Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

2022-08-26 • Updated

Information is not investment advice

Scalping may look like a scary word to a regular mind. Traders, in their turn, find a lot of hidden opportunities behind its meaning. In trading, you don’t have to do anything with a human scalp. Instead, you make “slices” of pips on the small changes in the price. In literature, scalping is defined as a short-term trading style, which helps to succeed in the market from small price changes as many times as possible within a day. Experts identify scalping as a quite risky trading approach, which requires keeping an eye on the charts for the whole day. Therefore, a scalper needs to have steel nerves and follow the market carefully. It's important to know the tips on risk management and place entry and stop loss levels in the right way. A self-confident newbie in scalping may turn into a loser if he does not have an algorithm for entering the market. Today, we will help you with this struggle and share with you some effective strategies for scalping.

You are a scalper if you:

If you answered "yes" to more than two points, then you are a true scalper! As for those who answered "yes" just once – you are probably considering this approach for now. Nevertheless, the strategies we are going to explain below are easy and understandable. We believe anyone of you may try them out and see how effective they are.

Key elements:

Algorithm of a “buy” scenario

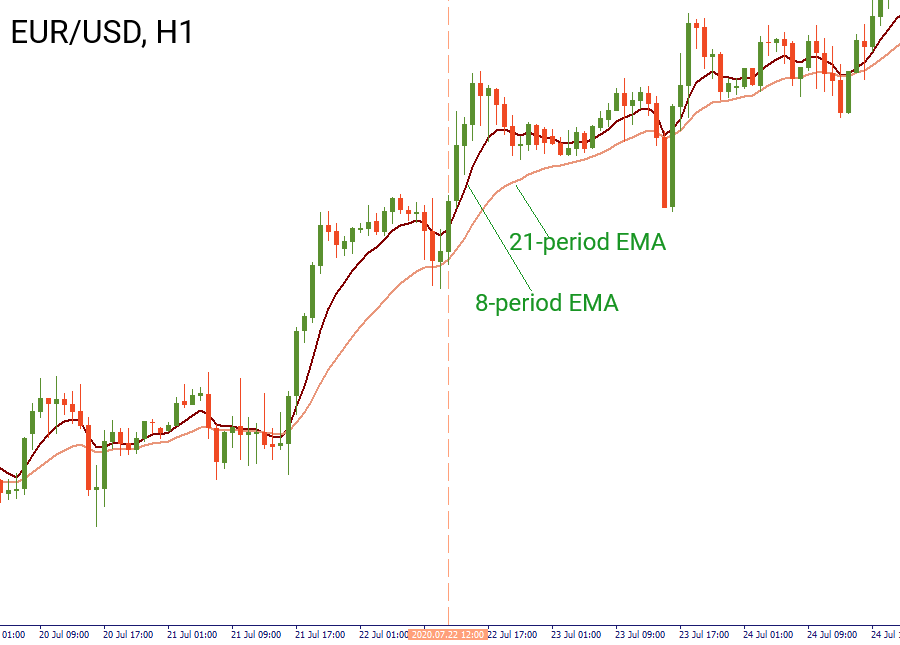

Let’s look at the example. We will be looking at the chart of EUR/USD on July 22. On H1 we can see that the price is moving within an uptrend. The 8-period exponential moving average was moving above the 21-period one.

