Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

2019-11-11 • Updated

Information is not investment advice

It is not a secret that it is necessary to place stop losses when you trade. It's worth mentioning that it is one of the main tools of risk management. However, it is also important to understand how to place stop orders correctly. If you don’t follow the simple rules of risk management, you will lose money very fast. Let’s find out the biggest mistakes you can make while placing stop losses and learn how to avoid them.

What? Don’t you know about stop loss, this precious guardian angel of every trader? Then you should definitely read our Forex guidebook!

1st mistake

Place a very tight stop loss

As you know, the price is a tricky thing, which may fluctuate before moving in the desired direction. If you place very tight stop losses (very close to the entry point), you may be affected by sudden volatility in the market, which could cancel your stop loss. As a result, you would miss a good opportunity to enter the market.

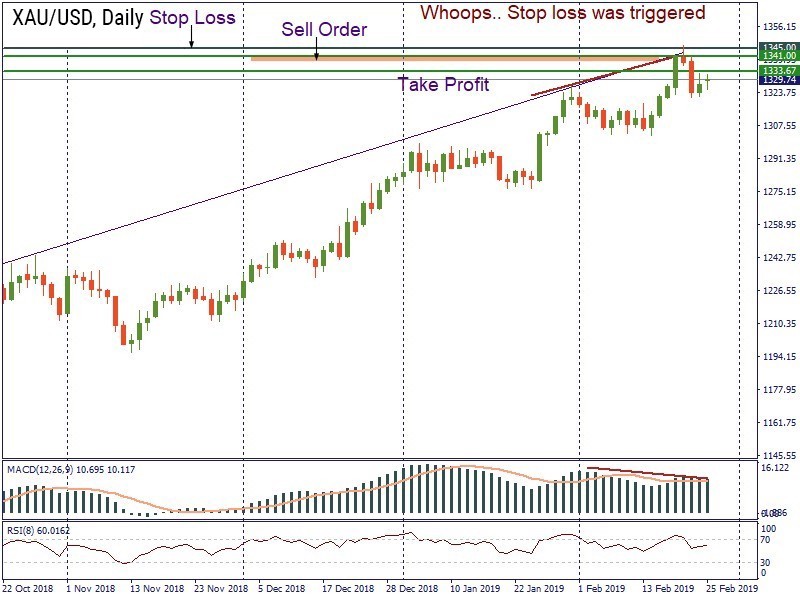

Imagine that you were trading gold. You noticed that RSI left the overbought zone and MACD formed a bearish divergence with the price. You decided to open a short position at $1,341 and placed a very tight stop loss at $1,345 (based on the previous consolidation around this level). The price indeed went down and made you happy. Suddenly, bulls came into play and tried to push the price higher. They did not succeed, but that unexpected attack canceled your stop loss. As a result, you missed a good opportunity to enter the market.

That is why it is very important to take volatility into account.

2nd mistake

Placing too wide stops

Another common trader’s mistake is connected with too wide stop losses. If you set stops too far, you increase the number of pips your position needs to move in your favor to make the trade worth the risk.

To avoid making this mistake, always consider your risk-reward ratio. The risk-reward ratio determines your potential reward for every dollar you risk.

For example, if you have a risk-reward ratio of 1:3, it means you’re risking $1 to potentially make $3. With a good risk to reward ratio your stop losses and take profits will be connected with your position size and you would be more likely to end up with profits.

On the chart below, RSI rose to the upper border of the oversold zone. You decided that the reversal was coming and opened a long position at 0.7020. You were so greedy and confident in the market and your forecast that your placed your take profit at 0.7124 and stop loss at 0.6973. As a result, the next candlestick went down and you experienced losses.

3rd mistake

Place stops exactly at support or resistance

Placing stop orders exactly at the support/ resistance levels may be dangerous, as the price may return to these levels after the breakout and trigger your stop before heading your direction.

On the EUR/USD chart, the break of the support at 1.2214 was inevitable. Finally, the negative news for the EUR on April 23 resulted in a breakout. You placed stop loss at the support level right after the breakout. As the price decided to move back to the 1.2214 level, your stop was broken. If you are not fast enough, you will miss an opportunity for entry. It’s also worth mentioning that in the example below you placed your sell order exactly at the support level. As a result, the price bounced from it. You should be careful and do not open your order exactly at support/resistance levels.

4th mistake

Not determining your stop placements in advance

It’s quite obvious, but sometimes traders do forget about it. You should know about your exact entry point, profit targets and stop losses before you open a trade. This strategic step removes any emotions from the decision because you haven't risked any of your capital yet. You simply look at the chart and analyze the further direction of the price.

5 mistake

Moving your stop to break even or marginal profits ASAP

Sometimes, if you see that the market moves in the desirable direction, you get too excited and move your stop loss without proper analysis of the situation. It may result in unexpected losses.

If you make an entry, you should be able to tell about the stop loss level: "If the price went above/below this level, then my reasons for entry would be disproved by the market, thus, my current analysis would be wrong." You need to stick to your original plan. It helps to overcome the emotional trading.

Move your stop-loss only if the market proves you need to do that. For example, if the certain support is broken and indicators signal further fall, it may be a good decision to move your stop a little bit lower. Vice versa, if bulls managed to break the key resistance and other factors show an uptrend, you may move your stop loss higher.

Conclusion

Placing stop losses is very important for every trader. It is a necessary part of every trading strategy. However, this order may play tricks on you, if it is placed incorrectly. Avoidance of the mistakes mentioned in the article will help you to apply stop losses and use it for eliminating risks easily.

Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Trend strategies are good - they may give significantly good results in any time frame and with any assets. The main idea of the ADX Trend-Based strategy is to try to catch the beginning of the trend.

Counter-trend strategies are always the most dangerous but also the most profitable. We are pleased to present an excellent counter-trend strategy for working in any market and with any assets.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later