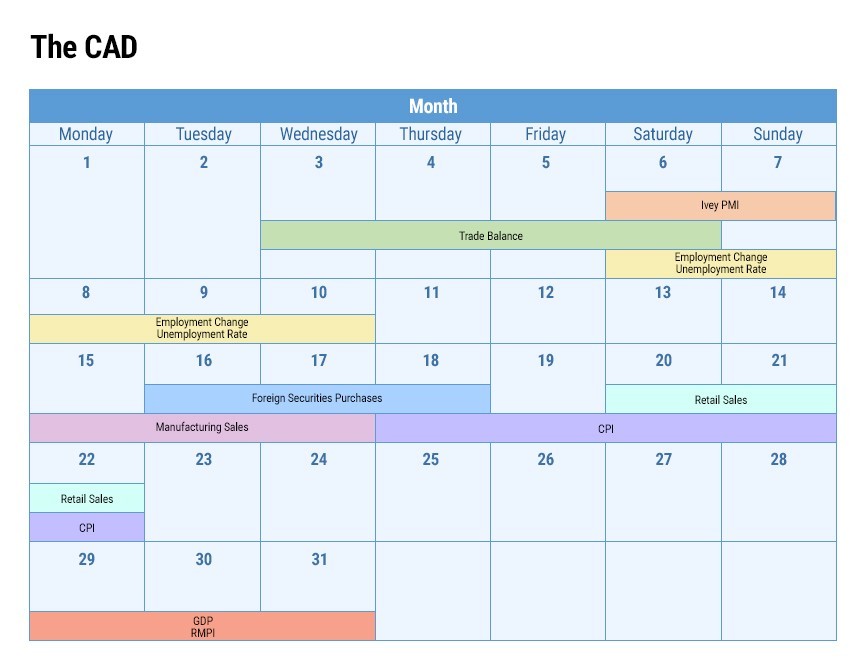

Economic calendar for the Canadian dollar (CAD)

A month in Canada begins with the publication of the country’s trade balance (about 35 days after a month ends) and the indicators of employment (about 8 days after a month ends). In addition, it is recommended to follow purchasing managers’ index by Richard Ivey School of Business, which reflects the current conditions of the economy.

The middle of the month is important for the level of securities’ purchases by foreigners (approx. 50 days after a month ends), manufacturing sales (approx. 45 days after a month ends and consumer inflation (approx. 20 days after a month ends).

End of the month is the time for announcement of monthly GDP growth (about 60 days after the end of the previous month) and retail sales (approx. 50 days after the month ends).

Some of the quarterly releases include labor productivity (released about 65 days after the quarter ends), business outlook surveys and monetary policy reports by the Bank of Canada (BOC).

BOC rate statement is scheduled 8 times per year. It contains the decision on the key interest rate and the central bank’s economic outlook.

Some economic events can affect any currency as they may contain outstanding news, decisions, and discussions. Traders are recommended to follow these events with great attention.

Some of them are:

Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Trend strategies are good - they may give significantly good results in any time frame and with any assets. The main idea of the ADX Trend-Based strategy is to try to catch the beginning of the trend.

Counter-trend strategies are always the most dangerous but also the most profitable. We are pleased to present an excellent counter-trend strategy for working in any market and with any assets.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later