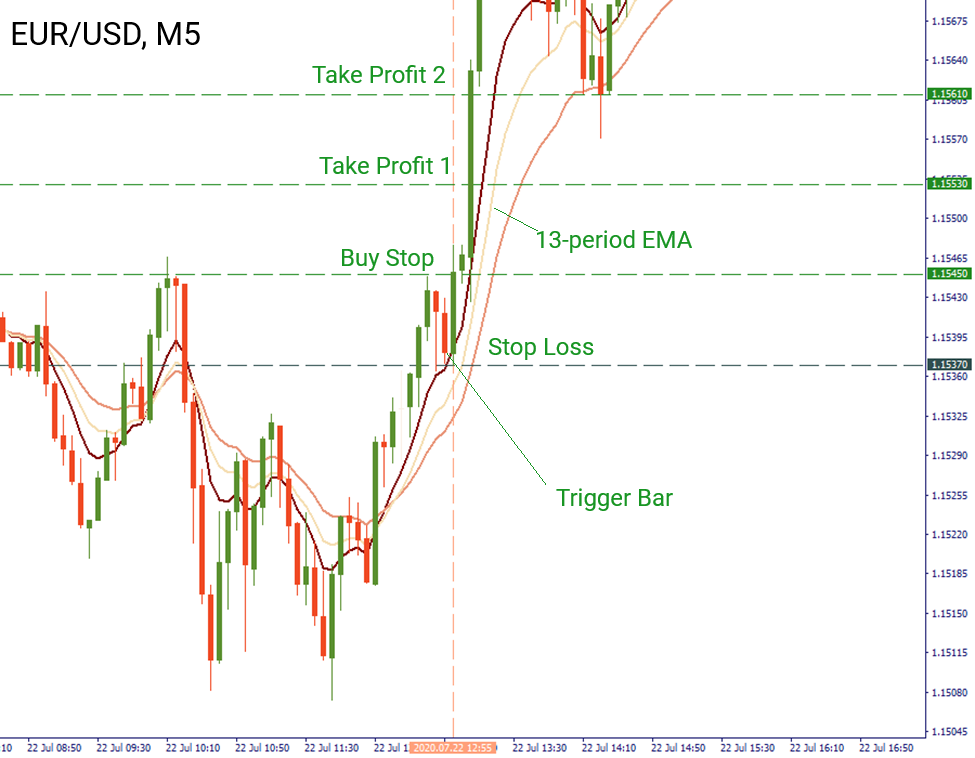

We switched to M5 and waited for the candlestick to test the 8-period EMA by its lower shadow. The trigger candlestick occurred at 12:55 on July 22. We counted 5 candlesticks back from the trigger one and chose the one with the highest high. We opened a buy position at 1.1545. We placed a “buy stop” order at the high of the highest candlestick. The stop loss is placed at the low of the trigger bar at 1.1537, while take profit levels go to:

1.1545-1.1537=0.0008

TP1 = 1.1545+0.0008=1.1553

TP2 = 1.1553+0.0008=1.1561

Algorithm of a “Sell” scenario

On the other hand, let’s look at the steps for opening a short position.

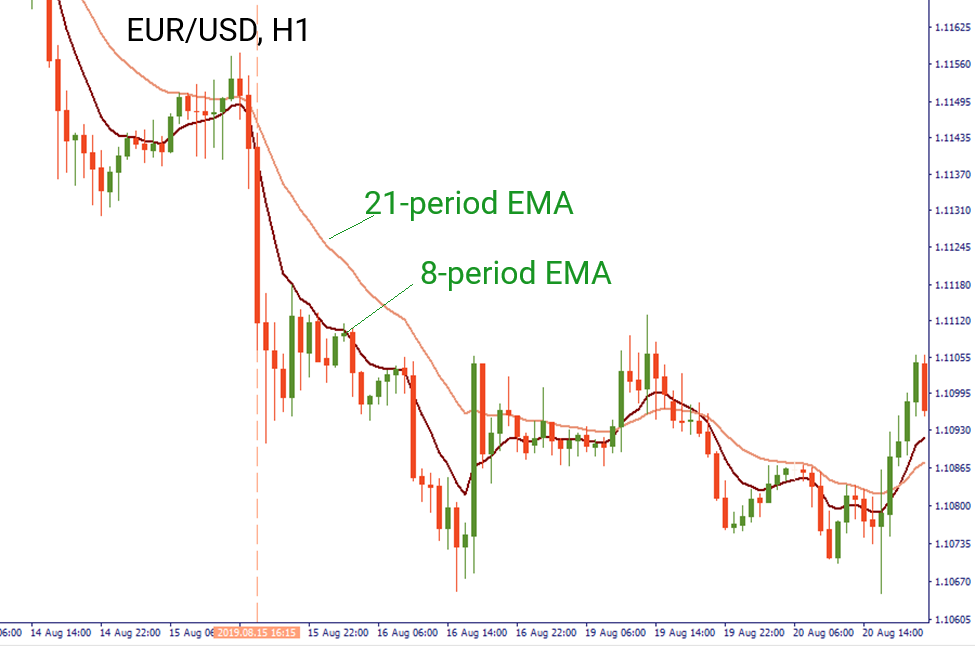

On the H1 chart of EUR/USD, we noticed that the pair was moving within a downtrend. The 8-period EMA was moving below the 21-period EMA.

We opened the M5 chart and waited for the trigger bar. It appeared at 16:25 on August 15. We counted 5 candlesticks back from the trigger one and chose the one with the lowest low. This is our sell order which goes to 1.1134. Stop loss is placed at the high of the trigger bar at 1.1144. The take profit levels are calculated as follows:

1.1144-1.1134=0.0010

TP1 = 1.1134-0.0010=1.1124

TP2 = 1.1124-0.0010=1.1114

The second strategy is for those who love trading gold and want to learn how to scalp the precious metal. Keep in mind that it requires your full attention to the chart.

Key elements:

Algorithm of a “buy” scenario

You need to buy when both slow and fast oscillators break above -30. Close your position when the fast oscillator (9) leaves the zone. Stop loss goes several pips below the support level nearby.

Algorithm of a “sell” scenario

When you consider opening a short position, you need to sell when both slow and fast oscillators break below -70 and close when fast leaves the zone. Stop loss is placed several pips above the resistance level nearby.

Below you can see an example of long order. We opened a position when both slow and fast oscillators were above the -30 level at 1 946.12 and closed at 1 948.67 when the fast oscillator crossed the -30 level to the downside. The 1 945 level marks our stop loss.

Now you know what strategies you can use for scalping. We highly recommend you to try them out! At the same time, remember about risk management and don’t be greedy. This simple advice may save you from unsuccessful trades.

Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Trend strategies are good - they may give significantly good results in any time frame and with any assets. The main idea of the ADX Trend-Based strategy is to try to catch the beginning of the trend.

Counter-trend strategies are always the most dangerous but also the most profitable. We are pleased to present an excellent counter-trend strategy for working in any market and with any assets.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later